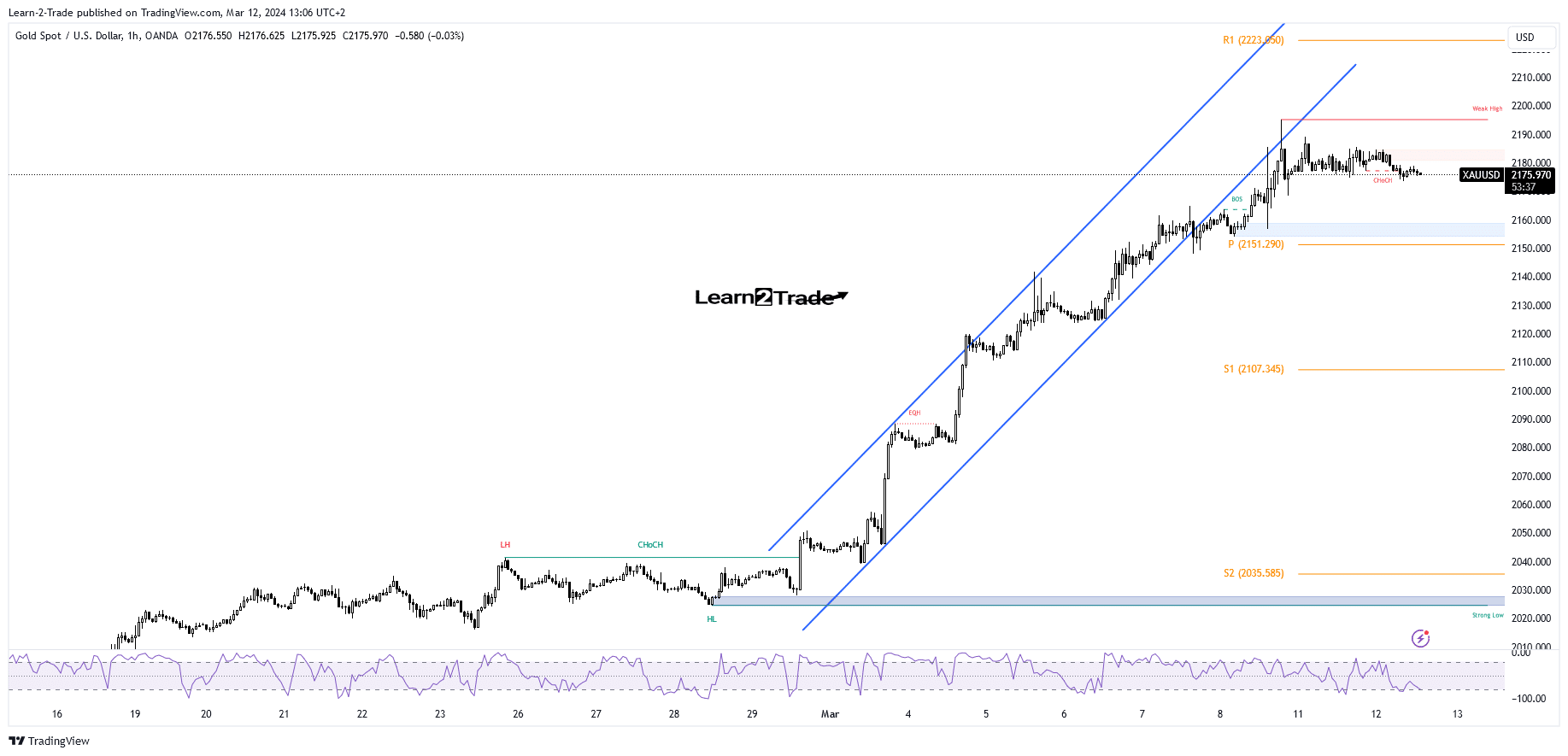

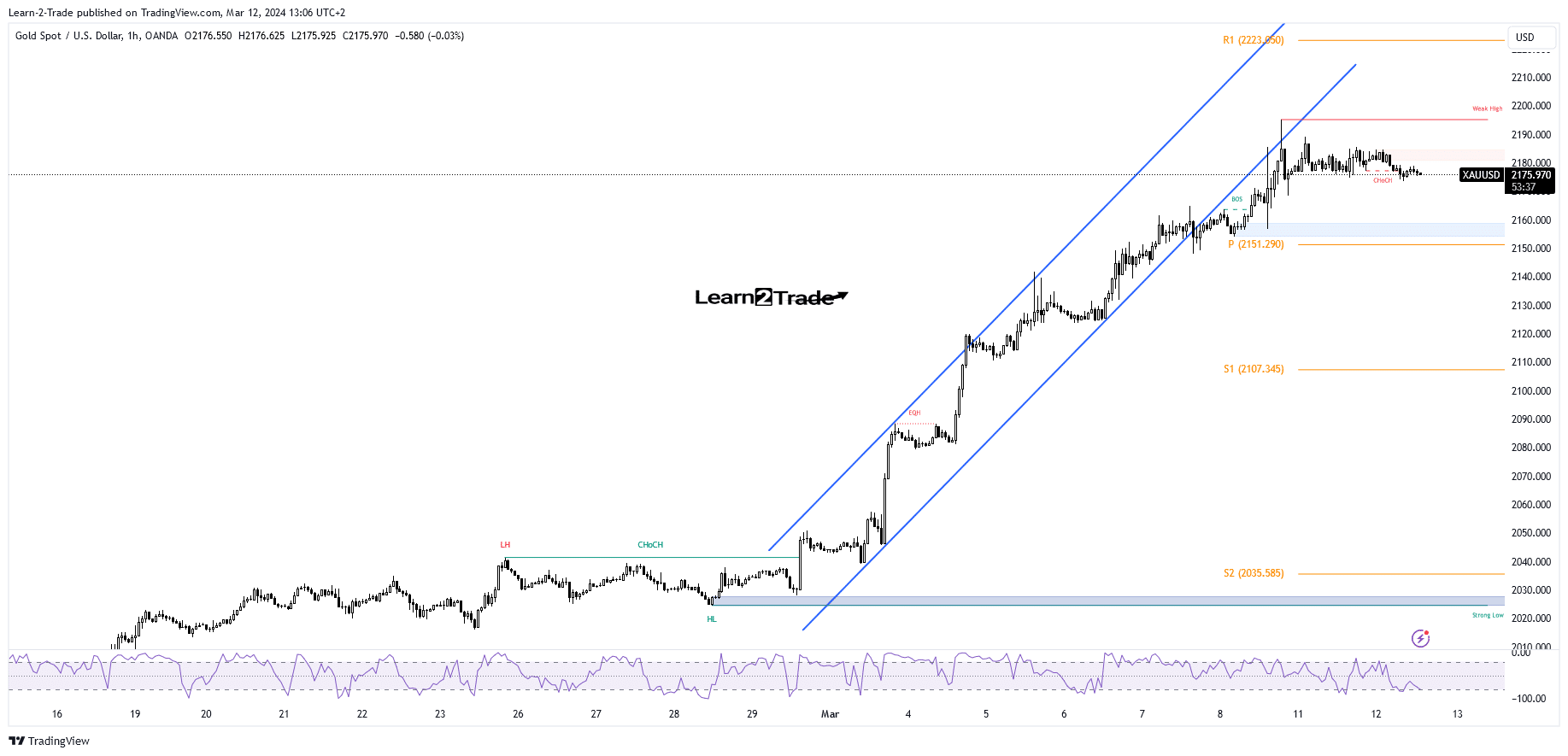

- KSAU/USD broke out of the upward channel, signaling an overbought situation.

- Removing a pivot point activates more drop.

- US inflation data should shake up markets.

The price of gold rose to $2,195 on Friday, marking a new all-time high. Now the metal has pulled back a bit and is trading at $2,175 at the time of writing.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

Fundamentals should move today’s prices as the US releases inflation data. The consumer price index is expected to rise 0.4% in February compared to an estimate of 0.3%, so the annual CPI could post a 3.1% increase for the second month in February. Meanwhile, core CPI is expected to register an increase of 0.3% after rising 0.4% in January. Higher inflation should boost the dollar, as the Fed should delay its first rate cut.

The Federal Reserve is expected to cut rates by 75 bps this year. On the contrary, lower inflation should weaken the USD. However, it remains to be seen how the yellow metal will react when the price signaled an overbought situation.

KSAU/USD turned lower ahead of the US numbers. This should bring high volatility and sharp moves.

Earlier, the UK published mixed data. The unemployment rate jumped from 3.8% to 3.9% even as experts expected the rate to remain at 3.8%, average hourly earnings reported a rise of 5.6%, less than the estimated growth of 5.7%, while the change in the number of claimants amounted to 16.8 thousand points, above the forecast of 20.3 thousand.

Gold Price Technical Analysis: In Range From All-Time High Price

KSAU/USD climbed to new highs within an ascending channel pattern. The price fell below the uptrend line, signaling exhausted buyers and overbought. The yellow metal tested the broken ascending line (channel support) and seems determined to print a corrective phase.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

The weekly midpoint at $2,151 is a potential downside target and barrier. A bigger move down could be triggered only after a valid break through this support is made.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money