- KSAU/USD remains bearish if it remains below the 50% retracement level.

- 61.8% and the middle line represent key support levels.

- US data could have a big impact today.

The price of gold fell 6% from fresh all-time highs in the last trading session. The precious metal is trading at $2,033 at the time of writing and is struggling to recover.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Downside pressure remains high as the US dollar could continue to rise. Fundamentally, KSAU/USD turned to the upside in the short-term as US factory orders reported a 3.6% decline versus an estimated 2.7% decline.

Today the Reserve Bank of Australia left the cash rate unchanged at 4.35% as expected. Later, the US will release data with a big impact. The ISM Services PMI is expected to jump from 51.8 points to 52.2 points, while the JOLTS jobs number could fall to 9.31 million from 9.55 million.

In addition, data on final services PMI and RCM/TIPP economic optimism will be released. Positive economic figures could boost the dollar, so KSAU/USD could reach new lows.

The BOC is expected to keep the overnight rate at 5.00% tomorrow. In addition, ADP non-farm employment change and Australian GDP could shake up the markets.

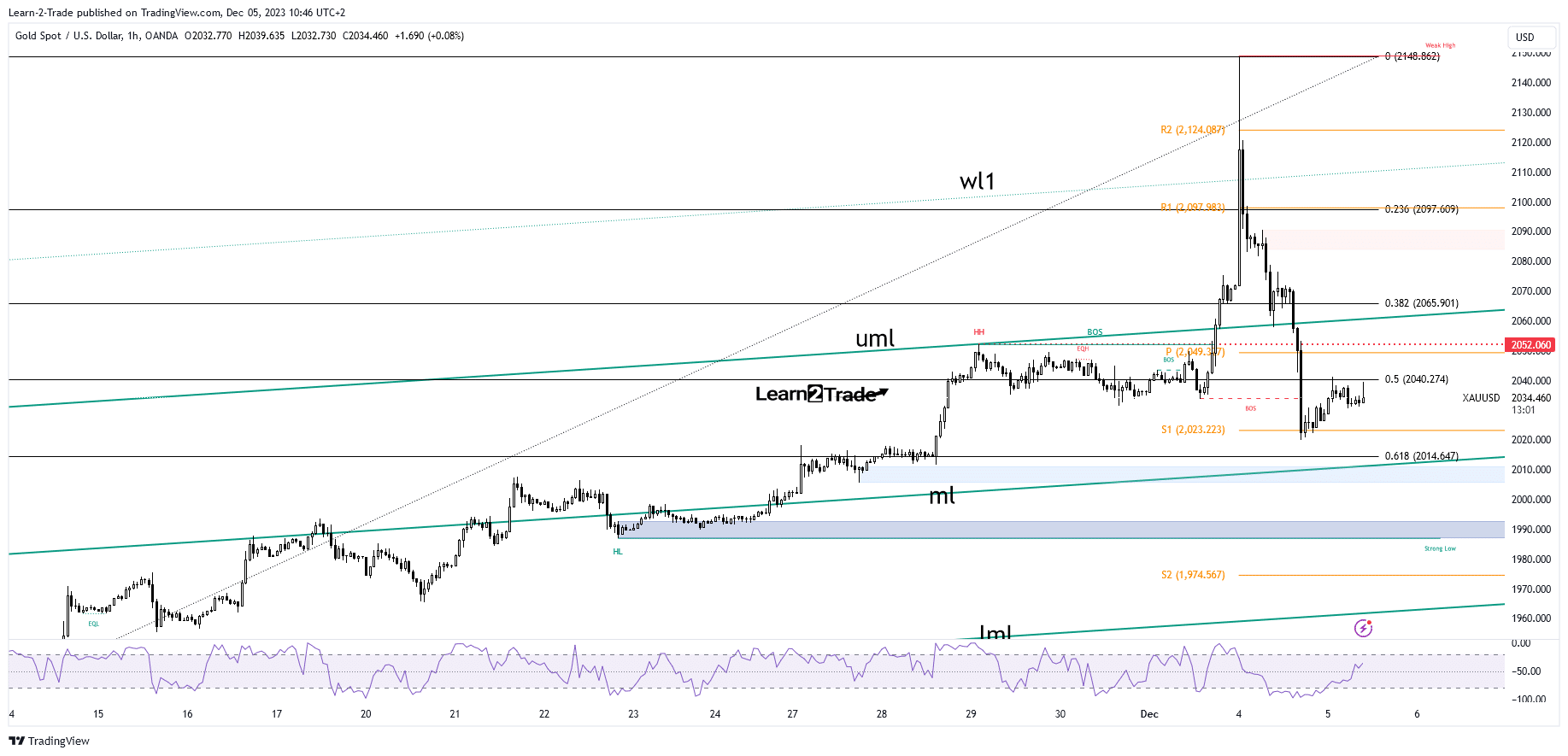

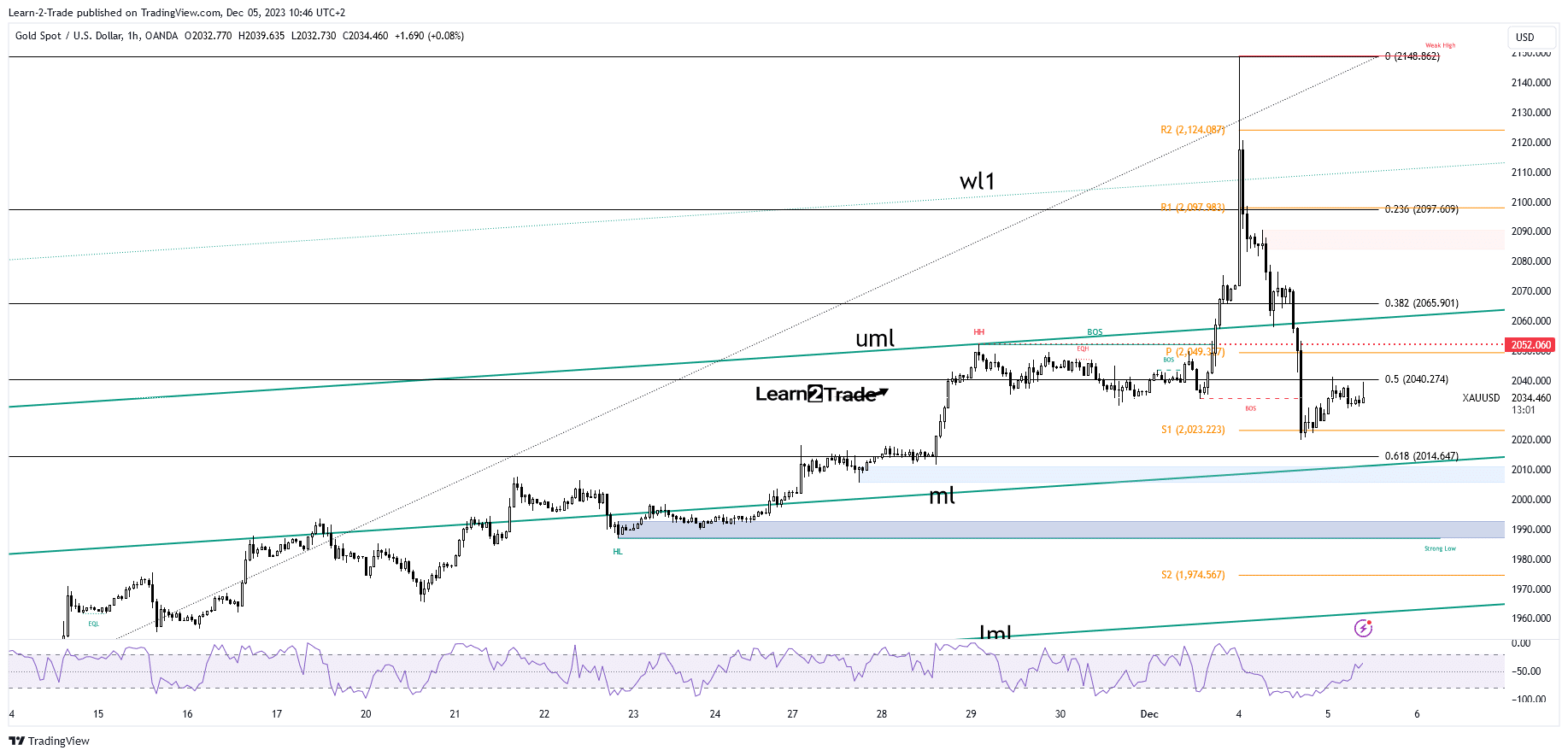

Technical analysis of the price of gold: a correction

As you can see on the hourly chart, the price registered a false breakout with a sharp decline through the weekly R2 of 2,124, signaling exhausted buyers.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

It canceled the breakout above the warning line (vl1) with a huge decline. The sell-off was paused by the weekly S1 of 2,023. Price has come back to retest the 50% retracement level (2,040), but as long as it is below it, the bias remains bearish.

From a technical point of view, 61.8% (2,014) and the middle line (ml) of ascending forks represent key and critical obstacles to the downside. Testing these levels and registering false breakouts can herald a new leg higher. On the contrary, removing these support levels activates more declines.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.