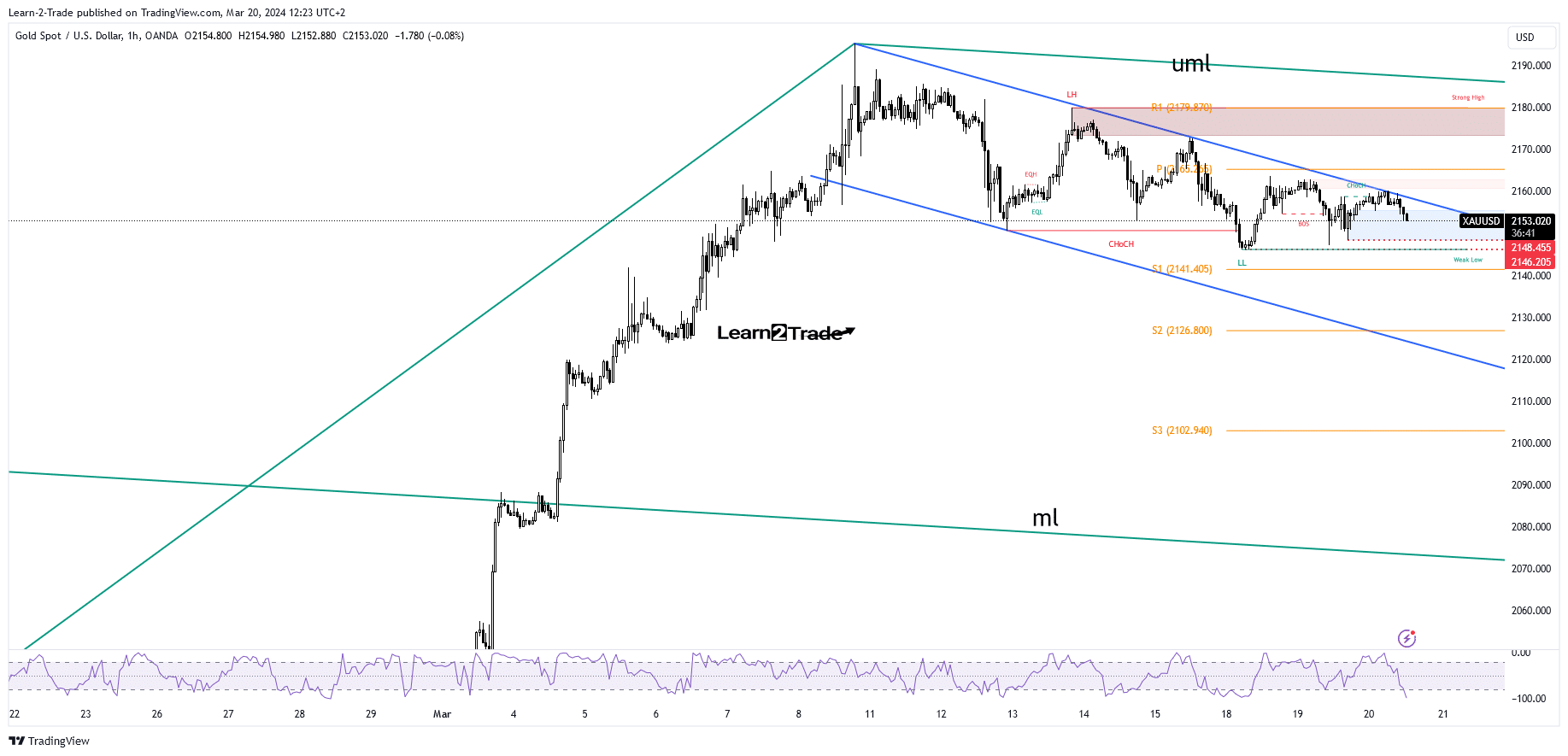

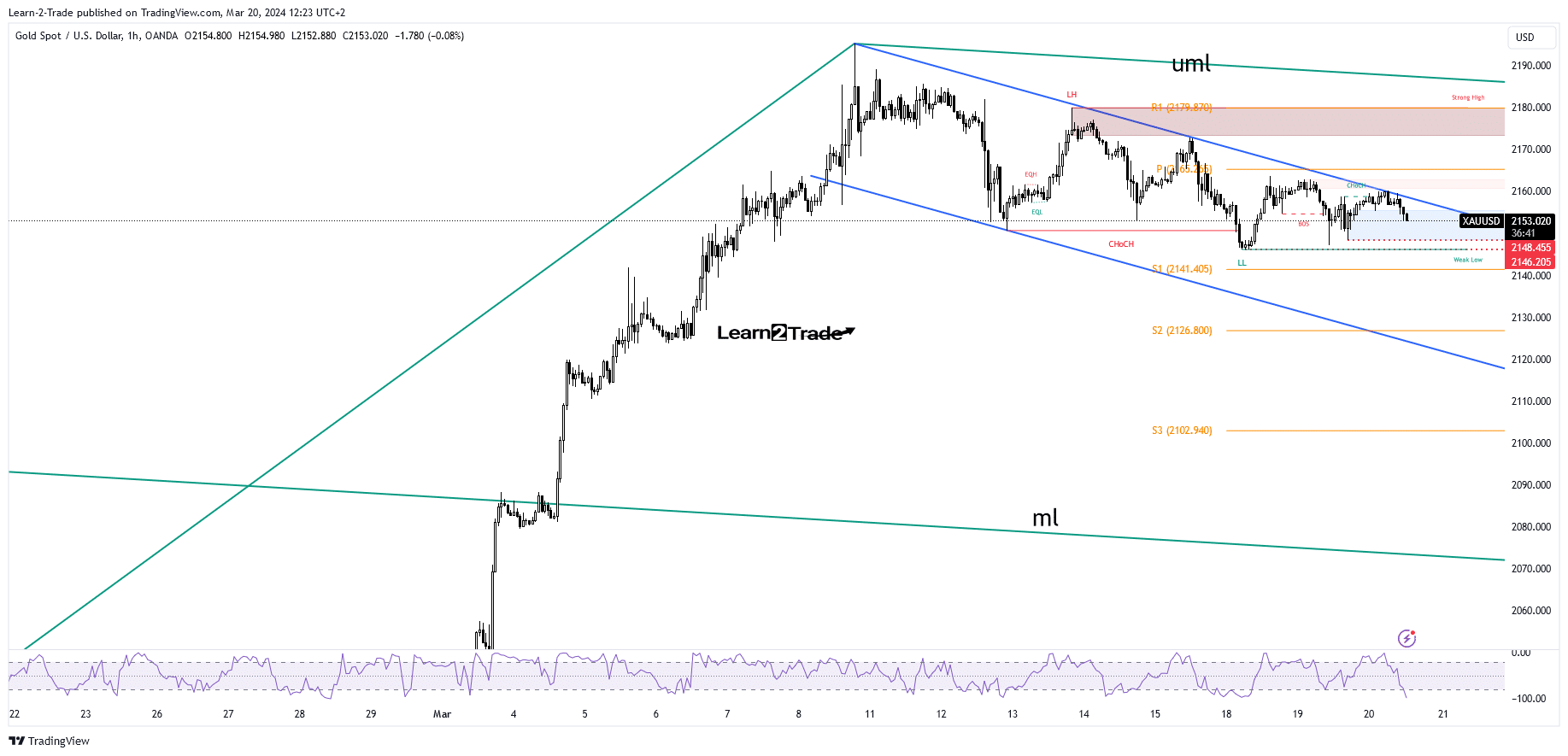

- The bias is bearish as long as it remains below the immediate downtrend line.

- FOMC should bring high volatility.

- The removal of the downtrend line indicates a continuation to the upside.

The price of gold is trading in the red at $2,152 at the time of writing. The precious metal appears determined to extend its selloff.

One significant factor contributing to gold’s weakness is the dollar’s outperformance following the FOMC’s rate decision and monetary policy statement.

-Are you interested in learning more about Bitcoin price prediction? Click here for details –

BOJ increased the interest rate by 0.20% yesterday, so the reference rate of BOJ jumped from -0.10% to 0.10%, while RBA left the monetary policy unchanged.

Furthermore, Canada’s CPI rose 0.3% versus an estimated 0.6% increase, but was above the 0.0% increase in the previous reporting period. Gold also remains under pressure as US building permits and housing starts were better than expected.

Today, the UK CPI rose just 3.4% compared to the 3.5% growth estimated after a 4.0% rise in the previous reporting period. At the same time, Core CPI was also worse than expected.

Later, the FOMC should move the markets. The Fed is expected to keep the federal funds rate at 5.50%, but the FOMC statement and FOMC press conference should bring a lot of volatility.

Technical analysis of the price of gold: the dominance of bears

Technically, the price retested the downtrend line, which is a dynamic resistance. As long as it’s under him, the metal could fall deeper.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

Former lows of $2,148 and $2,146 represent immediate downside barriers. Making a new lower low could trigger more declines. The lower channel line is considered a potential target if the rate continues to fall.

On the contrary, a hold above $2,146 and a valid break through the downtrend line indicates that the correction is over and we may have a continuation to the upside.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.