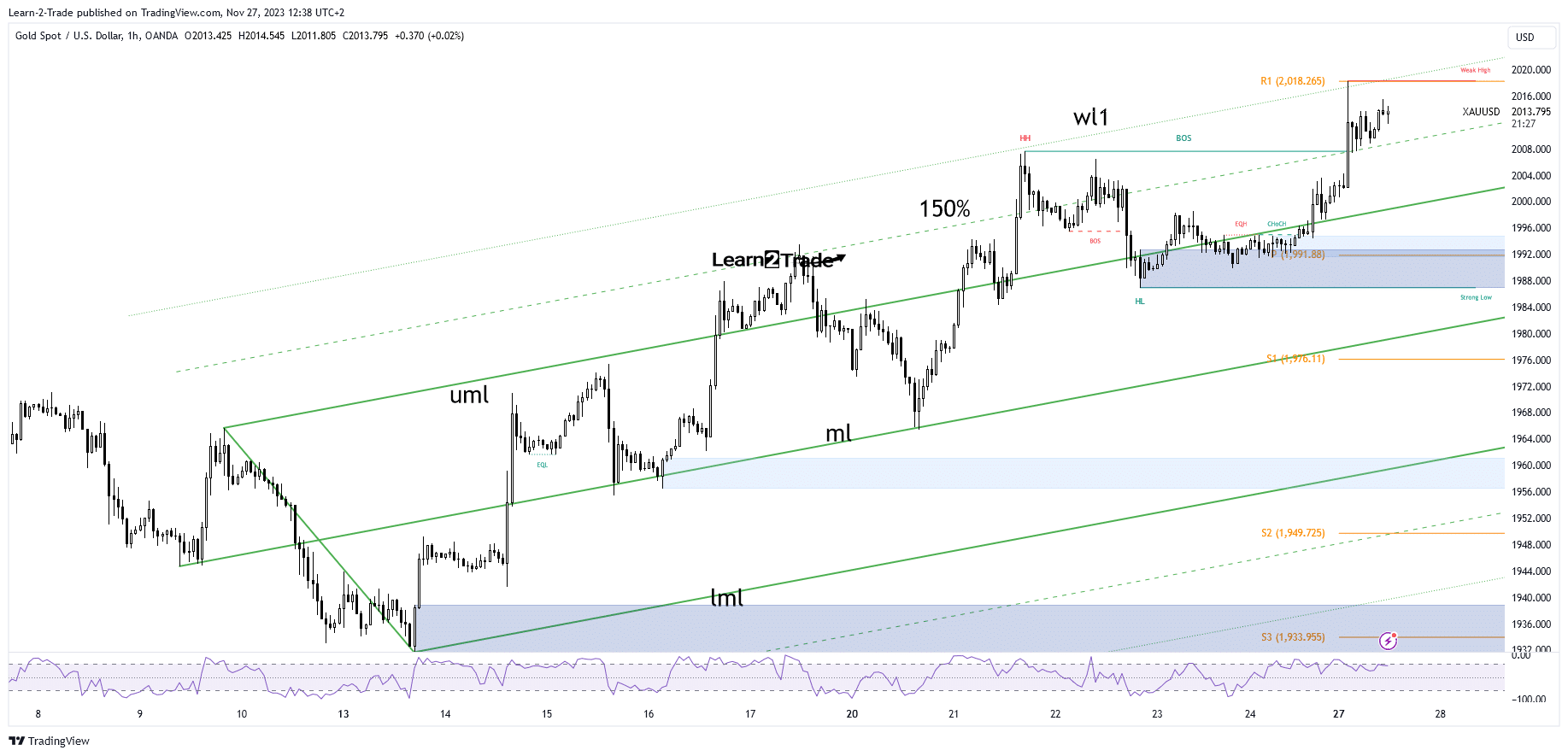

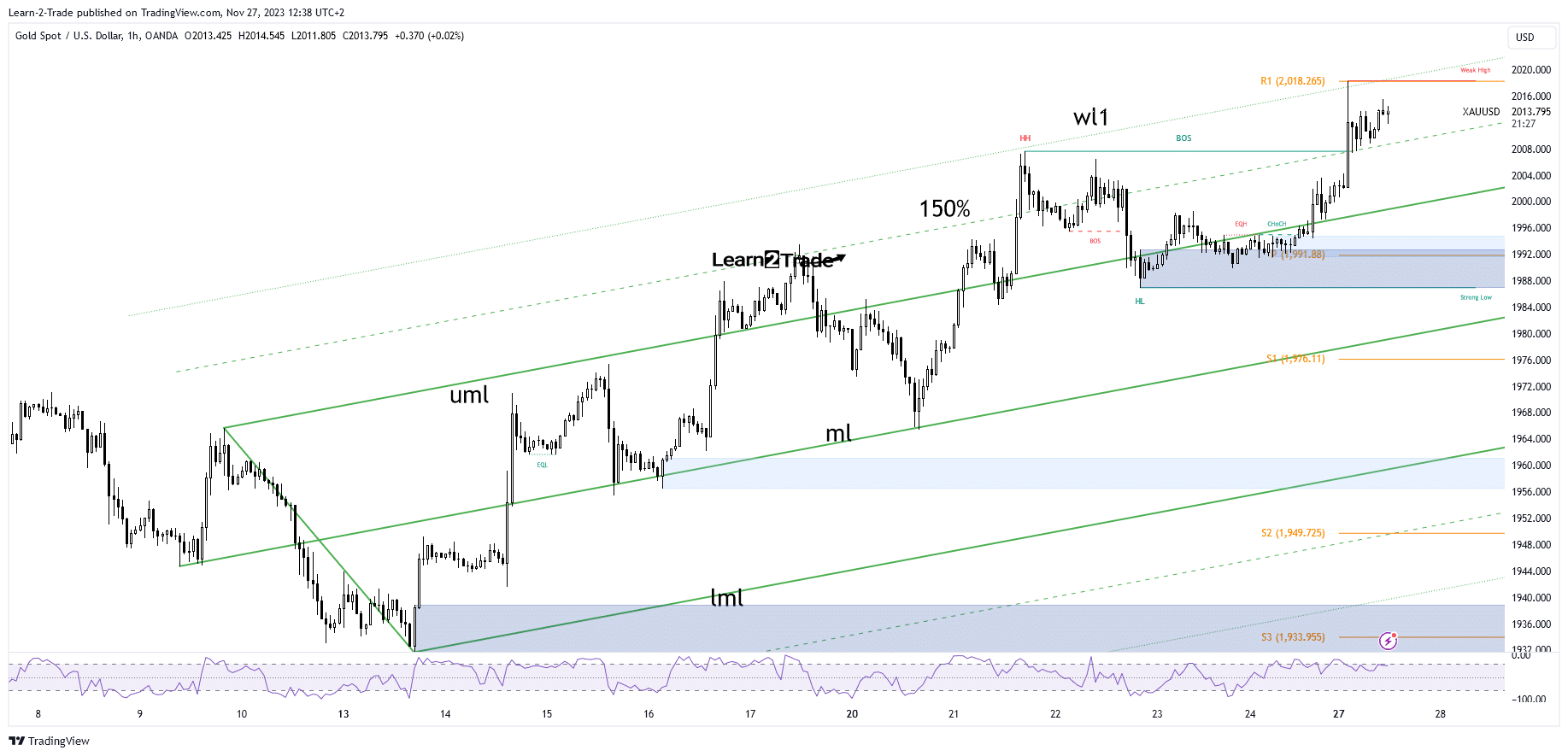

- The bias remains bullish as long as it is above the 150% line.

- A new higher high activates further growth.

- US data could trigger action on KSAU/USD.

The price of gold rose to a new higher high of $2,018. The precious metal has pulled back a bit and is trading at $2,014 at the time of writing.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

The continuation of the decline in the dollar helped KSAU/USD to extend its rise. The bias is bullish, so further gains are on the cards.

Basically, the yellow metal hit new highs as the US Flash Manufacturing PMI came in worse than expected on Friday at 49.4 points versus an expected 49.9 points, confirming the contraction.

Today, US new home sales are expected to fall from 759K to 724K. Bad economic data should weaken the dollar and could help KSAU/USD reach new highs.

On the contrary, positive data could save the dollar from falling, while the price of gold could fall again.

Also, ECB President Lagarde’s speech could have a significant impact. The US CB Consumer Confidence is considered a high-impact event and could bring sharp moves tomorrow. HPI and S&P/CS Composite-20 HPI data will also be released.

Gold price technical analysis: Bulls pause at $2,018

From a technical point of view, KSAU/USD strengthened after retracing above the upper median line (UML) of the ascending fork. The metal ignored the 150% Fibonacci line, reaching the warning line (vl1). This represents dynamic resistance, and the rate only prints a false breakout with a large separation, signaling exhausted buyers.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

However, the bias remains bullish as long as it is above the 150% Fibonacci retracement line and the former high of $2,007. A small consolidation above these current support levels may herald a continuation to the upside. However, a new higher high may trigger further growth. On the other hand, a drop below a short-term support level could trigger a correction.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.