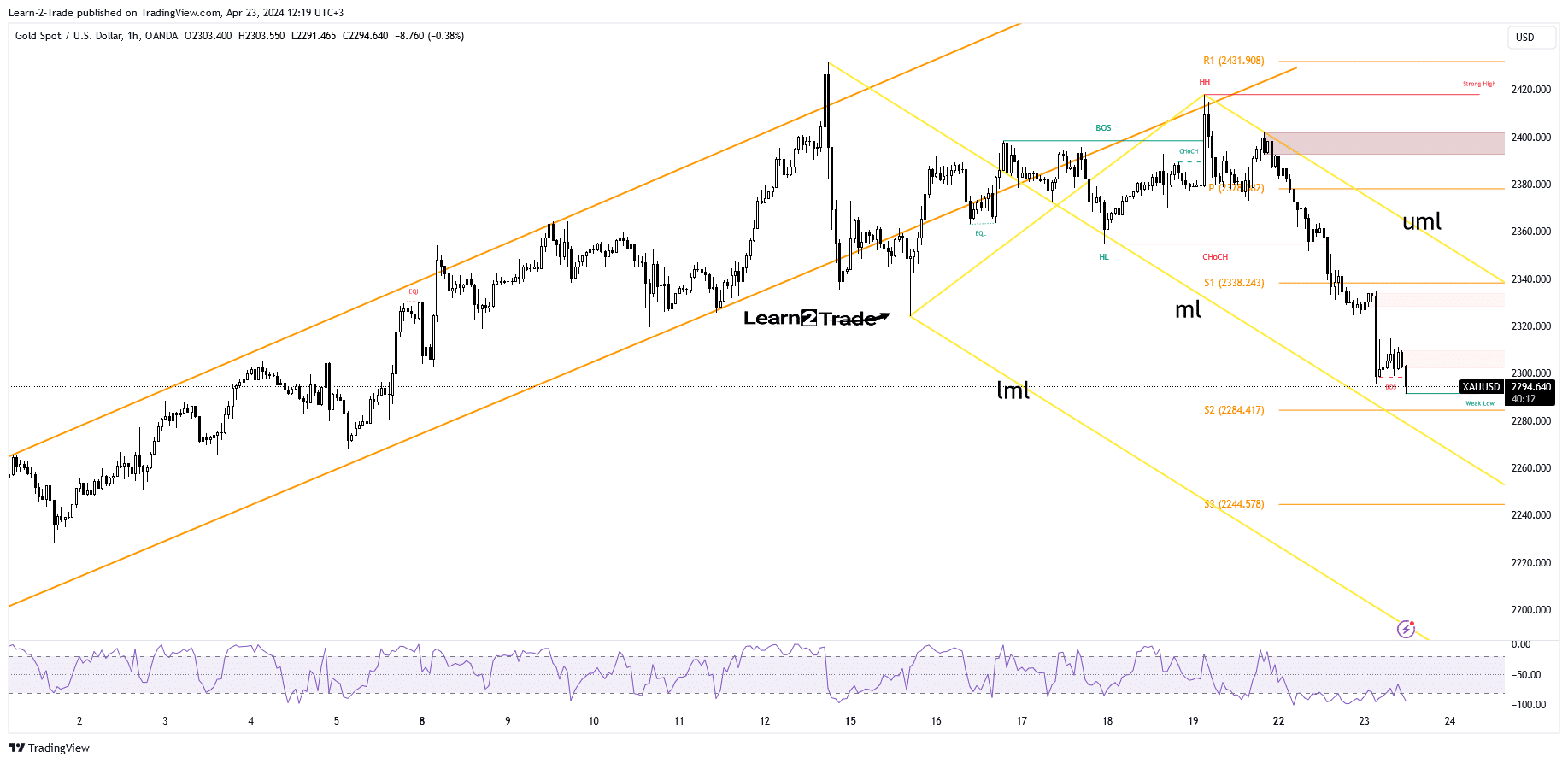

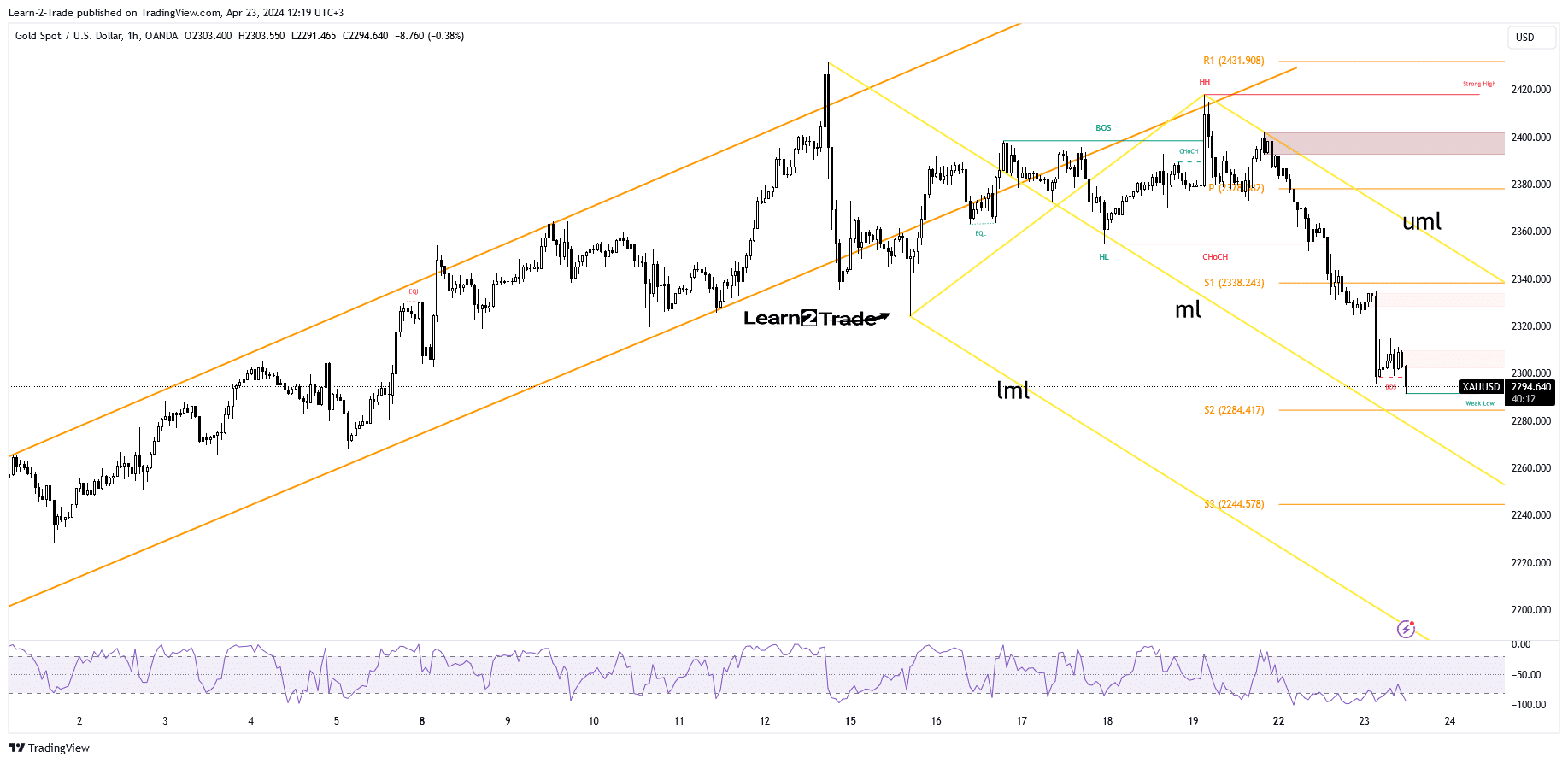

- A breakout from the upper channel heralded a potential leg down.

- Removing immediate negative obstacles opens the door for more falls.

- US data could change sentiment in the short term.

The price of gold fell after failing to retest the new high of $2,431 and is now trading at $2,294 at the time of writing.

The bias turned bearish in the short term. So, KSAU/USD could reach new lows despite a slightly weaker dollar.

–Are you interested in learning more about STP brokers? Check out our detailed guide-

Today, the fundamentals should be decisive and can change the mood. French PMI Flash Services reached 50.5 points above the expected 48.9 points compared to 48.3 points in the previous reporting period, confirming growth.

By comparison, Germany’s Flash Services PMI jumped from 50.1 points to 53.3 points, beating 50.6 percent, heralding further expansion.

On the contrary, the French Flash Manufacturing PMI and the German Flash Manufacturing PMI remained deep in contraction territory.

Furthermore, the Flash Services PMI in the Eurozone and the UK was better than expected, while the Flash Manufacturing PMI was worse than expected.

Later, US data should move the markets. Flash Manufacturing PMI and Flash Services PMI indicators are expected to be better than the previous reporting period.

In addition, data on new home sales and the Richmond manufacturing index will be released. Only positive US figures could save the dollar from falling.

Gold Price Technical Analysis: Targeting the Midline

From a technical point of view, gold has entered a corrective phase after retesting the main uptrend line. The price escaped from the upper channel, confirming a potential downside.

-Are you looking for automated trading? Check out our detailed guide-

The removal of the weekly pivot point at $2,378 opened the door for a bigger decline. It has now ignored the weekly S1 (2,338) and is about to reach the weekly S2 (2,284) and the middle line (ml). This presents important barriers to reduction. The removal of these support levels confirms more declines to come.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money