- KSAU/USD remains bearish if it remains below the 50% retracement level.

- US data and BOC should move the rate.

- A new lower low triggers more dips.

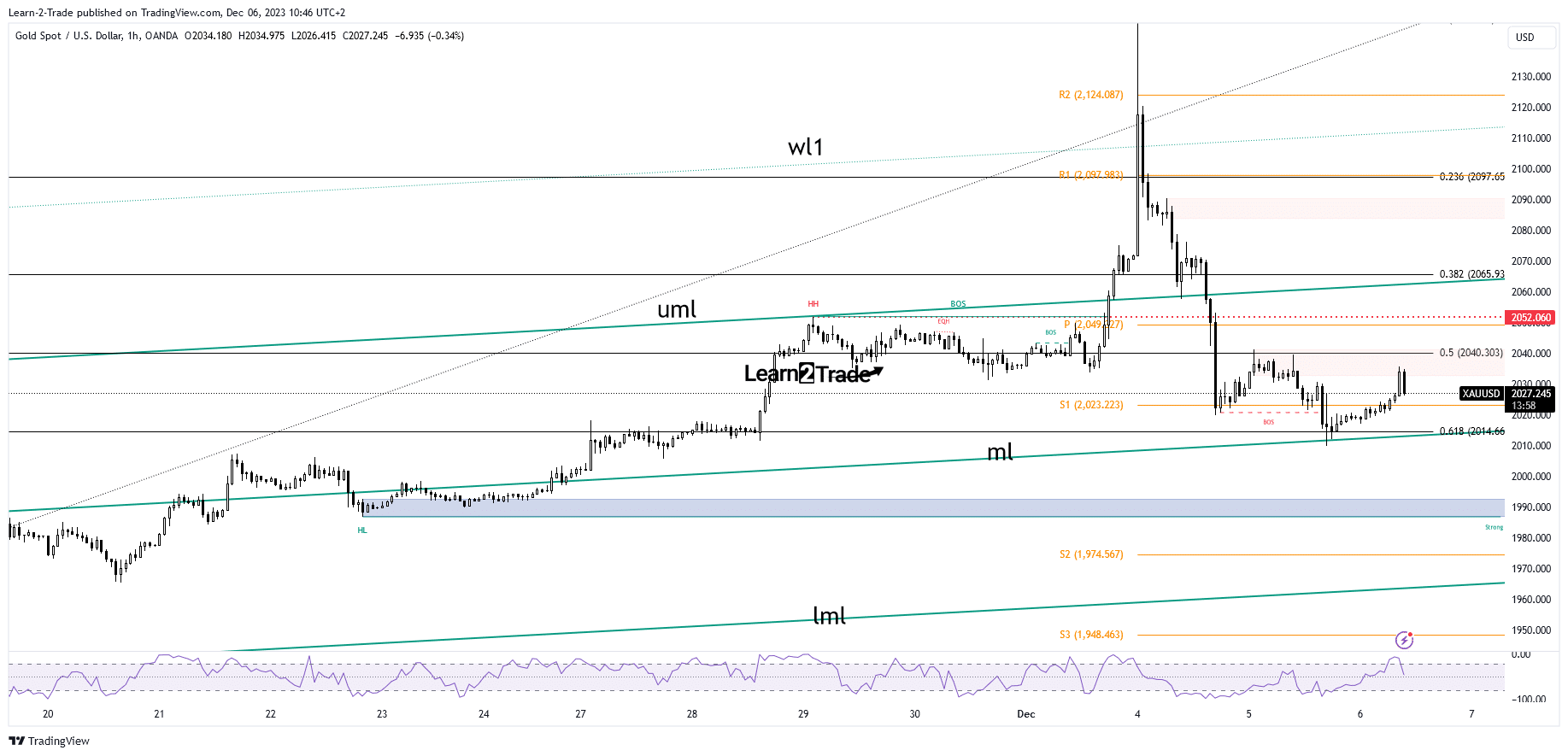

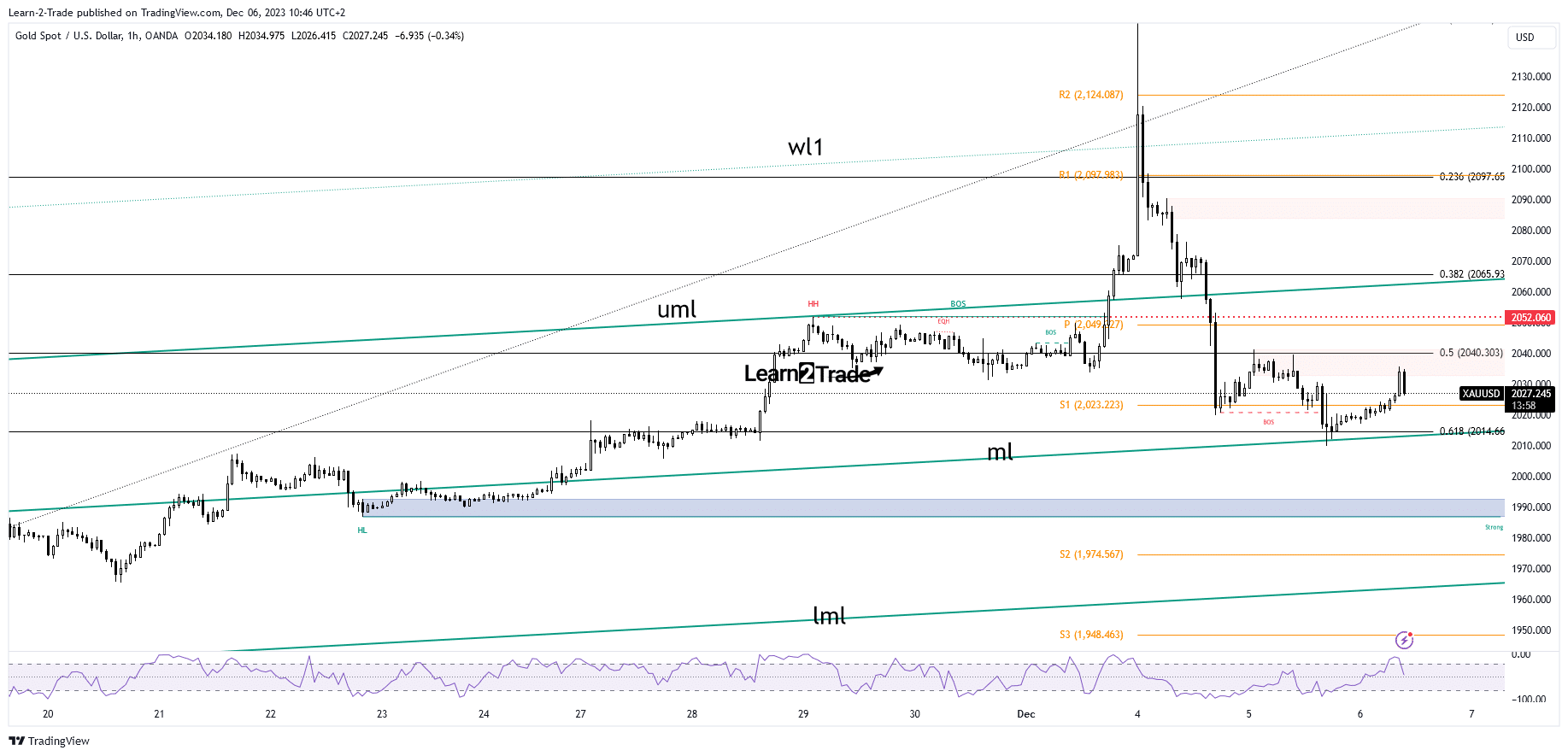

The price of gold fell to just $2,009 in the last trading session, where it found demand again. The metal has rebounded and is trading at $2,026 at the time of writing.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

After a massive move down, a bounce was expected. A higher US dollar rate forced the yellow metal lower. Further growth could drag the price of gold to new lows.

KSAU/USD turned higher after yesterday’s US JOLTS jobs numbers were worse than expected. The figure was reported at 8.73 million, well below the expected 9.31 million and compared to 9.35 million in the previous reporting period.

Gold rallied in the short term even though the US ISM Services PMI was better than expected, while the Final Services PMI matched expectations.

Today, Australia’s GDP recorded growth of just 0.2% against the expected growth of 0.5%. Later, US economic data and the BOC should move the rate. The Bank of Canada is expected to keep the overnight rate at 5.00%. However, the BPC Statement could bring about sharp developments.

In addition, the US ADP non-farm payrolls change could be reported at 131K from 113K in the previous reporting period.

Gold Price Technical Analysis: Bullish Momentum

The price of gold found support at 61.8% (2.014) and the middle line (ml) of the ascending fork. A false breakdown revealed a comeback. It reached the supply zone just below the 50% (2,040) retracement level.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Bottom pressure remains high as long as it is below this static resistance. Just jumping and stabilizing above the 50% retracement level can open the door for a bigger jump. On the other hand, a drop below 61.8% and below the midline, a new lower low, triggers more declines.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.