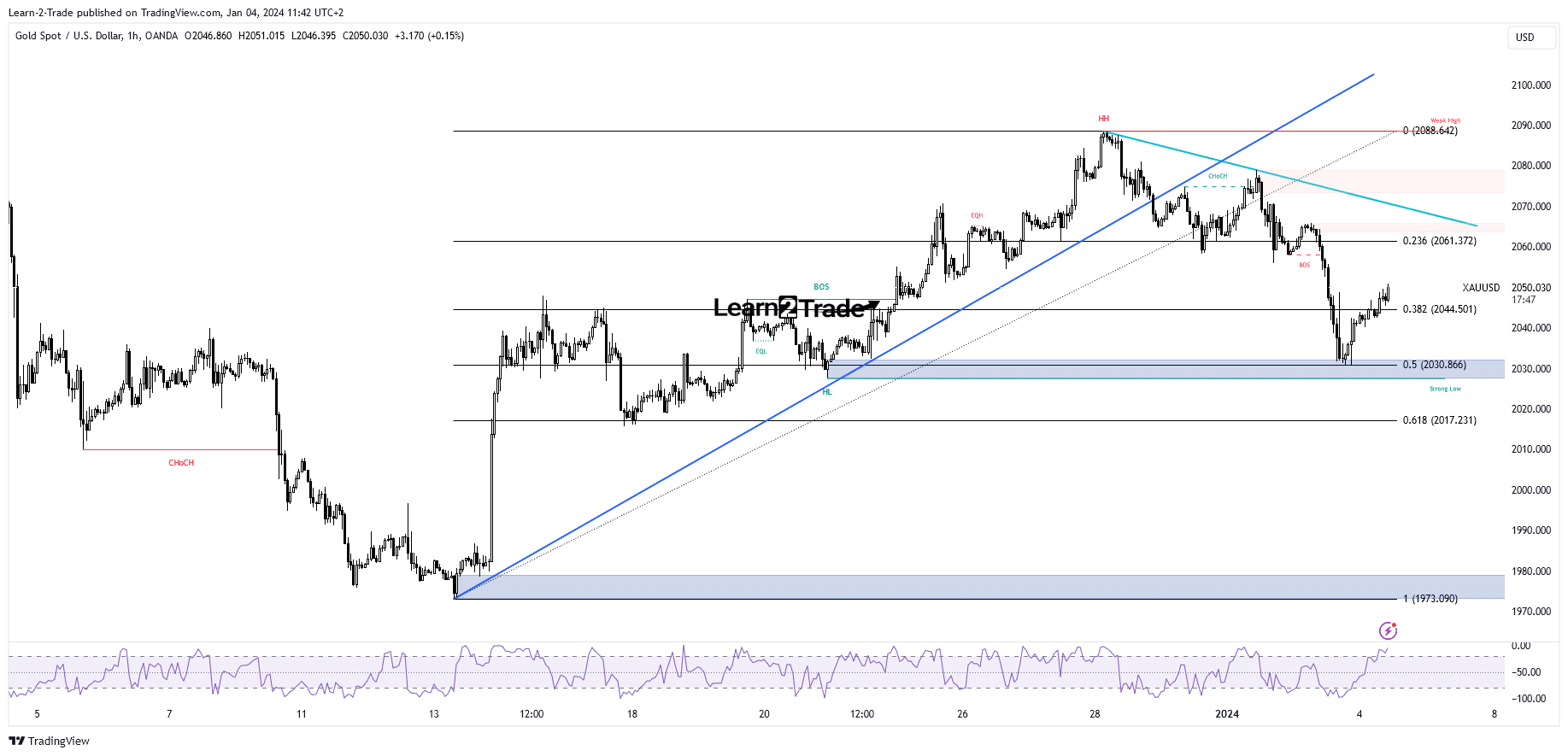

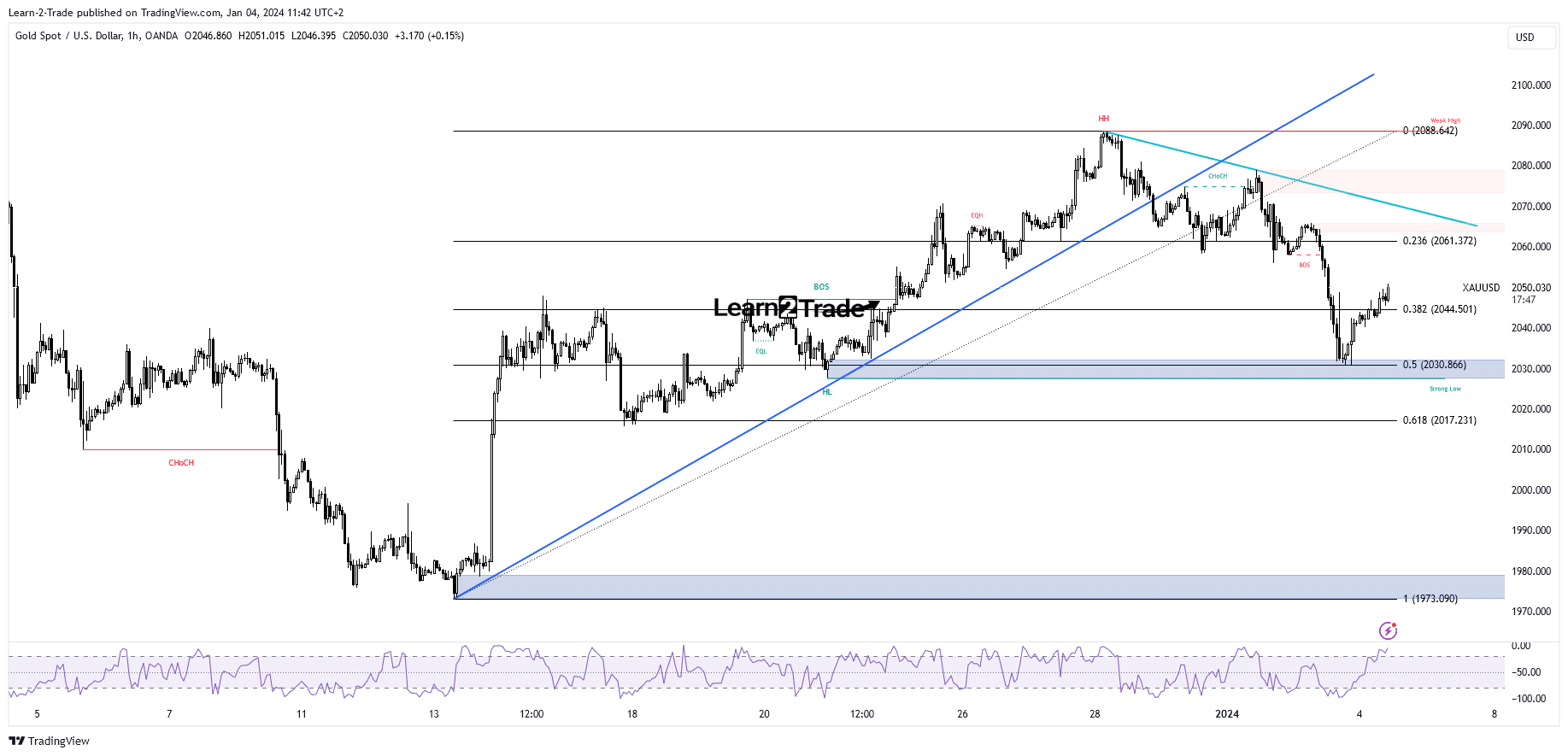

- The bias remains bearish as long as it remains below the downtrend line.

- Positive US data could punish the price of gold.

- A new lower low triggers more dips.

The price of gold rose and is now trading at $2,050, well above yesterday’s low of $2,030. The metal turned higher as the US dollar fell.

If you are interested in automated Forex trading, check out our detailed guide-

Basically, the US dollar took a hit from the US data and minutes from the FOMC meeting yesterday. JOLTS jobs and ISM manufacturing prices were worse than expected.

Moreover, the minutes of the meeting confirmed a potential rate cut of 75 basis points in 2024, so the gold price took advantage of this situation. Today, US economic data could once again have a big impact.

ADP Employment change excluding agriculture could be reported at 120K up from 103K in the previous reporting period. In comparison, the unemployment claims indicator is expected at 217 thousand in the last week. In addition, the Final Services PMI will also be released.

Also, don’t forget that the US will release NFP, average hourly earnings, jobless claims and ISM services tomorrow, so positive economic numbers should lift the dollar and may force KSAU/USD lower.

Gold Price Technical Analysis: Bullish Momentum

Technically, a correction was expected after the removal of the uptrend line and the 23.6% retracement level. However, the sell-off was halted by 50% (2,030), and has now jumped above 38.2% (2,044).

The rebound could only be temporary as the price may retest current resistance levels before falling again. KSAU/USD could extend its downward move if it remains below the downtrend line. Although only a new lower low, a valid breakdown below 50% could trigger further declines.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.