- Bias is bullish despite minor pullbacks.

- R3 is considered a potential target.

- The ECB could change its mood today.

The price of gold has extended its rally and is trading at $2,157 at the time of writing, below today’s high of 2161 (all-time high).

The weakness of the US dollar helped the yellow metal reach new highs. The bias is bullish, so more gains are in the cards.

–Are you interested in learning more about CFD brokers? Check out our detailed guide-

Yesterday, the ADP non-agricultural employment change reached 140 thousand, below the expected 149 thousand, but above the 111 thousand in the previous reporting period.

At the same time, JOLTS Job Openings were reported at 8.86 million versus the expected 8.80 million. The dollar has lost significant ground against its rivals as the Federal Reserve is expected to begin cutting the federal funds rate soon.

In addition, the BOC left the overnight rate unchanged at 5.00%. Today, the fundamentals should also be decisive.

The European Central Bank kept its monetary policy unchanged. The main refinancing rate remained at 4.50%. The ECB’s press conference revealed a slightly optimistic outlook, but it was primarily dependent on data to decide on monetary policy.

Moreover, Fed Chairman Powell’s testimony before the Senate Banking Committee should also have a big impact. US NFP data, average hourly earnings and the unemployment rate could bring big action tomorrow.

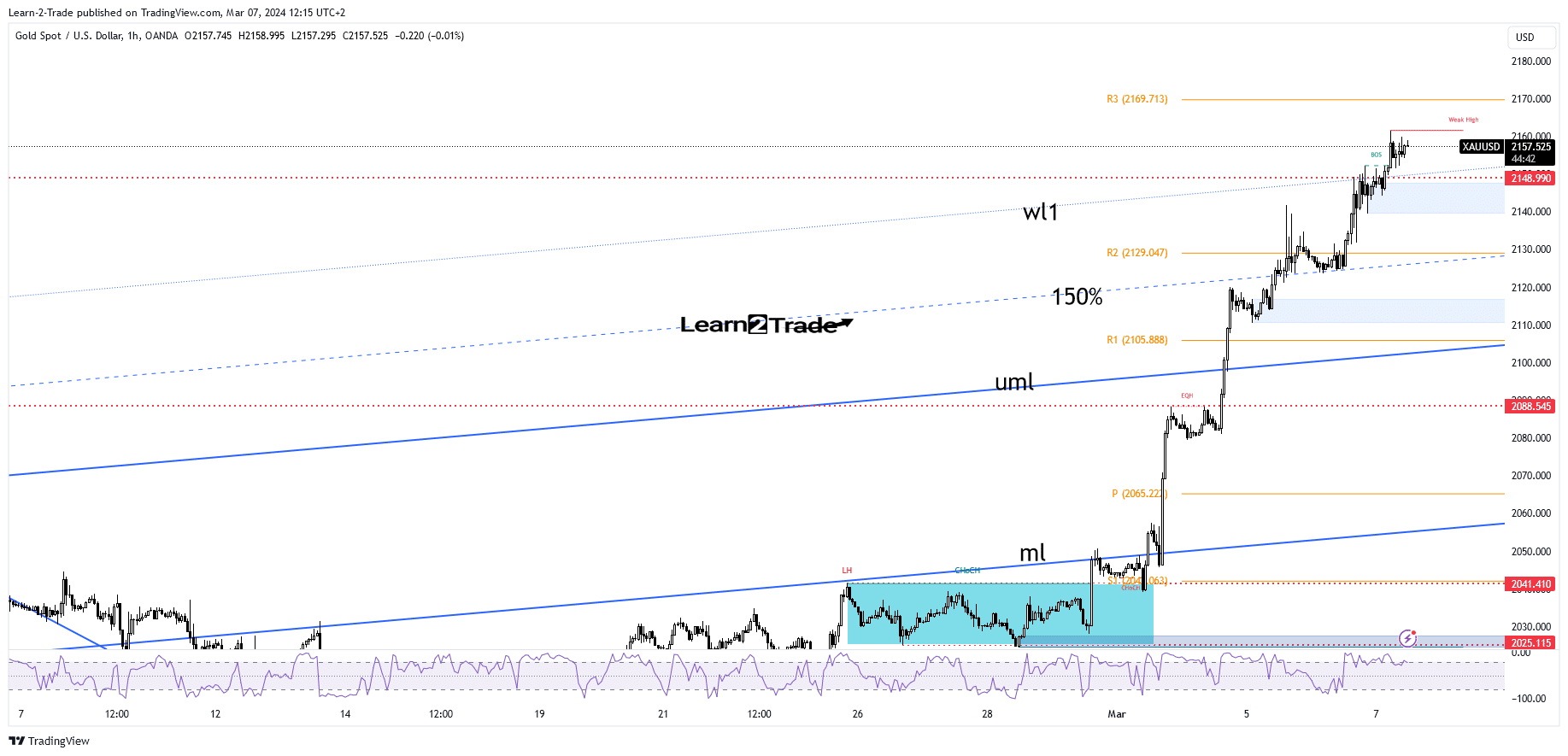

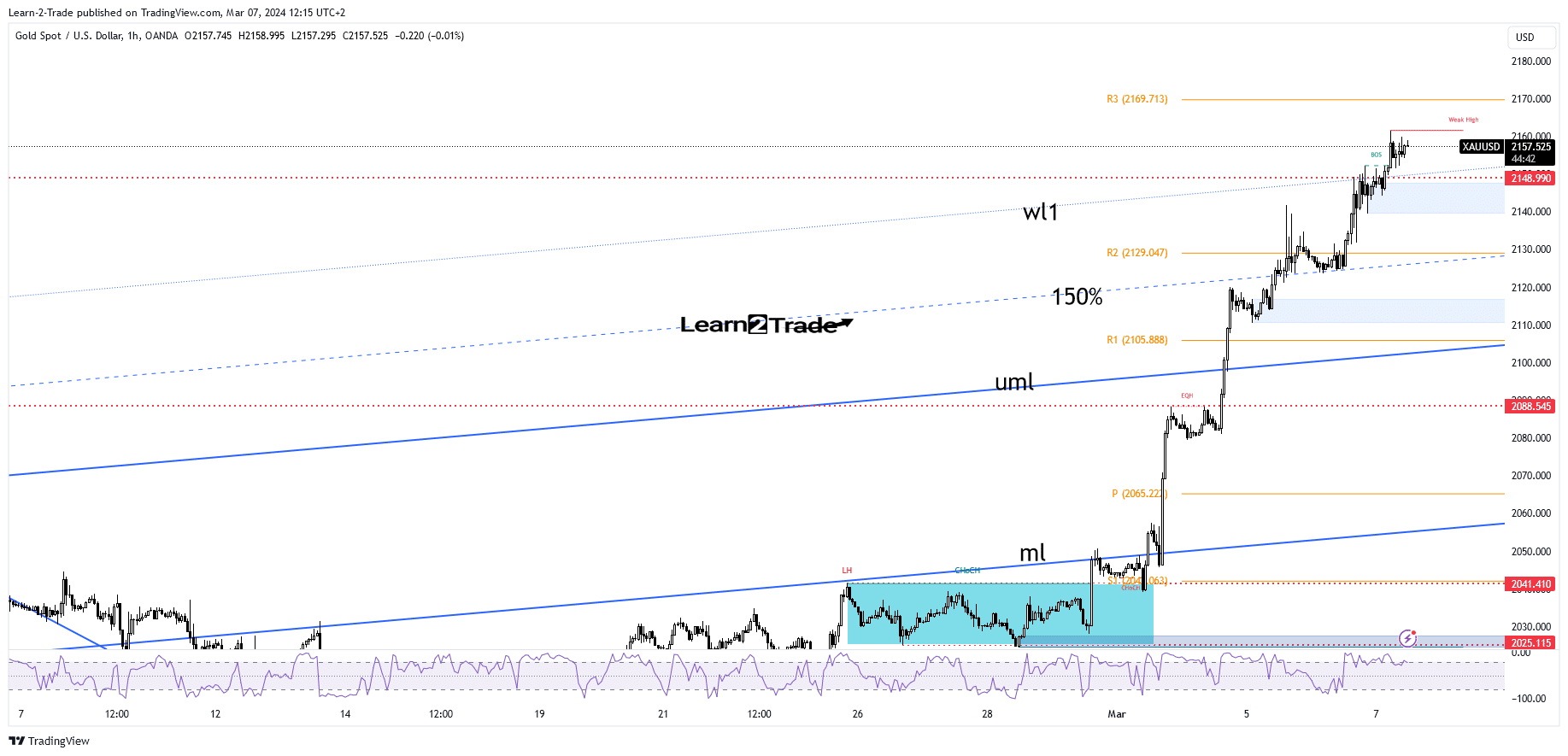

Gold Price Technical Analysis: Target $2,169

As you can see on the hourly chart, gold has broken the all-time high of $2,148 and the first warning line (vl1) of the bullish bull, confirming further upside ahead.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Staying near these obstacles signaled an imminent breakout and continuation. The weekly R23 of $2,169 represents the next major upside target if the rate continues to rise.

However, after such an impressive rally, we cannot rule out the possibility of a corrective decline as the price needs to attract new buyers and more bullish energy before printing new all-time highs. So, the outlook remains bullish despite minor pullbacks.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.