- KSAU/USD is bullish despite temporary dips.

- A new lower low activates a corrective phase.

- The breakout from the ascending channel pattern heralded exhausted buyers.

Gold pared gains after reaching today’s high of $2,417. The metal is trading at $2,381 at the time of writing. Despite the temporary correction, the bias remains bullish in the medium to long term.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

After its strong upward movement, there may be minor dips due to profit taking. Yesterday, the US released mixed economic data. Jobless claims remained at 212,000 last week, even as traders expected a potential rise to 215,000.

At the same time, the Philly Fed manufacturing index reached 15.5 points compared to 1.5 points in the previous reporting period.

On the other hand, Existing Home Sales and CB Leading Index report poor data. Today, the yellow metal recovered due to geopolitical tensions in the Middle East. However, KSAU/USD appears to be overpriced in the short-term, posing the risk of a downside correction.

Basically, speeches from MPC members, Briden, Rasmsden and Mann could deliver something later today. Gold is currently struggling to rally and recover from the latest sell-off as UK retail sales rose 0.0%, less than an estimated 0.3% rise and a 0.1% rise in the previous reporting period.

Gold price technical analysis: Bearish pattern

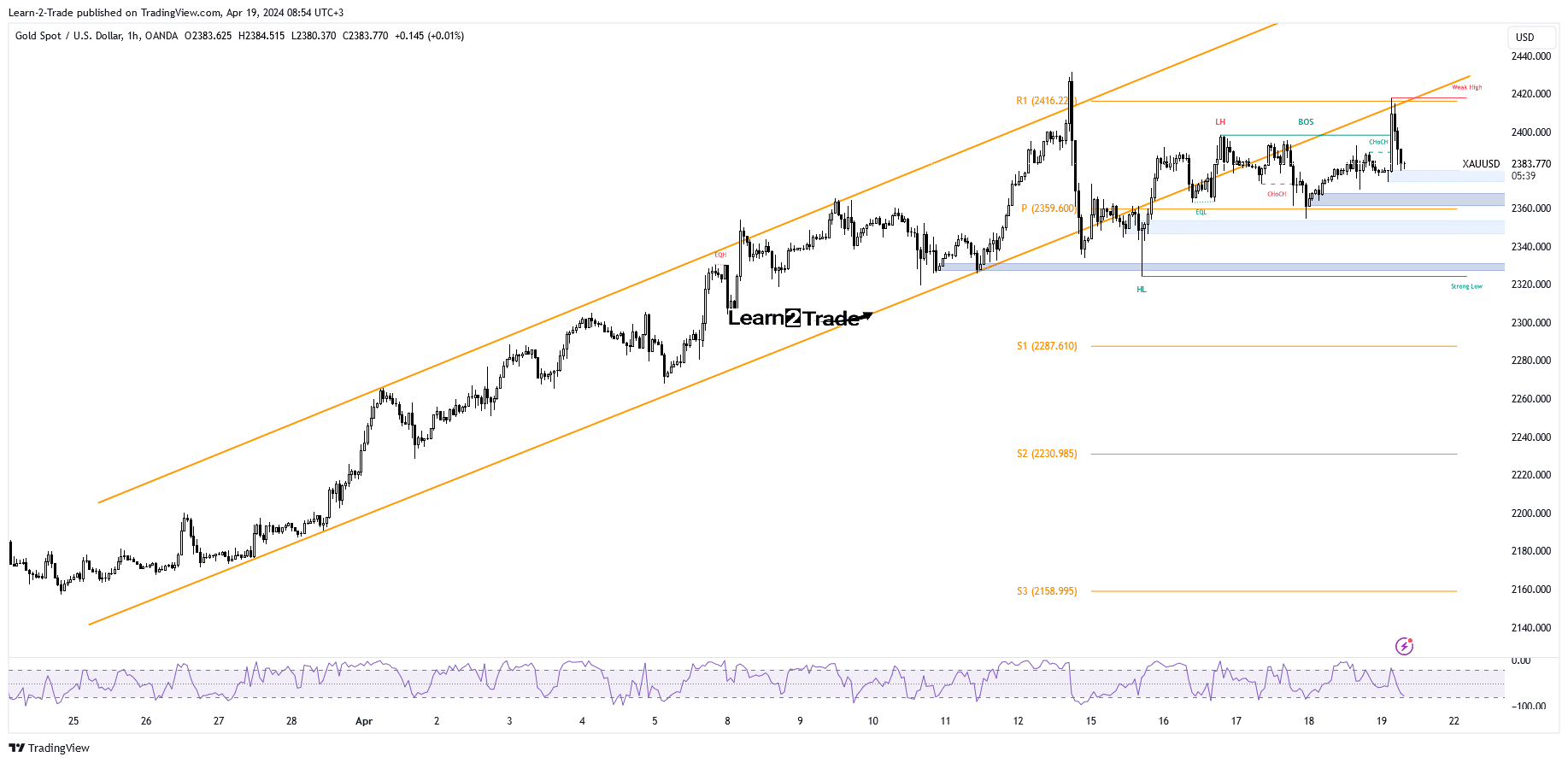

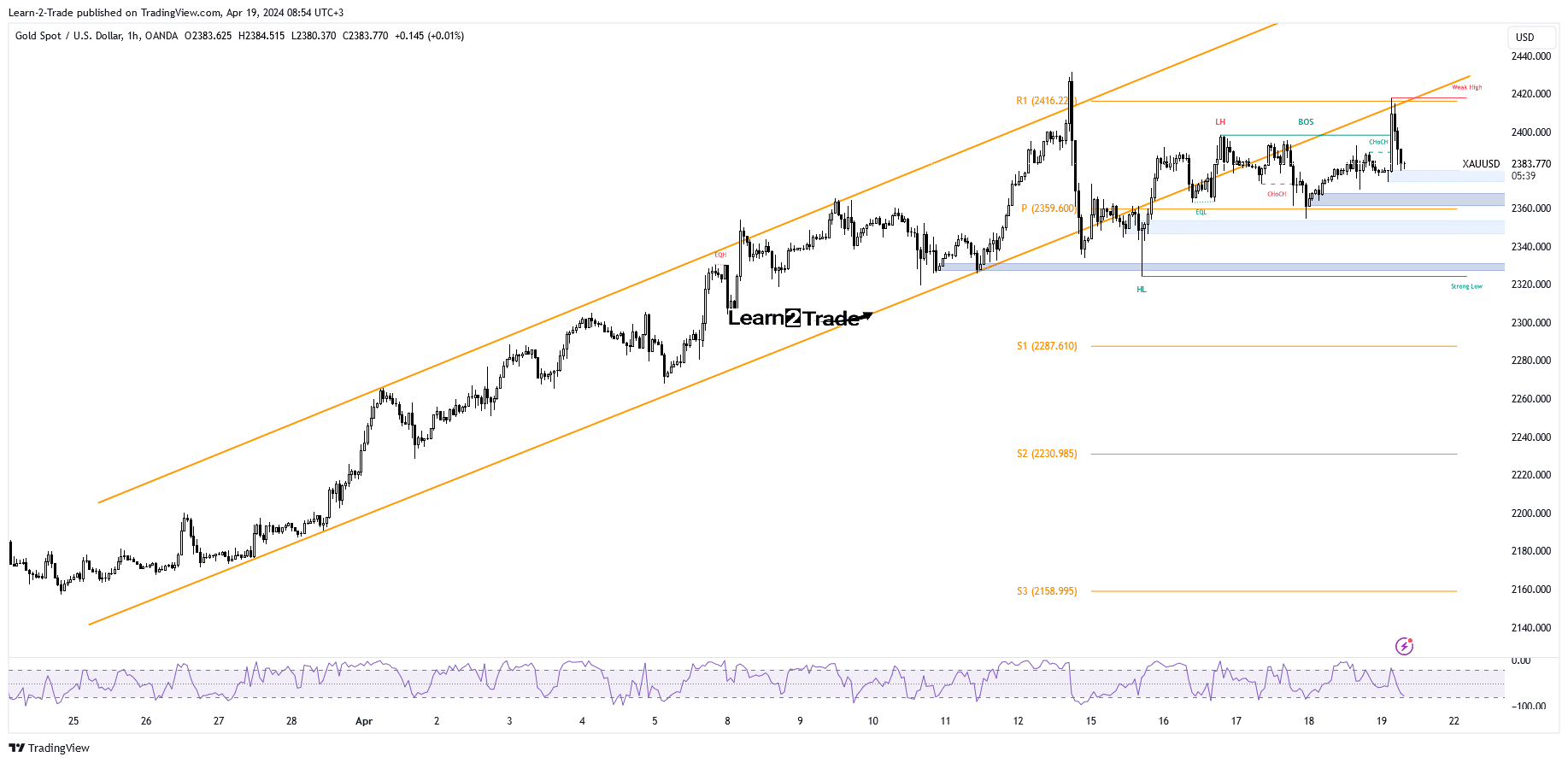

As you can see on the hourly chart, KSAU/USD has extended its rally in the ascending channel, reaching a new all-time high of $2,431. It has now broken out of this pattern, signaling buyer exhaustion.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

However, prices have bounced back higher and the broken uptrend line has been tested. It found resistance at the weekly R1 of 2,416. False breakouts with a large separation through this static resistance and above the uptrend line reveal an overbought situation. It is trapped between R1 (2,416) and the pivot point of $2,359.

Escape from this range could bring us new possibilities. If it closes below the pivot point, a corrective phase could be triggered after making a new lower low. However, a major correction will be confirmed only after the 2,318 down hurdle is cleared.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.