- Traders backed off bets on a rate cut in the UK and US.

- US GDP data came in higher than expected, indicating strong economic performance.

- Market participants expect the BoE to keep rates on hold next week.

The GBP/USD weekly forecast is neutral as the resilience of both the US and UK economies creates a level playing field for the currency.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

GBP/USD Ups and Downs

The pound ended the week flat, with the UK and US economies showing resilience. Business activity in the manufacturing and service sectors for both countries increased. As a result, traders pulled back on rate cut bets in the UK and US.

More data from the US supports the view that the Fed’s rate cuts will not start in March. GDP data came in higher than expected, indicating strong economic performance. Meanwhile, the Fed’s preferred measure of inflation was in line with expectations.

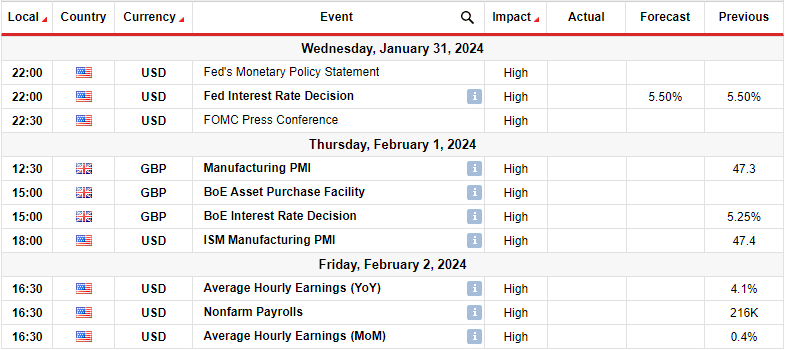

Next week’s key events for GBP/USD

Next week, the main reports from the US will include the minutes of the FOMC meeting, the ISM manufacturing PMI and the employment report. Meanwhile, traders will be paying close attention to the Bank of England policy meeting in the UK. On February 1, the BoE is likely to keep interest rates at 5.25%. At the same time, investors will be watching closely for any indication of the timing of a potential rate cut.

Meanwhile, the minutes of the FOMC meeting and the NFP report will hint at possible Fed rate cuts. Another upbeat jobs report could further reduce rate cut bets, sending the pair lower. The opposite is also true.

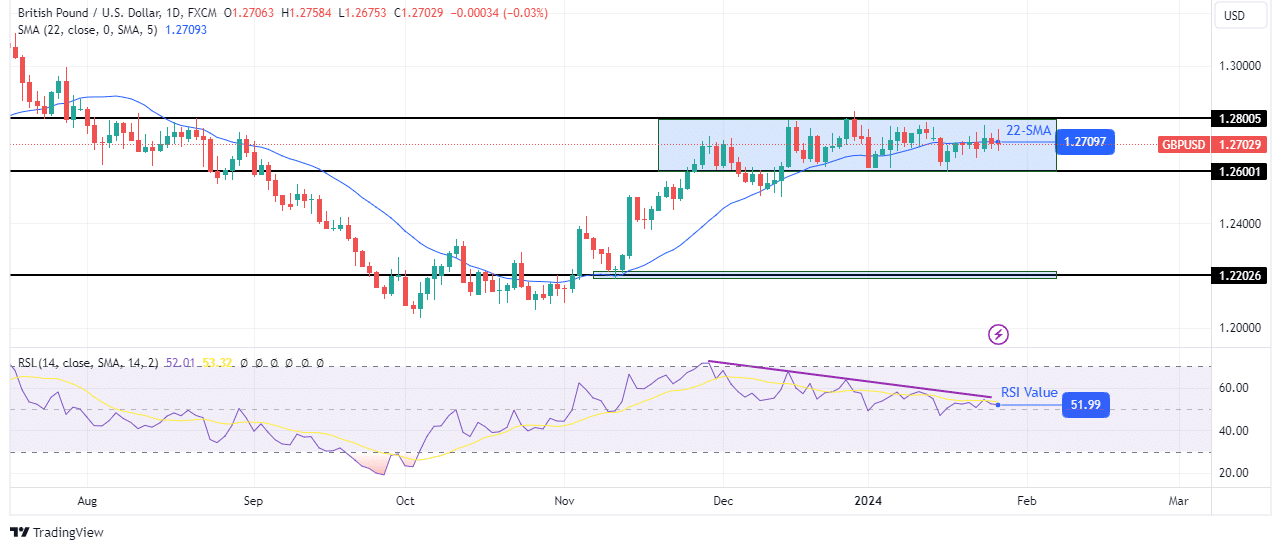

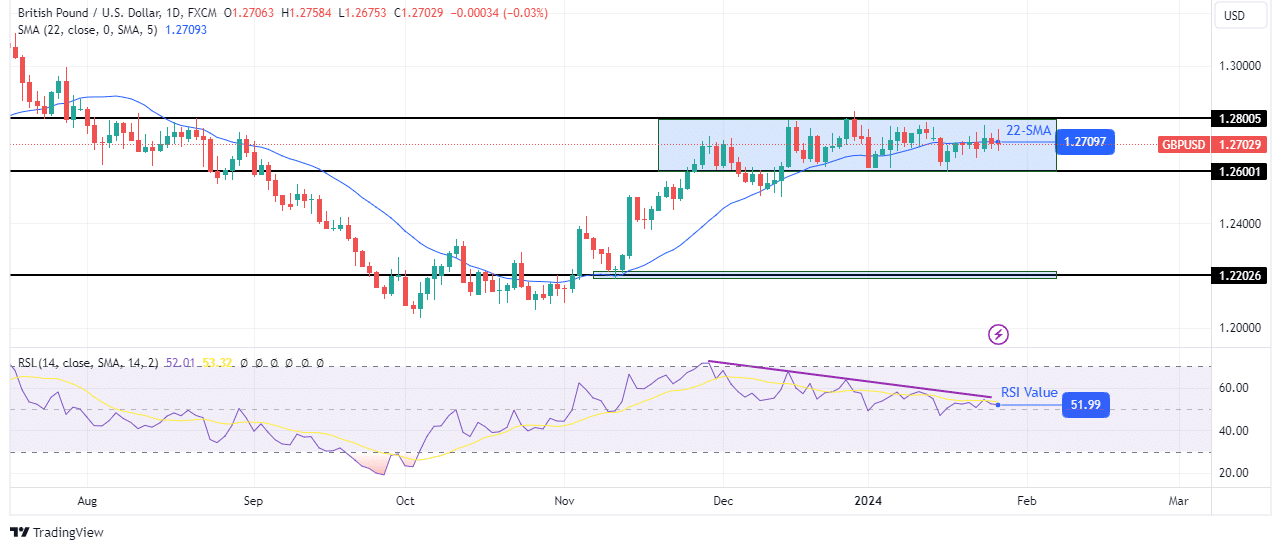

GBP/USD weekly technical forecast: Bullish momentum weakening near 1.2800

The pound is consolidating in a narrow range with support at 1.2600 and resistance at 1.2800. The bullish trend slowly weakened as the price approached 1.2800. The price started holding near the 22-SMA until it started to cut through the line. This indicates a transition from a trending market to a range market.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

If this is a break in a bullish trend, the price will eventually break above the range resistance to continue higher. However, there are indications that the bears could take over. The RSI made a bearish divergence with the price, showing weaker bullish momentum. Therefore, if the bulls fail to regain momentum, the bears could break below the range support to start a new downtrend.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money