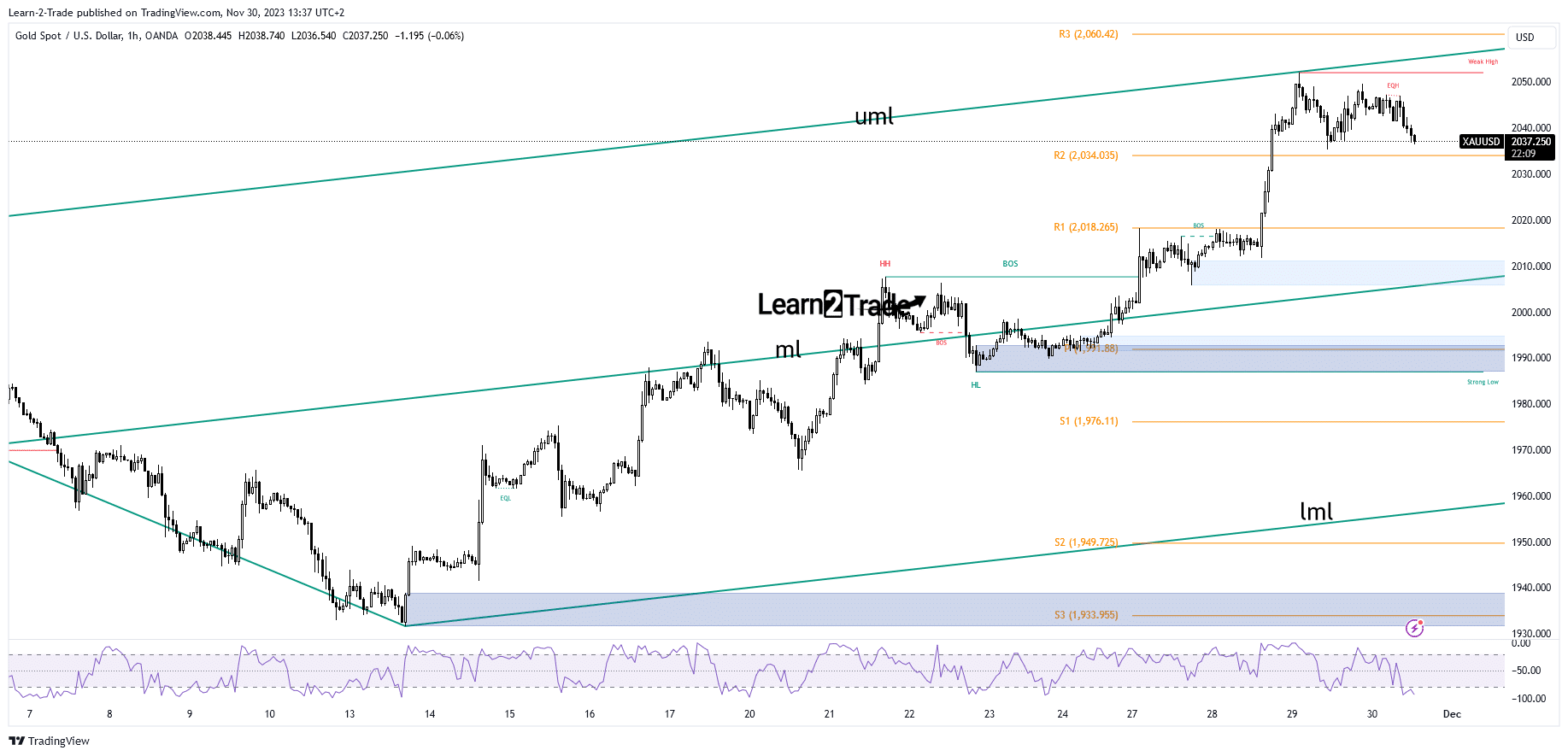

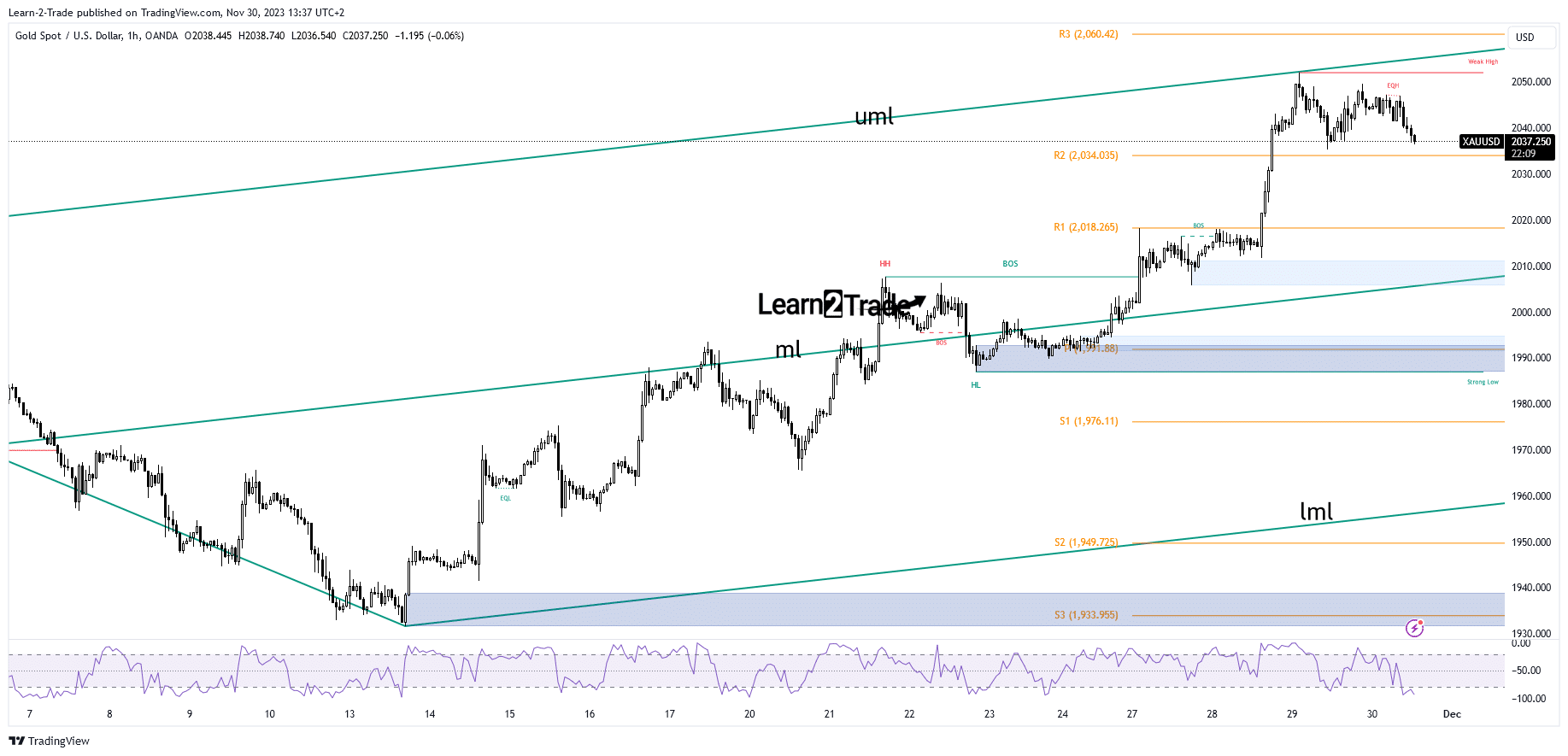

- The bias remains bullish as long as it is above R2.

- Removing static support opens the door for more falls.

- US data should have a big impact today.

The price of gold is trading in the red at $2,036 at the time of writing. The price turned lower as the US dollar found a bottom and bounced back.

US Prelim GDP, Prelim GDP Price Index and Prelim Wholesale Inventories were better than expected. Dollar index rises as US economy shows robustness. Further USD appreciation should force KSAU/USD to fall significantly.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

Today, China’s manufacturing PMI reached 49.4 points versus the expected 49.8 points, confirming the contraction. In comparison, the non-manufacturing PMI fell to 50.2 points from 50.6 points, even as traders expected a potential rise of 50.9 points. Australia, Japan and the eurozone posted mixed data.

However, traders have shifted focus to the United States data. The core PCE price index could see an increase of 0.2%, jobless claims could be reported at 219k last week, the Chicago PMI is expected at 46.0 points, while pending home sales could announce a decline of 1 .9%.

In addition, data on personal consumption and pending income will be published. Bad economic data may help KSAU/USD to continue its rise.

Technical analysis of the price of gold: the downward slide

Technically, KSAU/USD found resistance at the upper middle line of the ascending forks (uml). It is now moving sideways in the short term. However, the bias remains bullish if it remains above the weekly R2 of $2,034. This stands as a static support. Testing and registering only false positives could herald a new bullish momentum.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Conversely, taking out R2 opens the door to a move down to R1 (2.018) and down to the midline (ml).

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.