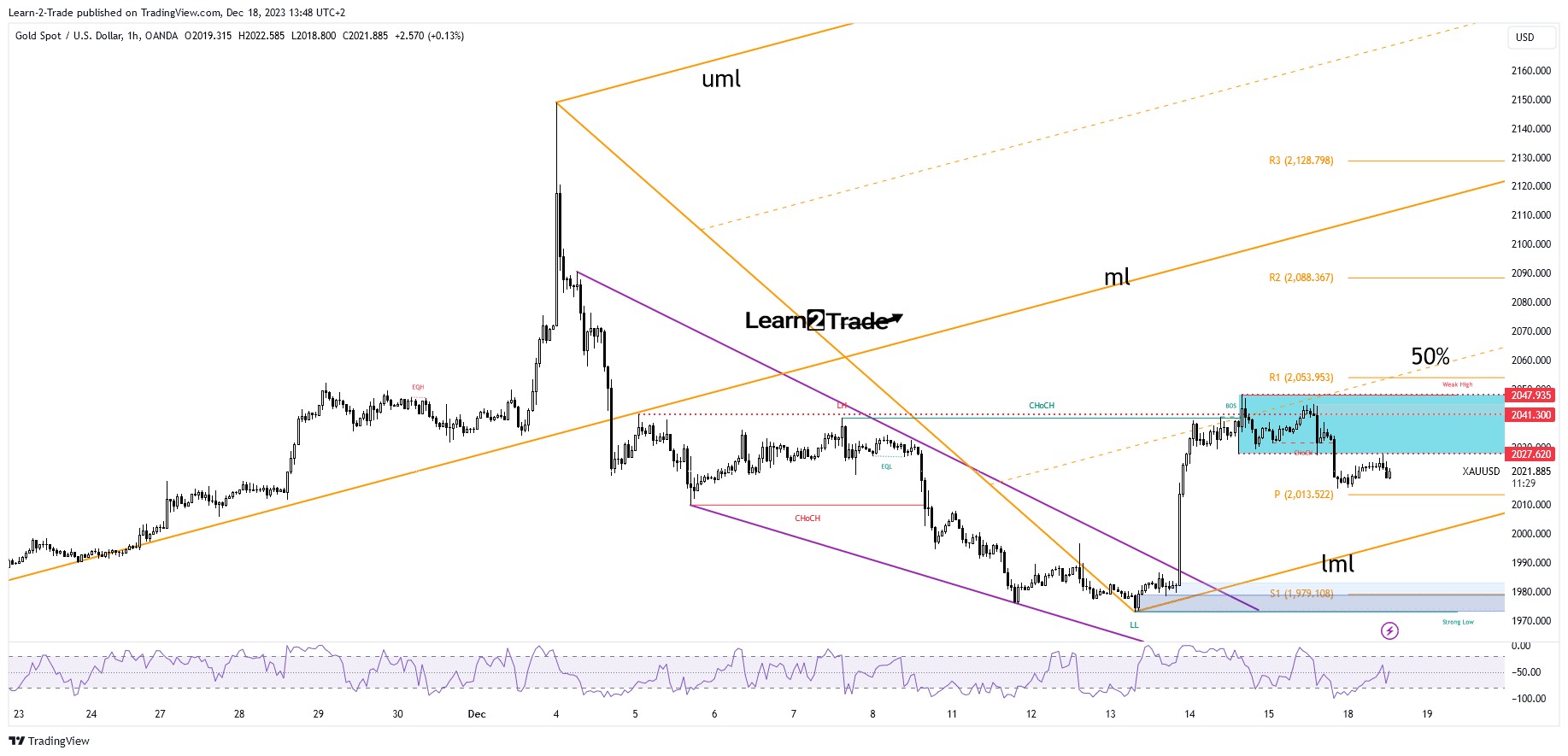

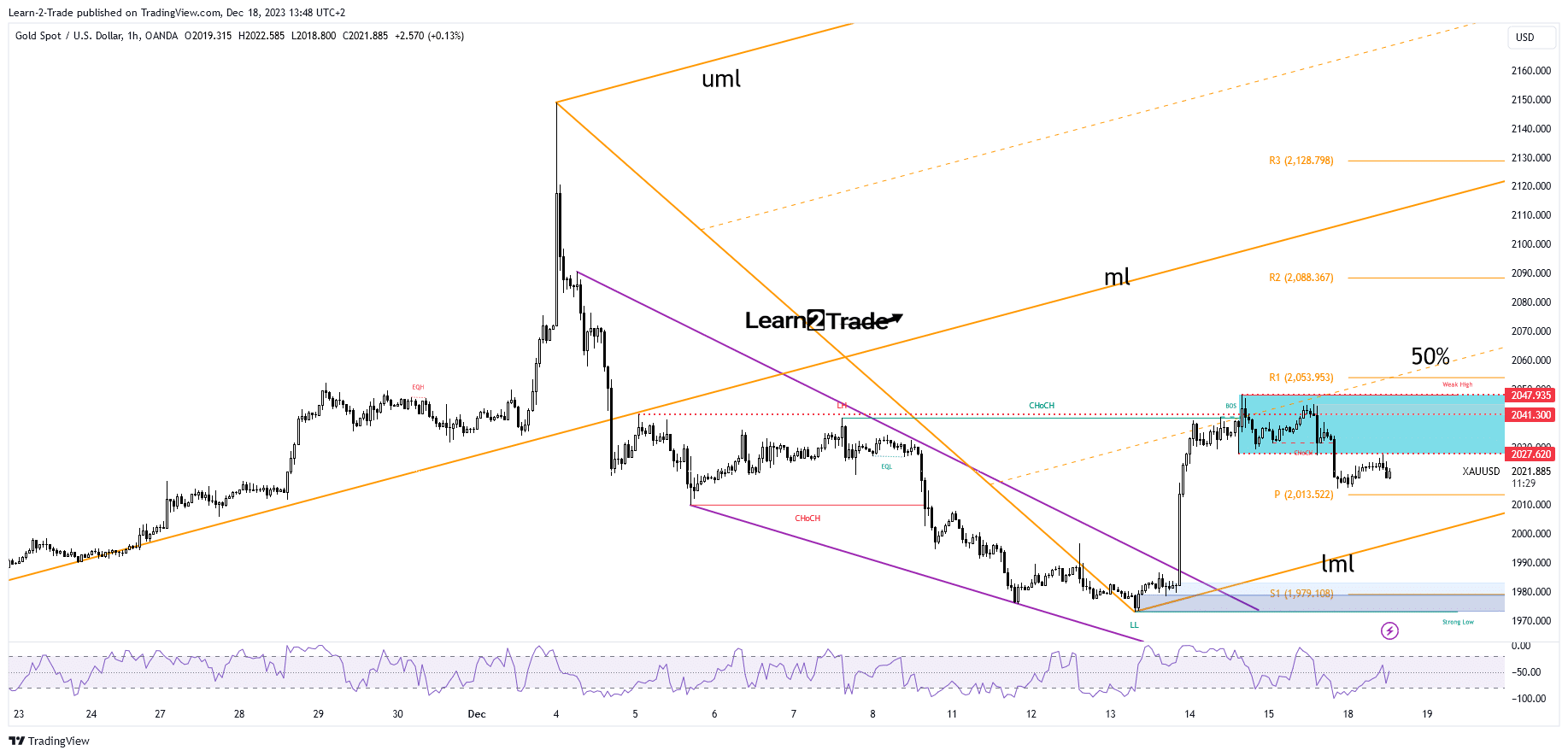

- KSAU/USD pulled back after registering only false breakouts through current resistance levels.

- The lower middle line (LML) stands as the main support.

- Canada’s CPI could change sentiment tomorrow.

The price of gold turned lower as the US dollar struggled to continue its current rally. The metal is trading at $2,022 at the time of writing. A little has changed today, so we have to wait for new opportunities.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

The price fell even as the US released mixed economic data on Friday. The Flash Services PMI was better than expected, confirming further expansion. Meanwhile, the Flash Manufacturing PMI, the capacity utilization rate, industrial production and the Empire State Manufacturing Index were worse than expected.

Today, only the US NAHB housing market index and the New Zealand trade balance could bring some action. However, traders for tomorrow’s economic data and high-impact events before taking action.

Minutes from the Australian monetary policy meeting and the BOJ could shake up markets in the morning. The BoJ benchmark rate is expected to remain steady at -0.10%. Moreover, Canadian inflation data could change sentiment in the short term.

The consumer price index is expected to drop 0.2% after rising 0.1% in the previous reporting period. Also, the US will release data on building permits and housing starts.

Gold Price Technical Analysis: Downtrend Intact

As you can see on the hourly chart, the price found resistance just above the static resistance at $2,041 and behind the 50% Fibonacci line of the ascending villa. False breakouts revealed buyer exhaustion and the price turned to the downside, escaping the range between $2,047 and $2,027.

–Are you interested in learning more about forex tools? Check out our detailed guide-

It has now retested the support of the broken range and could continue its downward movement. The weekly pivot point at $2,013 stands as an immediate downside barrier. The main support is represented by the lower middle line (lml).

Technically, the pullback could be temporary after the last rally. It could test short-term support levels before developing a new leg higher. As long as it is above the lower median line (LML), KSAU/USD could give birth to a bigger leg higher.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.