- The western forecast GBP / USD turns bears after immersion to 7 week orders.

- An upset American GDP and job-free receivables, together with a cautious food, launched a dollar recovery.

- Markets are now focused on the labor market information next week for a new incentive.

GBP / USD Sunday forecast has turned the bear after the price has reduced significantly last week, reaching 7-week hunting nearby 1.3320. This move was credited with a stronger dollar after a cautious fed and praise of data.

–Are you interested in learning more about ECN brokers? See our detailed guide-

The wide proud richest wealth of the American dollar followed the stronger growth of American GDP, recovery in a permanent march of goods and a falling claim without work. This has strengthened the opinion that the Federal Reserve cannot submit an aggressive reduction in the rate this year. Caution Ton Feda again echoed by food chairperson and other policy makers, who have further pushed Greenback up.

On the other hand, Soft PMI data in the UK discovered a slower growth momentum, further weighing at the request for the pound. Composite PMI fell to 51.0 in September of 53.5 in August, underlines the fragiveness of the economy in the UK. The weaker gilded demand and political uncertainty and surfing also retained settled.

Inflation data on Friday was expected at 2.9% I / I; Lack of surprise and slightly better risk regime helped GBP / USD stabilize in the weekend. However, the wider feeling remains beneficial for the US dollar because the market scales the role for faster alleviation, while the Bank of England retains its careful attitude.

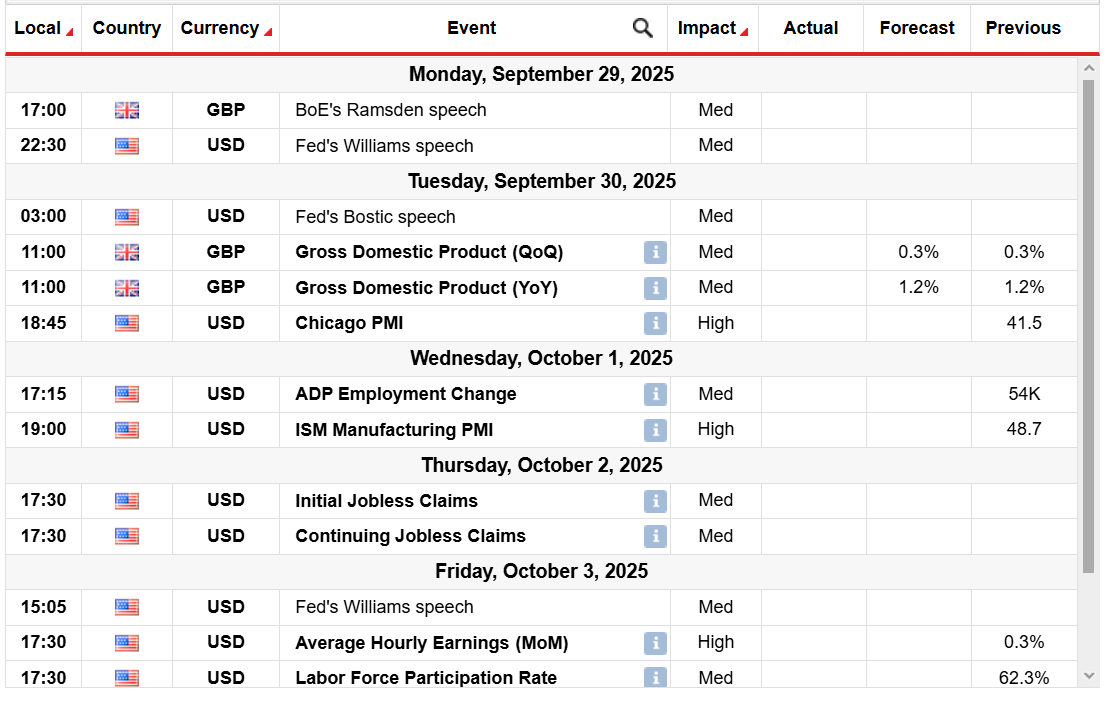

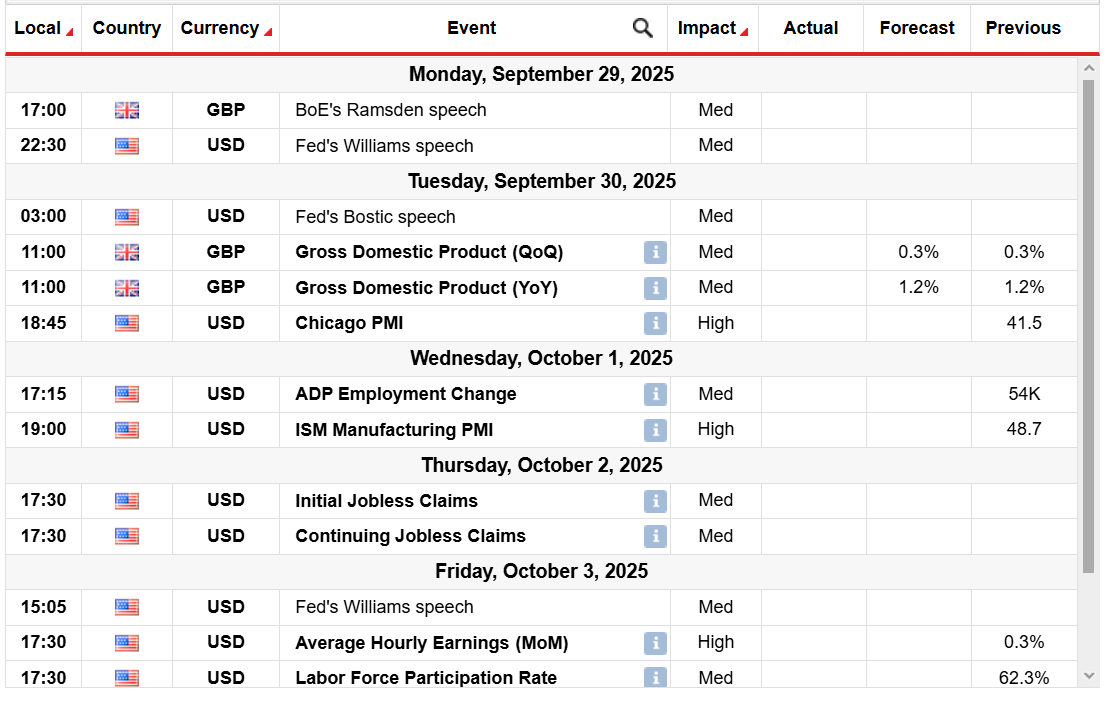

GBP / USD Key events next week

Switching to the last week of the month, the focus now switches to the American labor market and the Growth Data, with the following significant events:

- UK GDP (Tuesday)

- Jolts job opening (Tuesday)

- Changing employment of ADP (Wednesday)

- American Non-Farm Payment List (Friday)

Another round of strong American data could further undermine GBP / USD, while the cooling of the labor market signs could muffle the dollar recovery. Traders will also monitor speeches fed and BoOE for fresh policies, together with the US tariff development.

GBP / USD Sunday technical forecast: Demand zones resist bears

The daily GBP / USD reveals neutral for group bias, because parachutes encountered solid support at 1,3340, and the prices jumped at 1.3400 mark during the week closing. However, prices lie down below key moving average, which could collect the sale of traction, pushing according to 200-year on 1,3125. This requires a clear termination of the demand zone.

–Are you interested in learning more about making money in forex? See our detailed guide-

On the other hand, if prices remain supported by demand zone, the function could further obtain and tests the usa zone MA at 1.3480-1,3500. Markets are likely to consolidate, waiting for a fresh incentive.

Looking for forex trading now? Invest in Ethorro!

67% of retail orders lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.