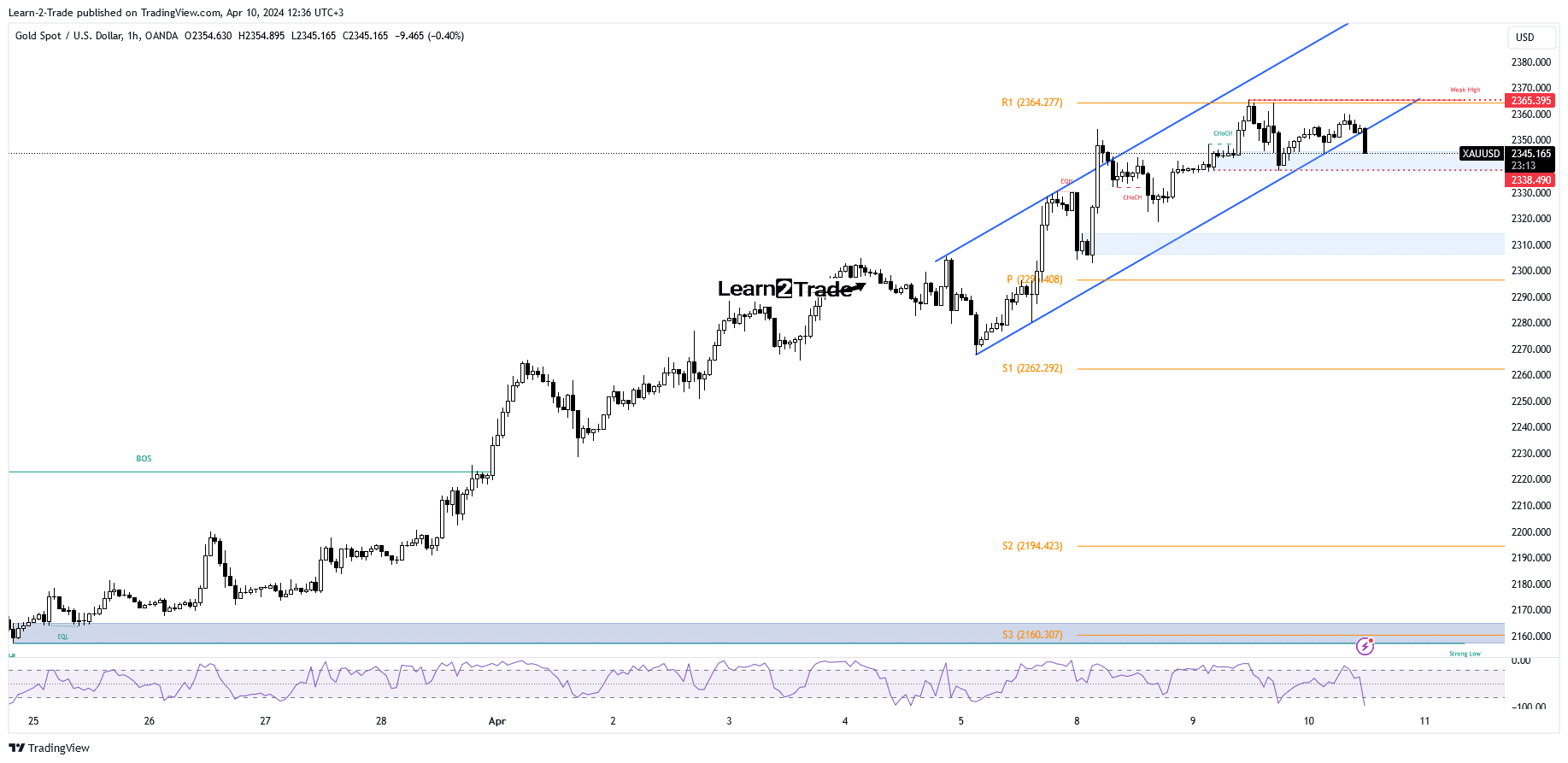

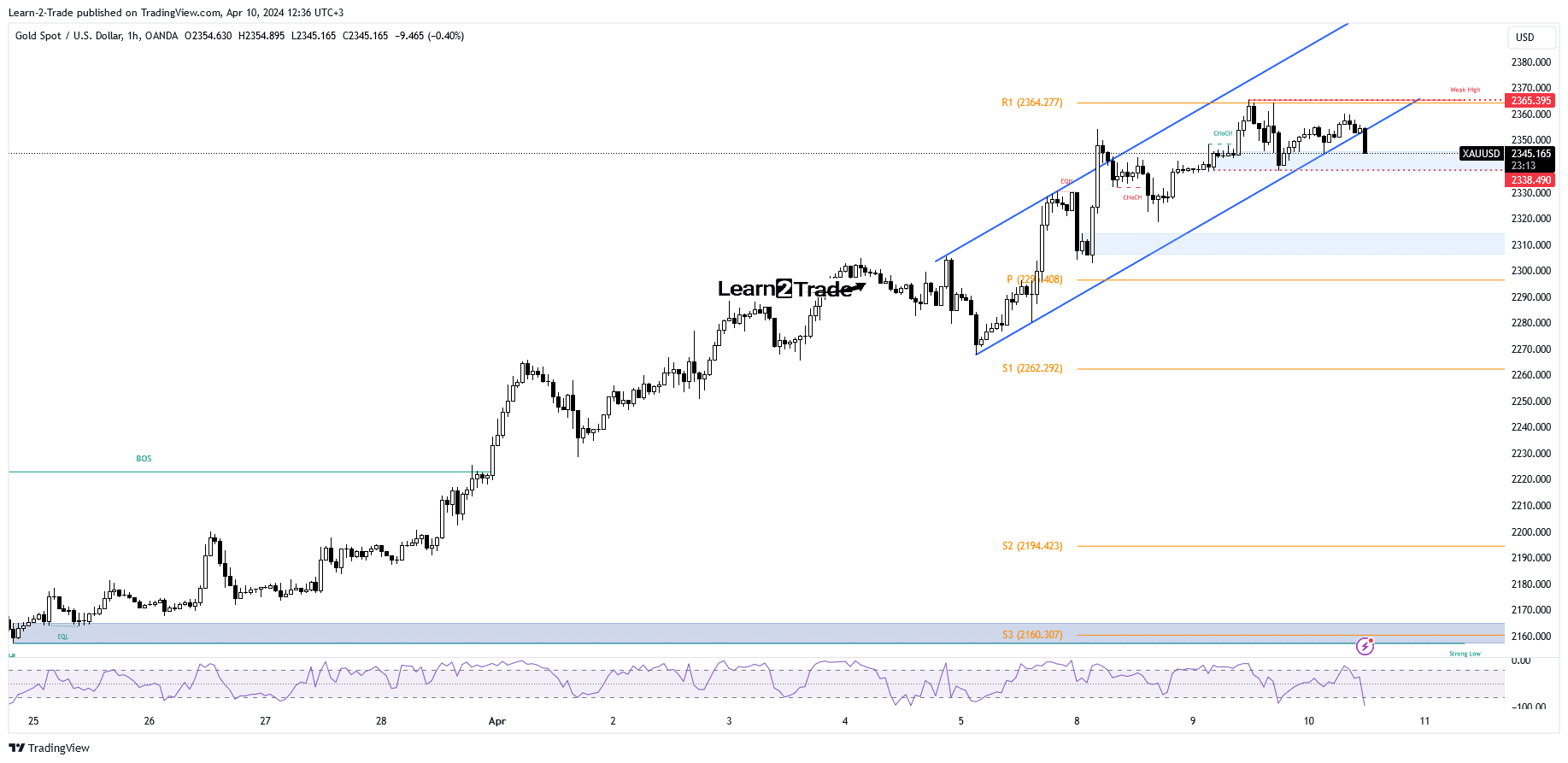

- The price of gold remains bullish as long as it is above 2,338.

- US data should show sharp developments.

- Only a new higher high activates further growth.

The price of gold rose as high as $2,365 in the last trading session, marking a new all-time high. The metal has now pulled back a bit and is trading at $2,345 at the time of writing.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

Anything could happen today, as the economic calendar is filled with high-impact events. The RBNZ left monetary policy unchanged, so the official cash rate remained at 5.50%.

Later, the US consumer price index could report a 0.3% increase last month versus a 0.4% increase in February. Year-on-year CPI may announce growth of 3.4% following growth of 3.2% recorded in the previous reporting period, while Core CPI is expected to register growth of 0.3%.

Higher inflation could lift the dollar and punish the yellow metal. Volatility should be high before and after the US data dump.

Furthermore, the FOMC and BOC meeting minutes also present high-impact events. The Bank of Canada is set to keep the overnight rate at 5.00%, but the FOMC minutes could change sentiment.

Gold Price Technical Analysis: Bear Formation

Technically, KSAU/USD found resistance at the weekly R1 of 2,364, and is now challenging the ascending line, which is flag support. It has fallen below this dynamic support, but the breakdown can still be reversed.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

The bias remains bullish as long as it is above the previous low of $2,338. A new lower low, removing this lower barrier, may trigger more declines.

On the other hand, false breakouts can herald a new bullish momentum. However, only a new higher high, a bullish close above $2,365, activates further upside.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.