- The gold correction could only be temporary.

- The middle line (ml) is viewed as dynamic support.

- Canadian CPI and FOMC minutes should move the rate.

The price of gold is currently falling, and could go even lower. It is currently at $1,971, well below today’s high of $1,985. This decline is normal after a period of growth.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

Although the US dollar fell against other currencies, gold continued to decline. U.S. building permit and housing starts were better than expected on Friday. Today, the US will split the leading CB index and may see a 0.5% drop.

There are some important things happening tomorrow that could affect the market. FOMC meeting minutes, RBA monetary policy meeting minutes and Canadian inflation data are out. The consumer price index could show a rise of 0.2% after a rise of 0.1% last time.

If inflation rises, the BOC may have to make some decisions at its meetings, which could affect the price of gold. Also, manufacturing and services data could have a big impact at the end of the week.

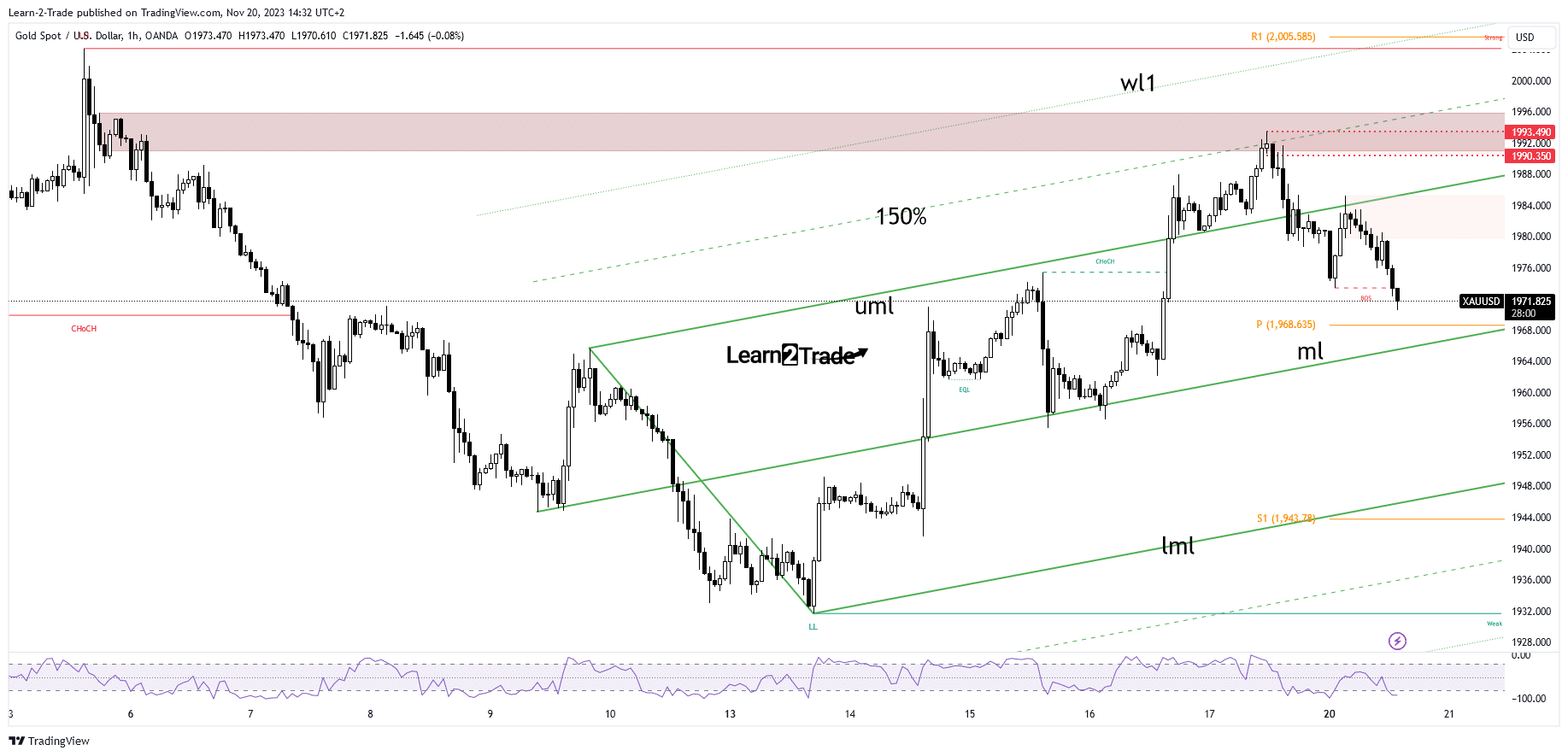

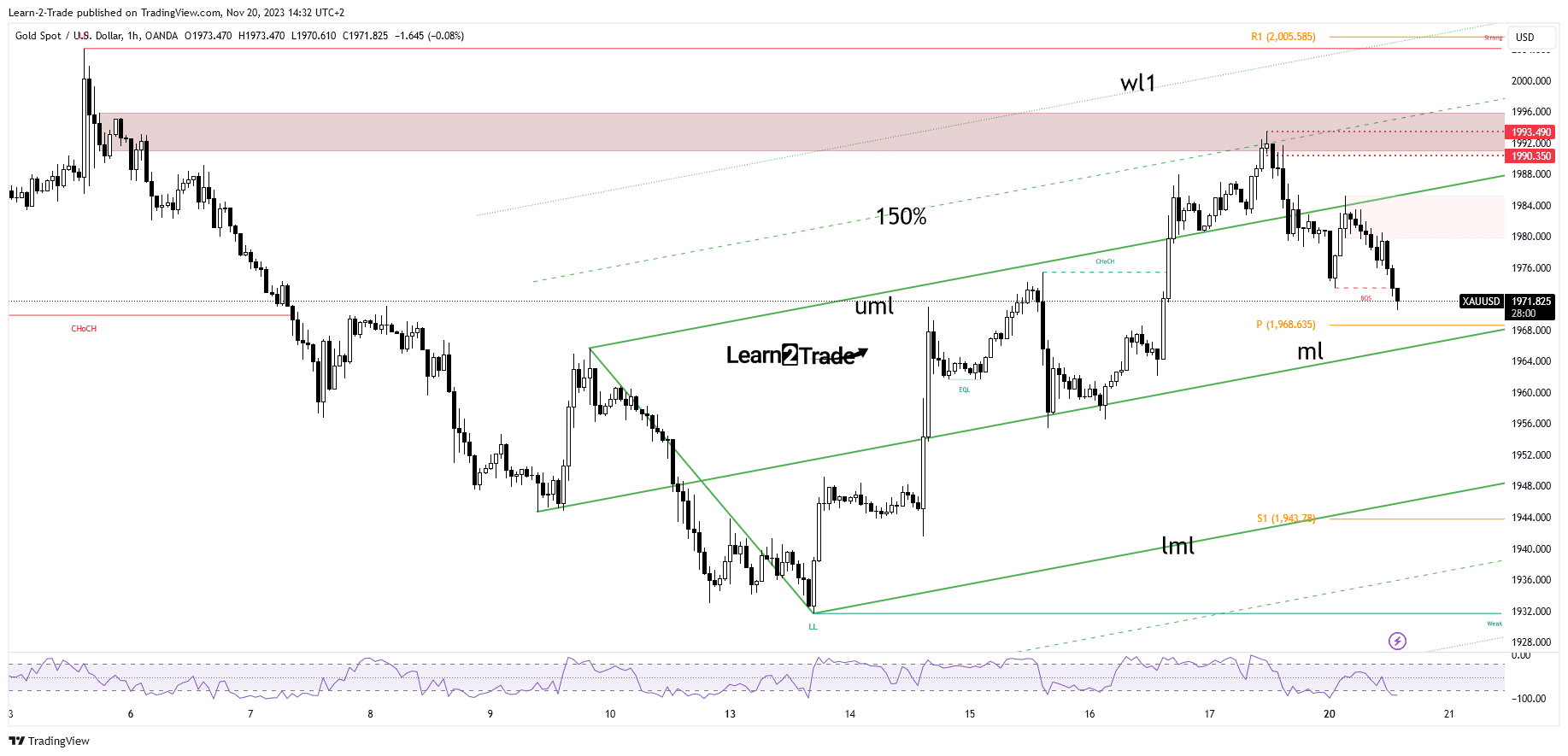

Technical analysis of gold price:

Looking at the technical side of things for XAU/USD, it hit a barrier at the 150% Fibonacci line, and is now descending. There is strong resistance around $1,996 that is preventing it from going higher. The rate tested the upper middle line (uml) and is now moving towards the weekly pivot point of $1,968, which is a solid support level. The middle line (ml) is like a moving support and a target for the downside.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

If the rate breaks through these support levels, a bigger decline could occur, but it could only be a temporary setback. The rate could take a breather to gather more positive energy before rising again. Watch for false breakouts below the median line (ml) as they could signal a new uptrend.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.