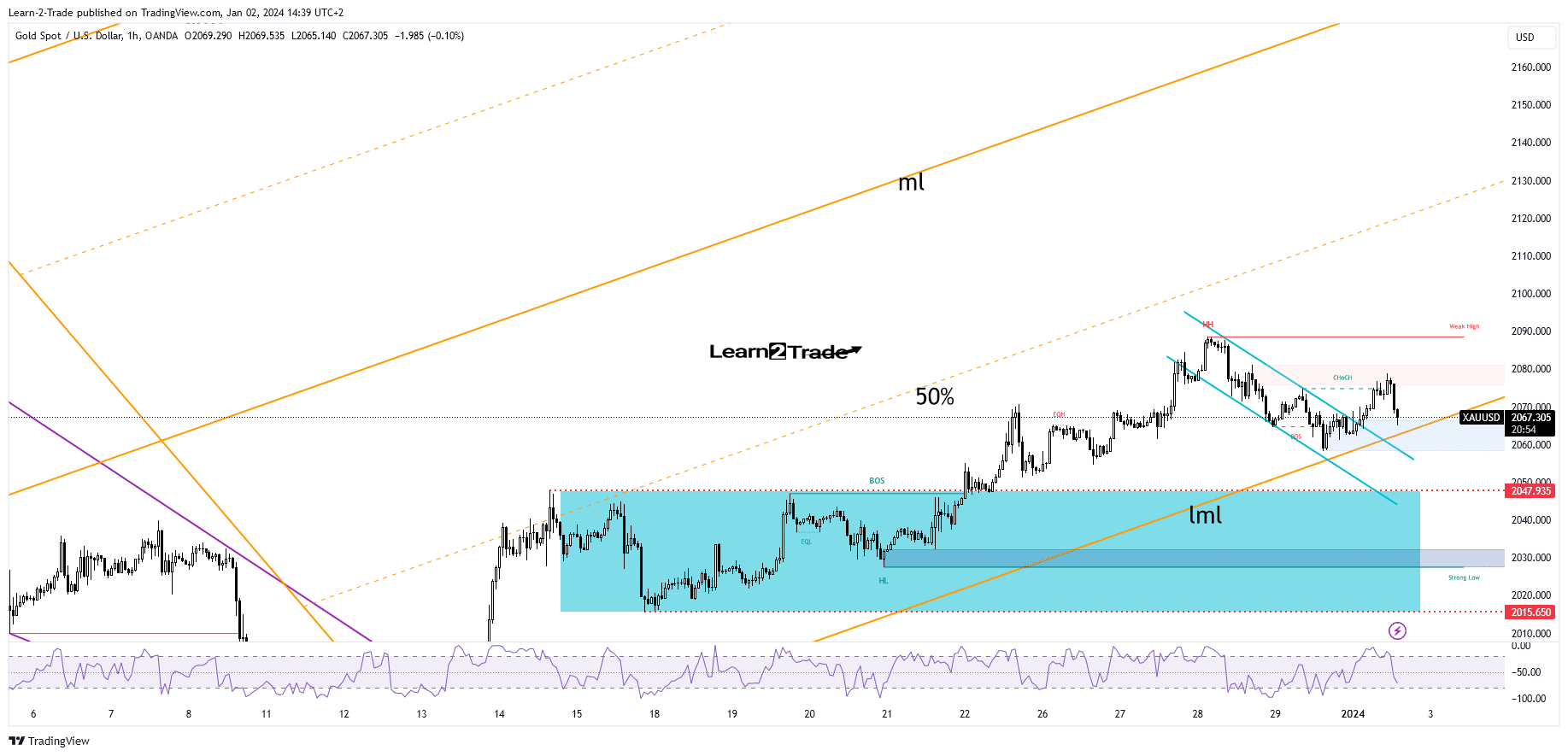

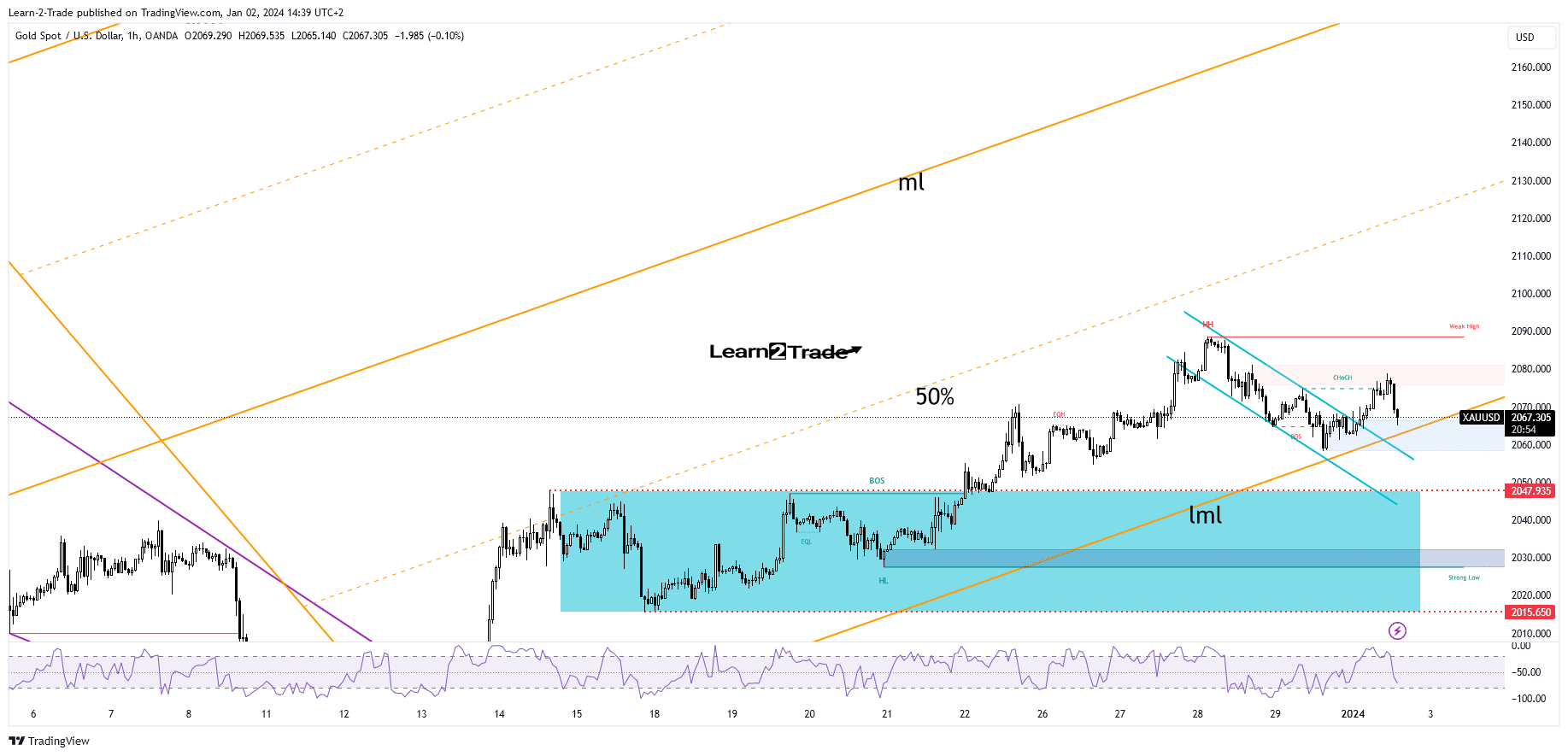

- The bias is bullish as long as it is above the lower median line.

- American data could be decisive tomorrow.

- A new higher high activates further growth.

The price of gold is trading in the red at $2,067 at the time of writing. The precious metal turned lower after reaching today’s high of $2,078.

It is likely that KSAU/USD fell lower as the US dollar rose. Today, the Eurozone released mixed data, but traders are waiting for US figures before taking action.

If you are interested in automated Forex trading, check out our detailed guide-

The final manufacturing PMI could jump from 48.2 to 48.4 points, which could be good for the dollar, while construction spending could again post a 0.6% increase. Positive US data should lift the USD. This situation can punish the price of gold.

Tomorrow the US data could be decisive. The ISM Manufacturing PMI could be reported at 47.2 points, which is above 46.7 points in the previous reporting period. The JOLTS jobs indicator is expected to be 8.85 million in November, up from 8.73 million in October, while the ISM Manufacturing Prices indicator could be reported at 50.0 points.

However, the most important event is the minutes from the FOMC meeting. As you already know, the Fed is expected to deliver 75 basis points of tapering in 2024, so a dovish report could weaken the USD.

Gold Price Technical Analysis: Selling

Technically, the bias remains bullish as long as it is above the lower median line (LML) of the ascending forks.

As you can see on the hourly chart, the price has broken out of the flag pattern, signaling a continuation to the upside. However, after the last rally, a retreat was somehow expected.

If you are interested in guaranteed stop loss forex brokers, check out our detailed guide-

The metal could retest the demand zone right above the lower median line (LML) to attract more buyers before jumping higher.

False breakouts below this dynamic support may herald new bullish momentum. A new higher high, clearing the high of 2,081, activates further upside.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.