- As long as it remains below the downtrend line, KSAU/USD could approach new lows.

- Fundamentals should move the rate during the week.

- After such impressive growth, a correction is natural.

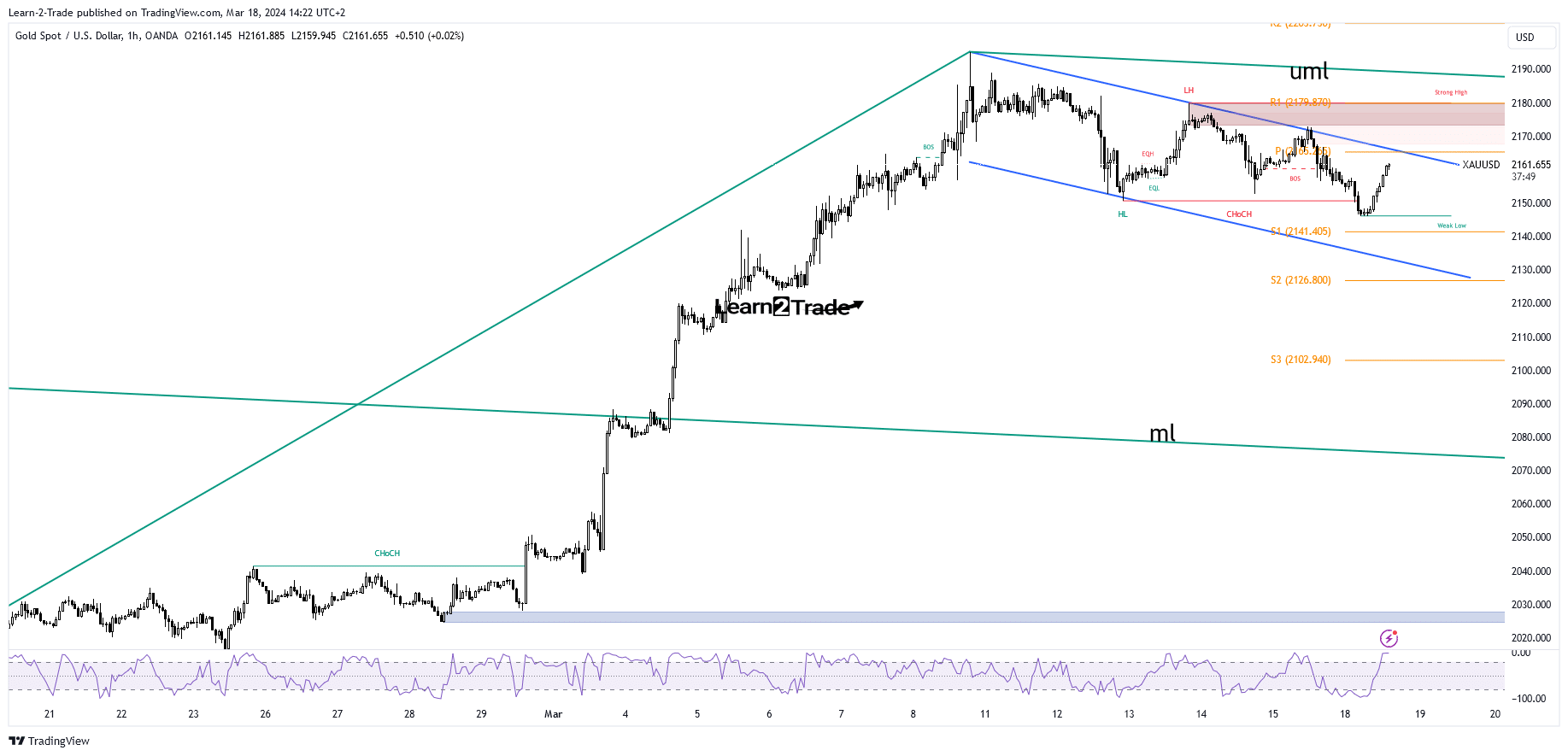

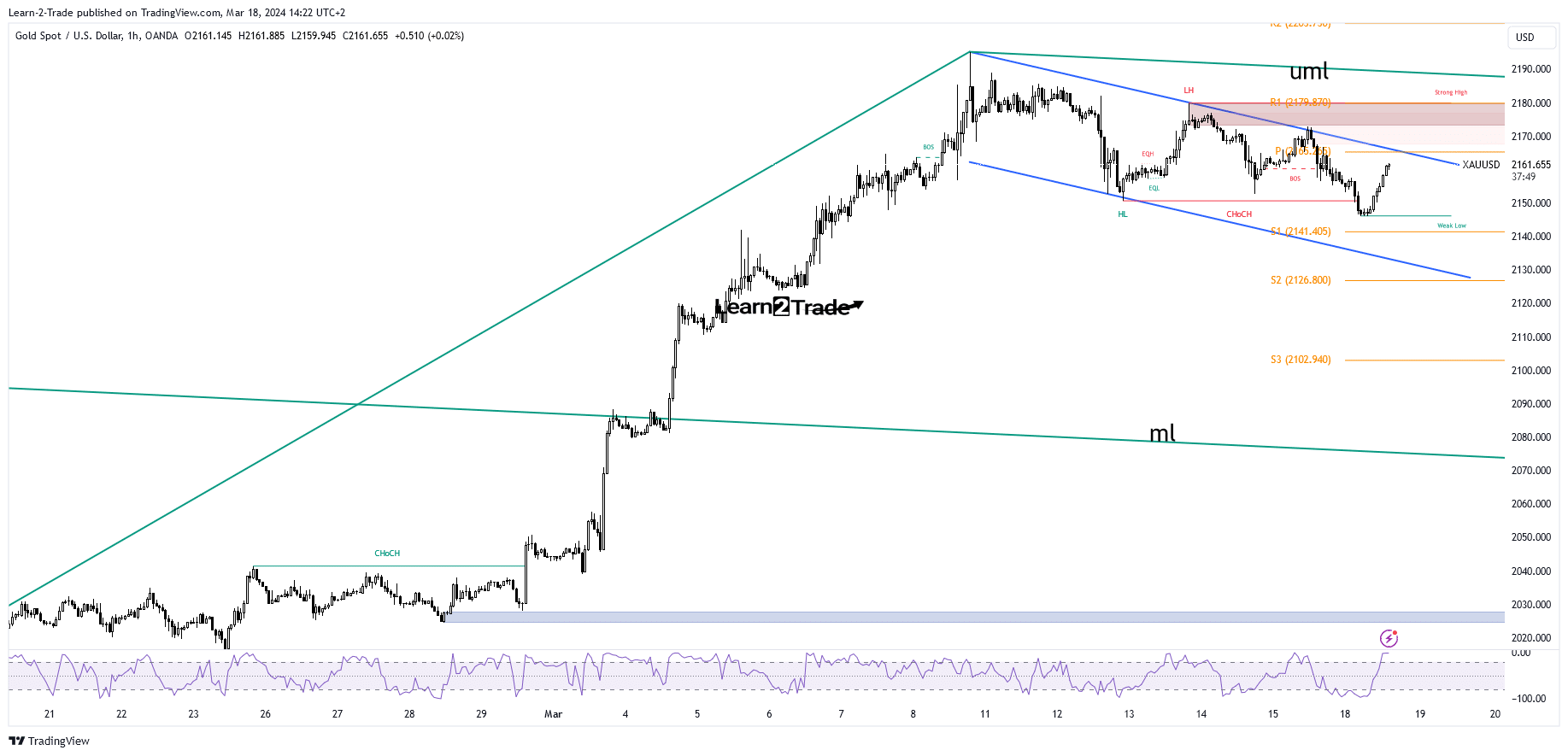

The price of gold has risen in recent hours and is now trading at $2,163. The precious metal fell slightly in the short term, but the bias remains bullish.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

Basically, KSAU/USD turned to the upside as US Prelim UoM Consumer Sentiment, Capacity Utilization Rate and Empire State Manufacturing Index were worse than expected.

Today, China’s industrial production increased by 7.0%, beating the expected growth of 5.3%. Retail sales recorded a growth of only 5.5%, which is less than the predicted growth of 5.6%. The unemployment rate unexpectedly jumped from 5.1% to 5.3%, while investments in fixed assets are better than expected. Furthermore, Final CPI and Final Core CPI in the Eurozone matched expectations, while the trade balance was reported higher at 28.1B above the 14.2B estimate.

BOJ and RBA are expected to keep monetary policy on hold tomorrow, but press conferences should move markets.

In addition, Canada’s consumer price index may post a 0.6% increase after rising just 0.0% in the previous reporting period. The FOMC and UK CPI are Wednesday’s high-impact events that remain key for gold.

Technical analysis of gold price: Down Channel

Technically, KSAU/USD fell within a lower channel pattern. It can print a more extensive correction if it stays below the downtrend line.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

The weekly pivot point at $2,165 represents static resistance. Price may try to test resistance levels in the short term.

We have a vital confluence area at the intersection between the pivot point and the downtrend line. A valid breakout activates further growth, while false breakouts can herald a new selloff.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.