- Retail sales in the US and UK were above expectations.

- Inflation in the UK eased more than expected to 1.7%.

- The dollar strengthened as markets increasingly bet on a Trump victory in November.

The GBP/USD weekly forecast shows a neutral bias as the US and UK economies show resilience. The price manages to close above the 1.3000 handle.

GBP/USD Ups and Downs

The GBP/USD pair ended the week almost flat amid economic reports from the UK and US. Retail sales in both countries exceeded expectations, indicating strong consumer spending. Meanwhile, UK inflation eased more than expected to 1.7%, below the Bank of England’s target. Market participants are betting on a rate cut in November.

–Are you interested in learning more about Australian forex brokers? Check out our detailed guide-

Elsewhere, the dollar strengthened as markets increasingly bet on a Trump victory in November. Such an outcome would likely increase inflation and pause the Fed’s interest rate cycle, boosting the dollar.

Next week’s key events for GBP/USD

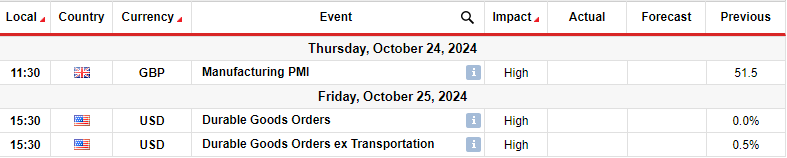

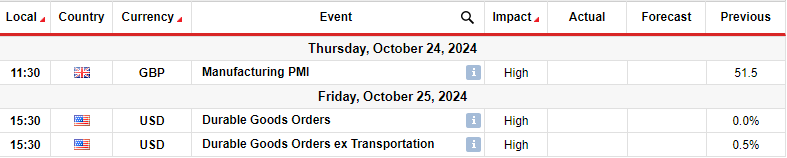

Next week, the UK will release data on business activity in the manufacturing sector. At the same time, traders will focus on US durable goods orders.

Previous reading revealed that the UK manufacturing sector is expanding. A better-than-expected reading on Thursday is likely to reduce the chances of a Bank of England rate cut in November. The opposite is also true.

Meanwhile, UK inflation fell below the central bank’s target of 1.7%. At the same time, inflation in services declined. Therefore, policymakers may be more willing to cut rates.

Meanwhile, US durable goods orders will show the state of demand, which will weigh on Fed rate cut expectations.

GBP/USD Technical Forecast: Bears active below 1.3051 support

From the technical side, GBP/USD price is retesting 1.3051 after recently breaking below. Bears took the lead after price reversed at the key resistance level of 1.3400. The bearish divergence of the RSI was the first sign of trouble for the previous bullish trend. Soon after, the bears broke the 30-SMA support, while the RSI fell below 50, into bearish territory.

If you are interested in guaranteed stop loss brokers, check out our detailed guide-

However, the price must now break away from the 1.3051 level to continue the downtrend. Before that happens, bulls could cause 22-SMA. A break above the SMA would bring GBP/USD back to a high at 1.3400. On the other hand, if the SMA holds or the price immediately falls, the bears will target the support level of 1.2701.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.