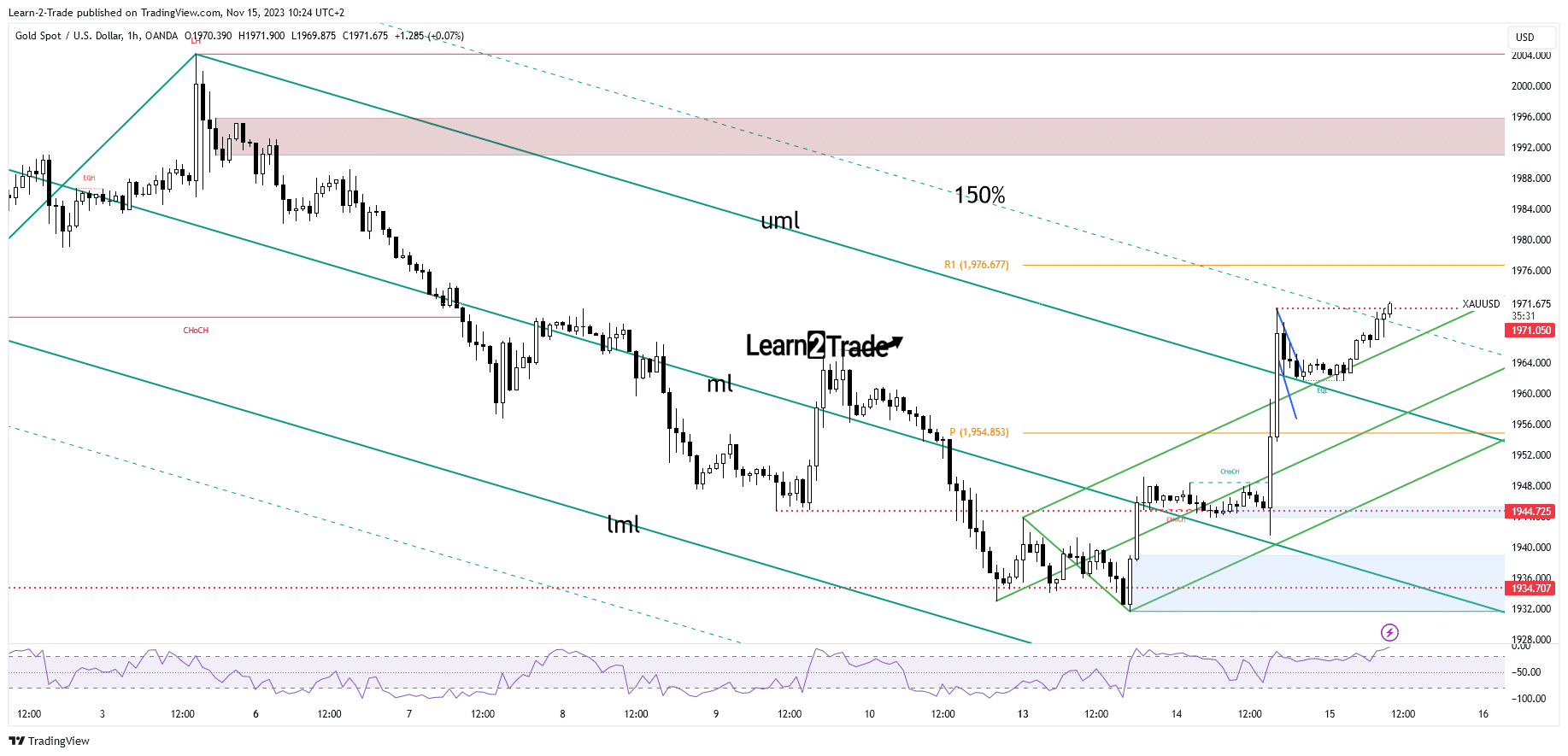

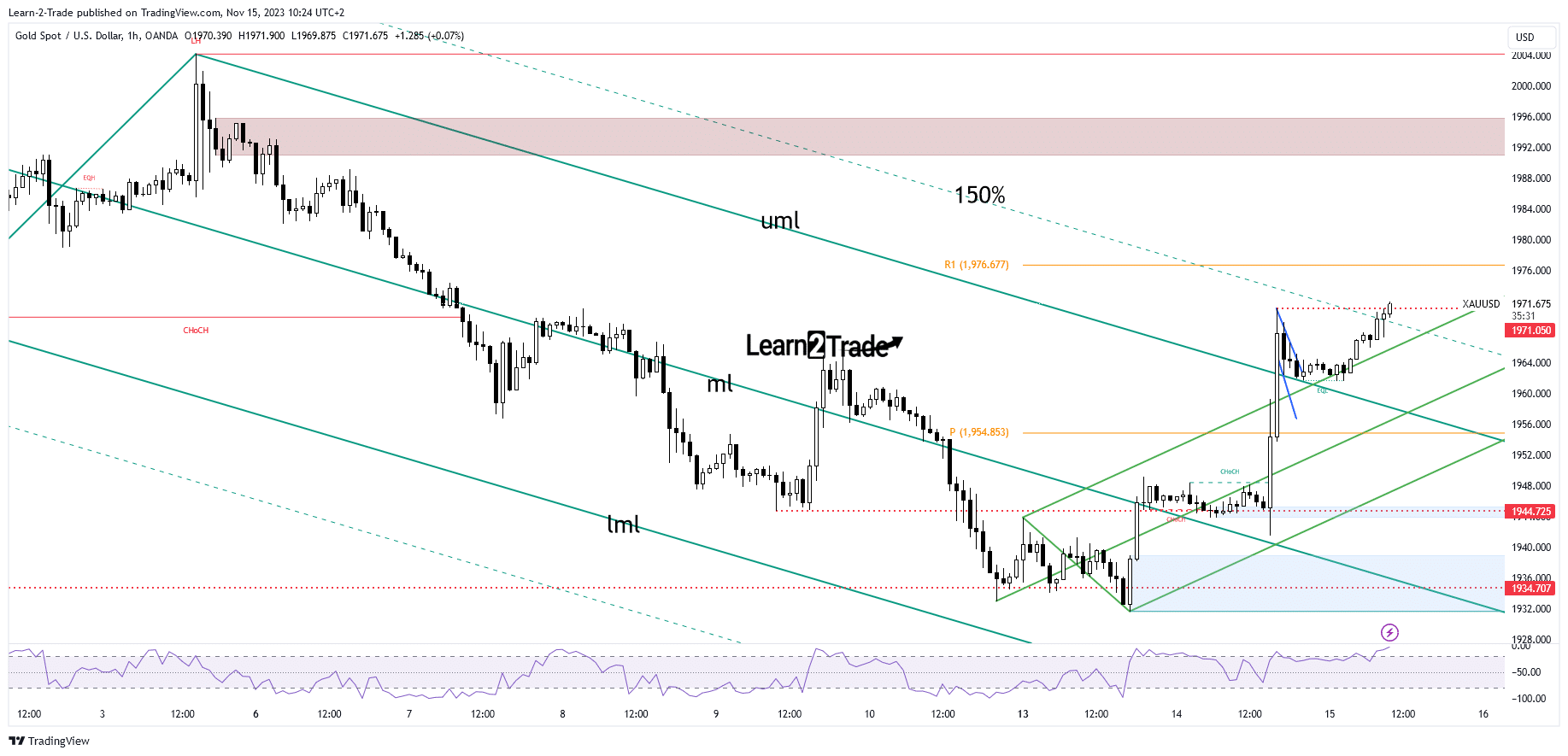

- The bias is bullish as long as it is above the upper median line.

- US economic data should bring a lot of volatility today.

- Removing static resistance activates further growth.

The price of gold rose in the recent trading session, reaching a new high of $1,971. It fell a bit in the short term, but quickly bounced back to $1,971. This happened due to recent US inflation data, where the Consumer Price Index (CPI) showed lower than expected inflation.

–Are you interested in learning more about Thai forex brokers? Check out our detailed guide-

That is why the Federal Reserve (FED) has decided to keep the monetary policy unchanged at the upcoming meetings. As a result, the US dollar weakened against other currencies, which led to a rise in gold prices.

Good news came out of China today – industrial production and retail sales were better than expected. In Australia, the wage price index is in line with what was predicted. In the United Kingdom, the Consumer Price Index rose 4.6% instead of the estimated 4.7%, and the Core CPI rose 5.7%, slightly less than the expected increase of 5.8%.

Looking ahead, the US will release some important data. Retail Sales could post a 0.3% decline, Core Retail Sales could post a 0.1% decline, PPI is expected to post a 0.1% rise, and Core PPI could post a 0.0% rise again .3%. Pay attention to these numbers as they can affect the market.

Gold Price Technical Analysis: Testing $1,971 Resistance

Technically, KSAU/USD is rising again after testing certain levels. It went above the 150% Fibonacci line and is now trying to break the 1,971 level, which is like a barrier. If it manages to go higher than this, it could continue to rise, reaching at least the R1 level (1,976). The current trend looks positive as long as it is above a certain line.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.