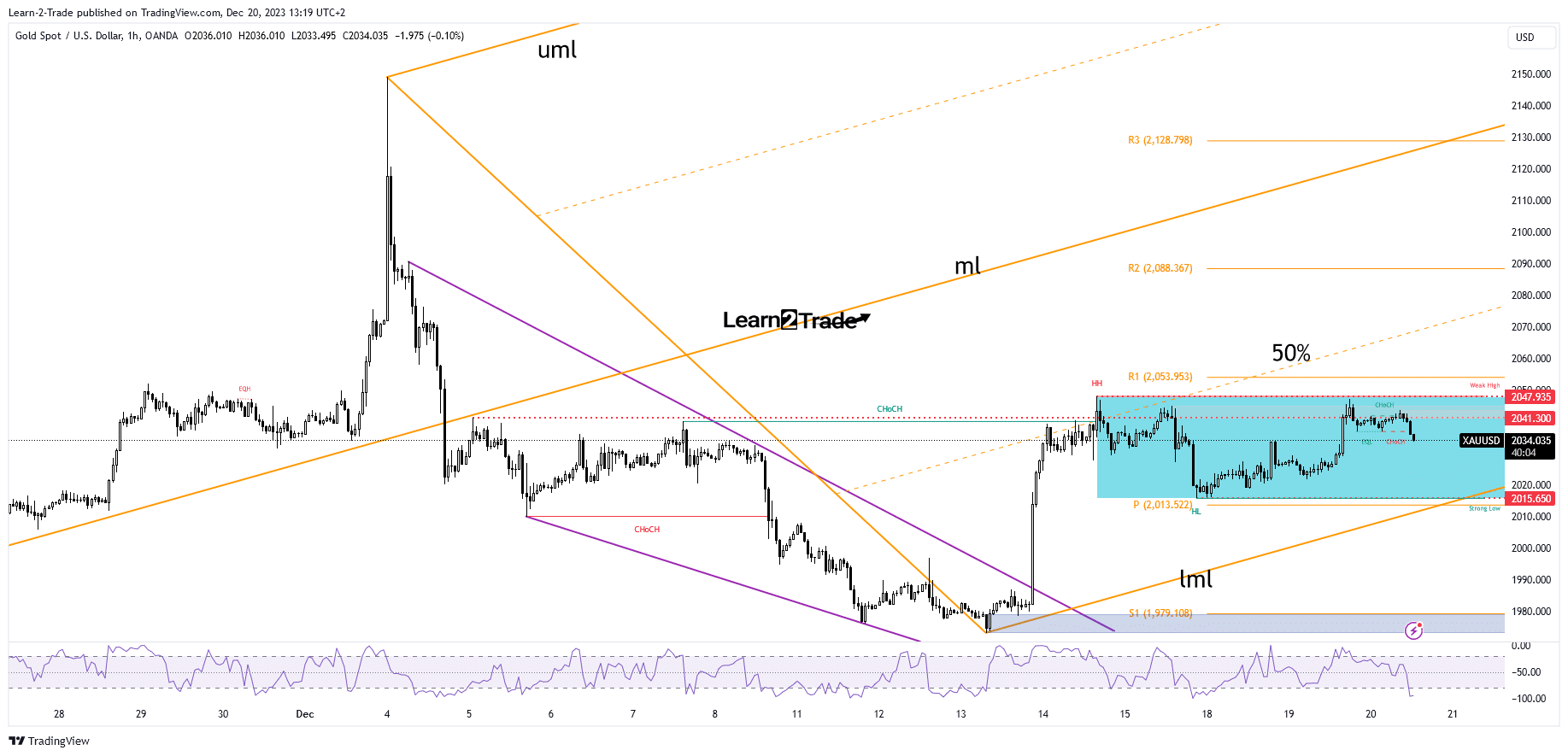

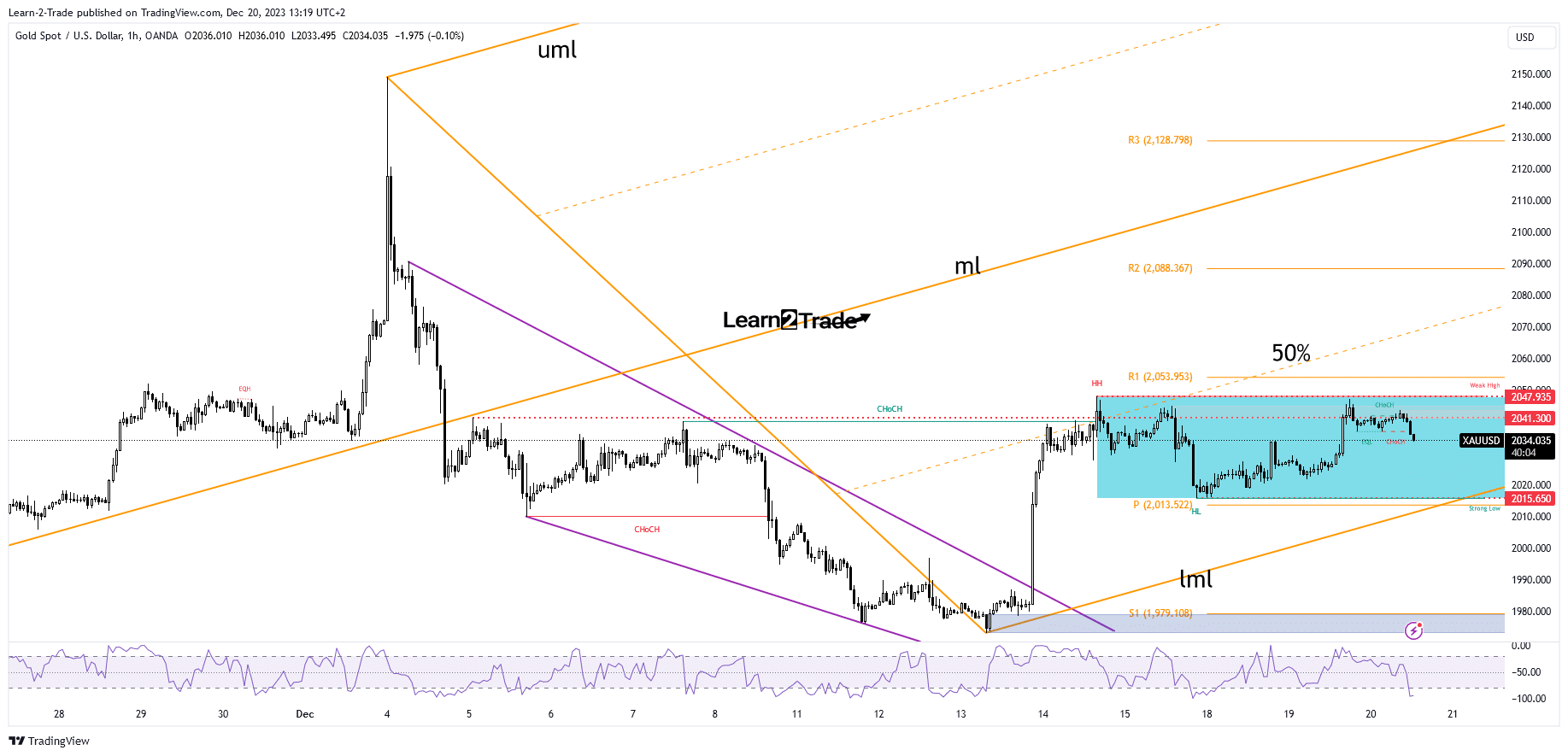

- Gold could jump higher as long as it is above the lower median line.

- A new higher high activates further growth.

- US CB Consumer Confidence should take high action.

The price of gold is trading in the red at $2,036 at the time of writing. However, the outlook is neutral in the short term. The precious metal was little changed despite the high-impact data release.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

It pulled back a bit from yesterday’s high of $2,047, but upside pressure remains high. Housing starts in the US reached 1.56 million compared to the expected 1.36 million. However, building permits were disappointing last session. Furthermore, Canada revealed higher-than-expected inflation, while the BoJ kept monetary policy on hold.

The UK CPI rose 3.9% today, down from an estimated 4.3% rise and down from 4.6% growth in the previous reporting period.

In addition, the core CPI rose only 5.1% compared to a forecast increase of 5.6%, while the HPI reported a decline of 1.2% compared to an estimated increase of 0.0%.

Later, US data should weigh on markets. CB Consumer Confidence is a high-impact event and is expected at 104.6 points above 102.0 points in the previous reporting period. Furthermore, data on existing house sales and current accounts should also be published.

Gold Price Technical Analysis: Strong Upward Pressure

The price of gold is trapped between $2,047 and $2,015 in the short term. Its failure to reach range resistance caused buyer exhaustion. As noted in the previous analysis, KSAU/USD could extend its rally if it remains above the lower middle line (lml) of the ascending forks.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

However, only a new higher high, a valid break through the $2,047 range resistance can trigger an upward continuation. A retest of the lower intermediate line (lml) and $2,015 may bring us new long opportunities.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.