- XAU/USD is bullish as long as it is above the lower median line.

- US data should bring big action today.

- A new higher high activates further growth.

The price of gold continued its growth and reached $2,040 today. Now the precious metal has pulled back a bit and is trading at $2,035 at the time of writing.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

KSAU/USD jumped higher as the US dollar fell after reaching yesterday’s high of 103.82. Today, US data should be decisive. CB consumer confidence is expected to jump to 114.2 from 110.7 points, while JOLTS jobs could fall from 8.79 million to 8.73 million.

Bad economic data should weaken the dollar. On the contrary, positive data could punish the price of gold.

Tomorrow, Australia’s CPI q/q could register an increase of 0.8% after a rise of 1.2% in the previous reporting period, while CPI i/i is expected to register an increase of 3.7%. Lower inflation could boost KSAU/USD.

Furthermore, the US ADP-Non Farm Employment Change could fall from 164,000 to 145,000, the employment cost index could report a 1.0% increase, while the Chicago PMI could jump to 47.9 points.

However, the most important event of the week is the FOMC. The federal funds rate should remain at 5.50%, but the FOMC press conference and FOMC statement should bring sharp moves.

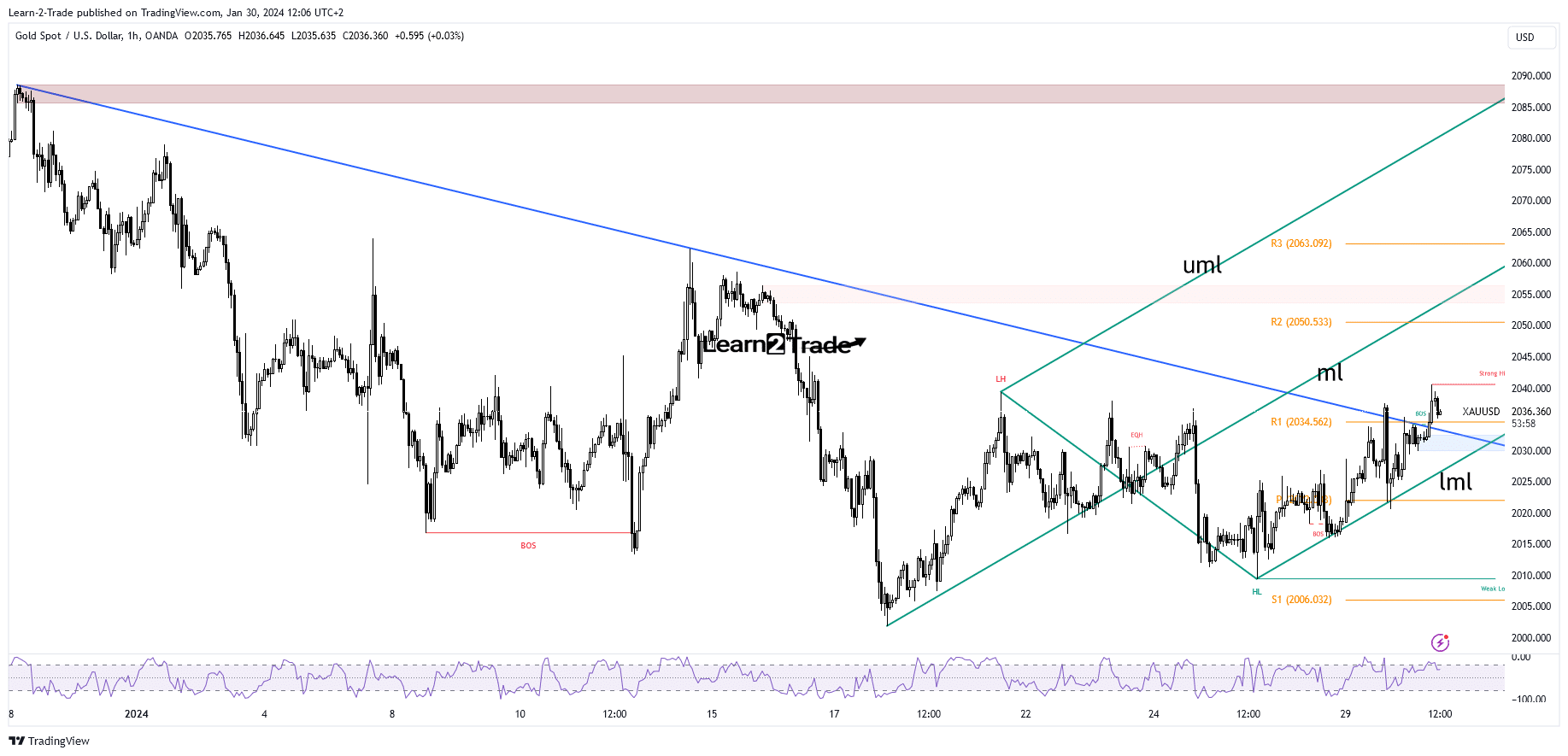

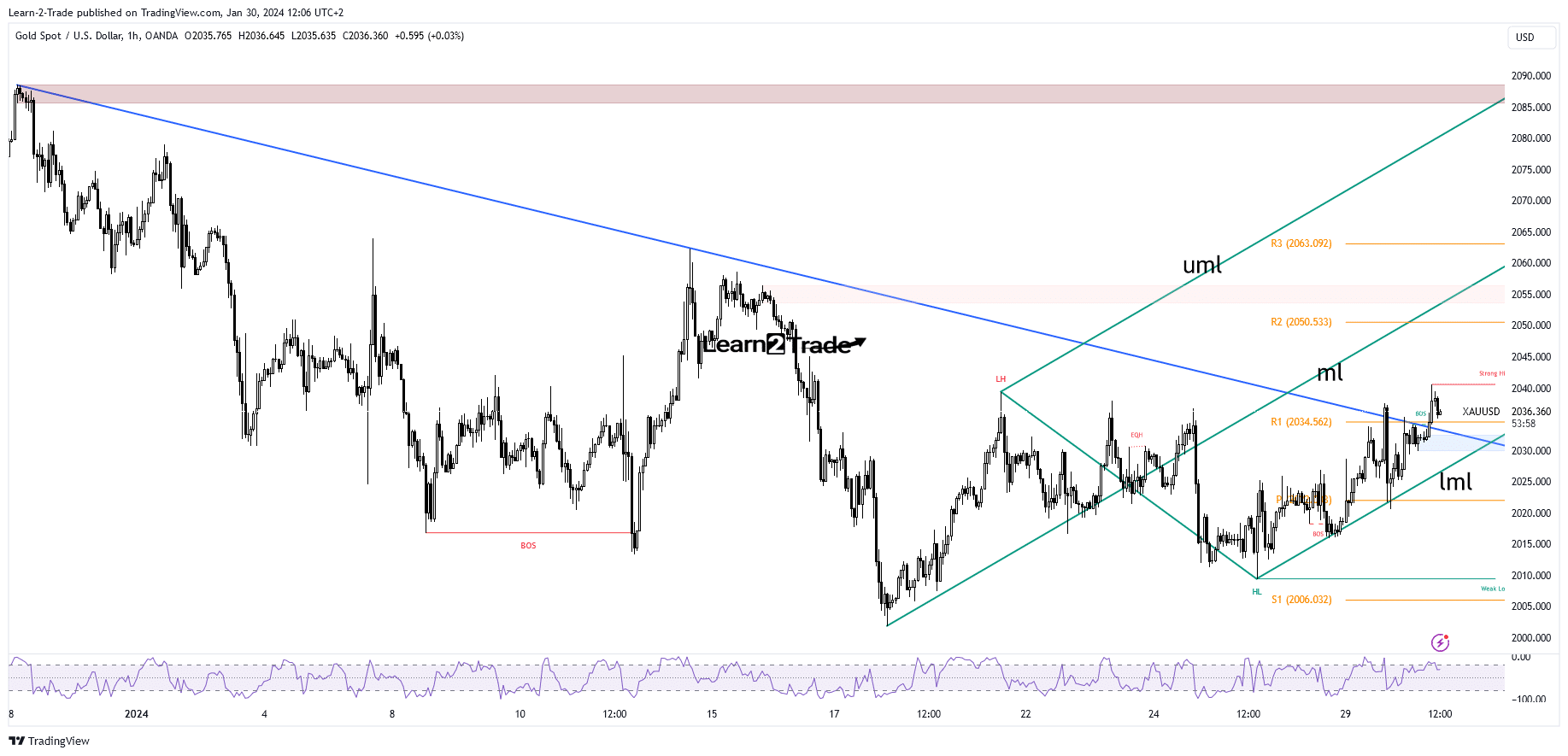

Gold Price Technical Analysis: Retesting the Decline Line

As you can see on the hourly chart, the price bounced above the decline line after retesting the lower middle line (lml) of the ascending fork, signaling a continuation to the upside.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

The bias is bullish in the short term as long as it is above the lower median line (lml). In the short term, the rate could retest the broken downtrend line before extending its rally.

A new higher high confirms more gains ahead. Only if you do not stay above the downtrend line, it can reverse the bullish scenario.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money