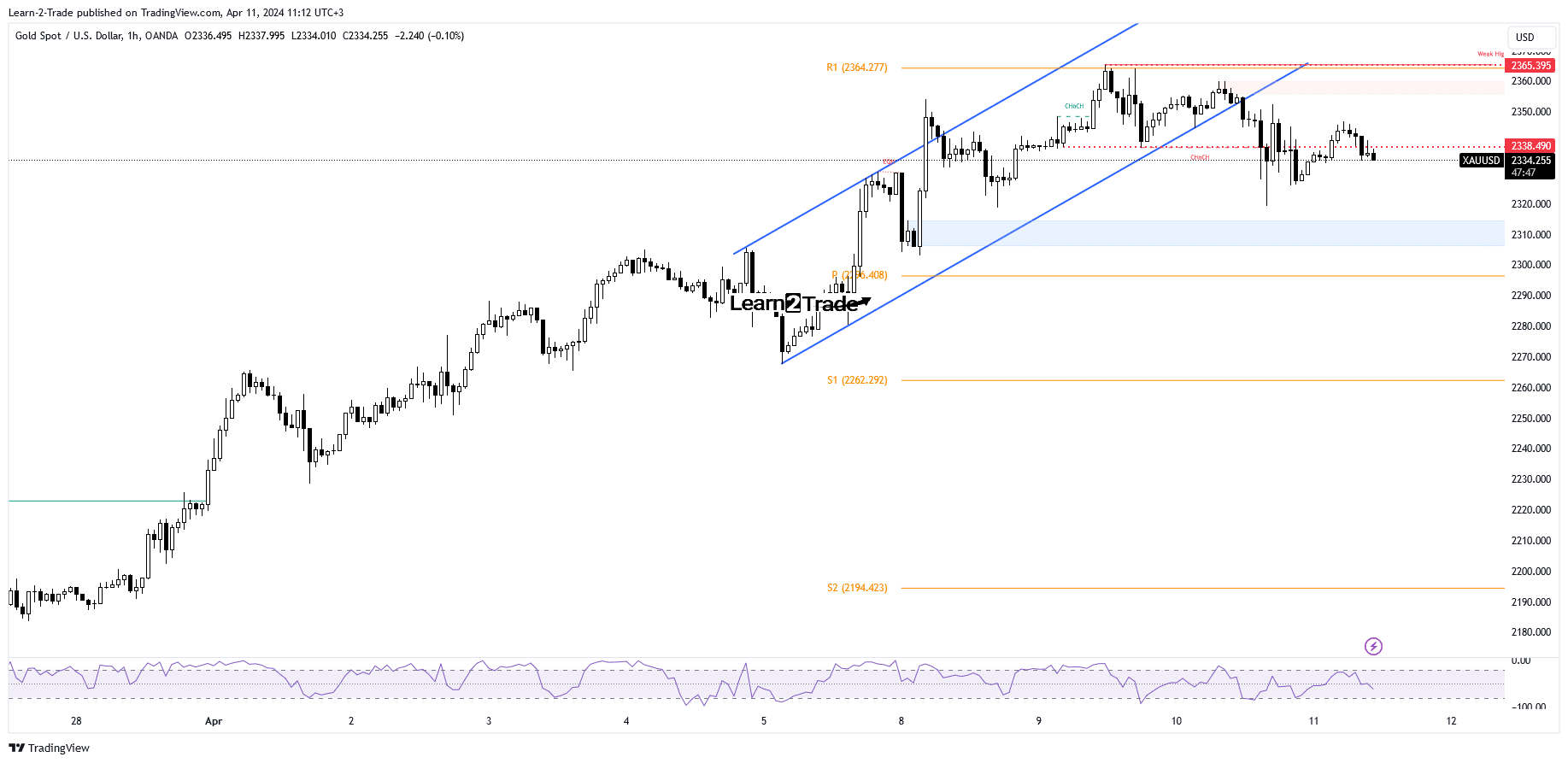

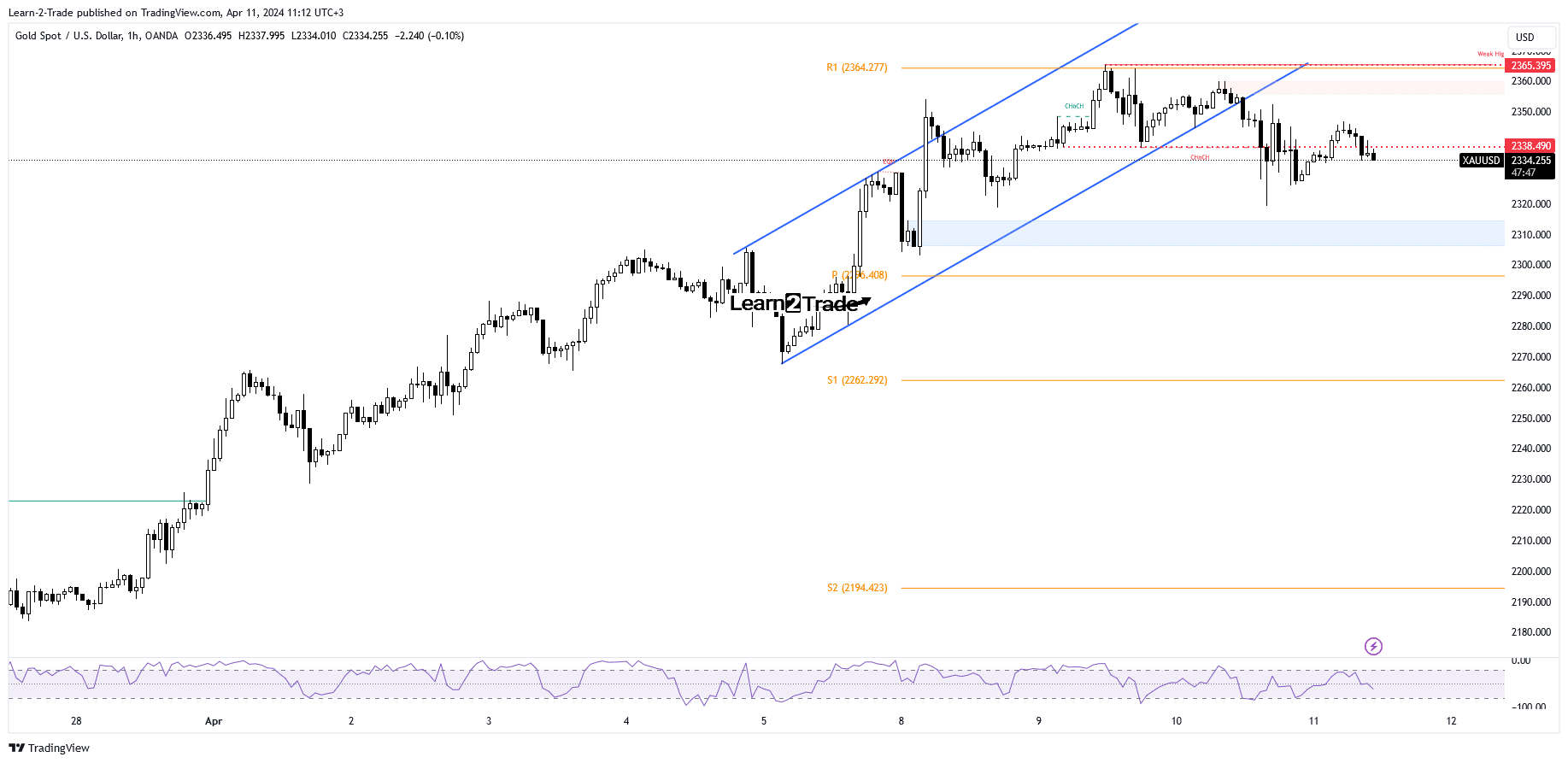

- Bottom pressure is high after breaking out of the flag pattern.

- The pivot point is seen as a potential target.

- ECB press conference and US data should move course.

The price of gold turned lower after hitting today’s high of $2,346. The metal is trading at $2,332 at the time of writing. A rise in the greenback boosted the greenback in the last trading session and weighed on XAU/USD.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

Further growth in the Greenback could weigh down the yellow metal in the short term. However, don’t forget that the bias is still bullish despite minor corrective downsides.

KSAU/USD registered sharp movements in both directions yesterday, as expected after the release of US inflation data. As noted in previous analyses, higher US inflation should lift the USD and pull gold lower.

The CPI reported a 0.4% increase in March, beating the estimate of 0.3% growth. The CPI rose 3.5% year-on-year, beating the forecast of 3.4% growth, while the Core CPI rose 0.4% versus the 0.3% expected.

In addition, the BPC and RBNZ kept monetary policy on hold at their April meeting. Today, the ECB is expected to keep the main refinancing rate at 4.50%.

The ECB press conference should shake up the markets today. In addition, the US will release data on PPI, Core PPI and jobless claims.

Gold Price Technical Analysis: Resistance to Confrontation

From a technical point of view, KSAU/USD found resistance at the weekly R1 (2,364) and has now broken out of the flag pattern, signaling a corrective phase.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

In the short-term, it tried to recover after the latest sell-off, but downside pressure looks high.

However, only a new lower low, clearing the current lows, could trigger a bigger decline towards the weekly pivot point of 2,296. A valid breakdown at this level confirms a continuation to the downside.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.