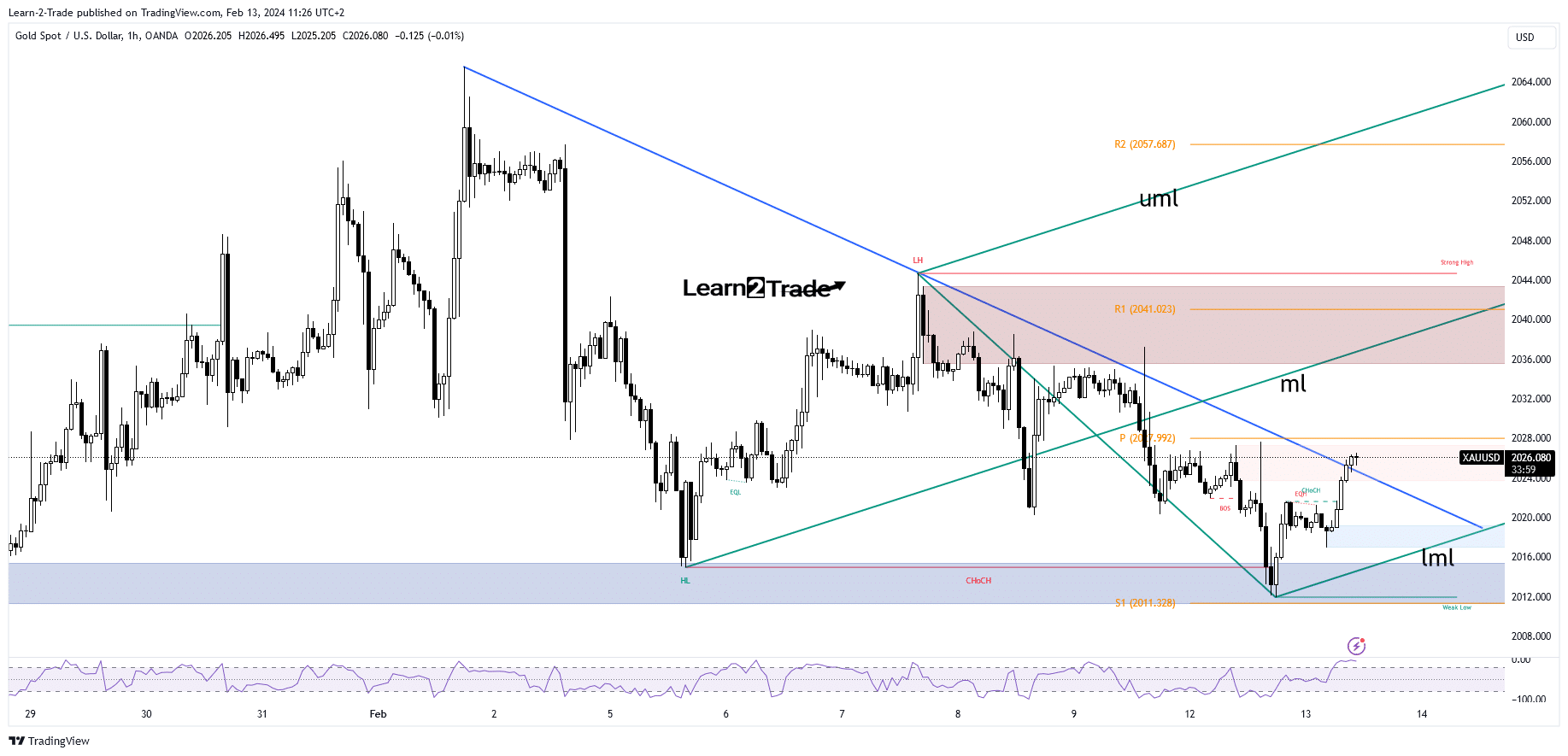

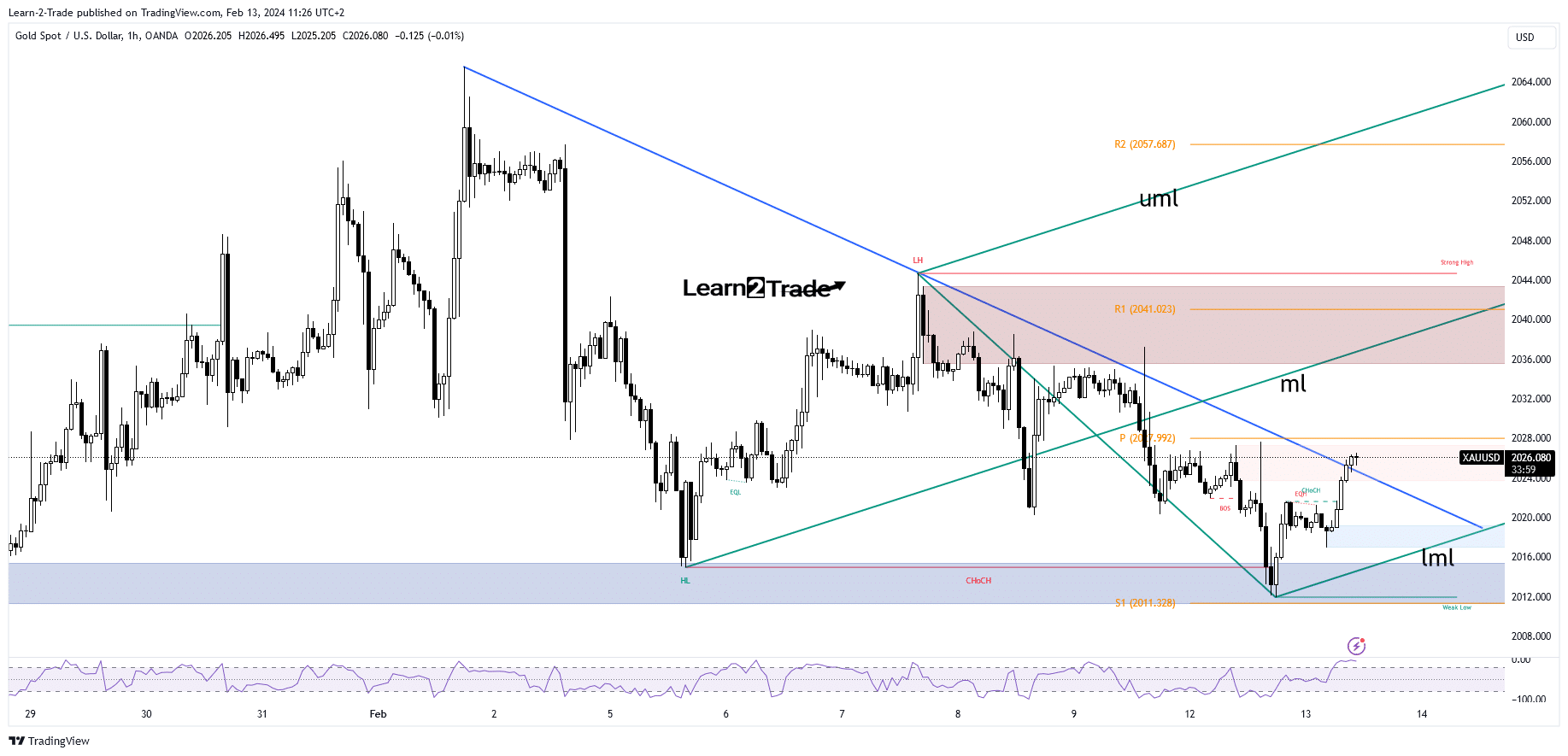

- Removing the weekly pivot point activates further growth.

- The midline is seen as a potential target.

- US CPI should bring sharp movements today.

Gold prices rallied on Tuesday even as the dollar index showed strength. The metal is now trading at $2,026 at the time of writing.

Basically, KSAU/USD turned upside ahead of US inflation numbers as experts expect lower inflation in January. The Consumer Price Index m/m can announce only a 0.2% increase compared to a 0.3% increase in December, while the CPI on an annual basis is expected to be 2.9%, down from 3.4% in the previous reporting period. period.

–Are you interested in learning more about copy trading platforms? Check out our detailed guide-

Moreover, the core CPI could again register an increase of 0.3%. Lower inflation could help the Federal Reserve cut interest rates at its upcoming monetary policy meetings. On the contrary, higher inflation should boost the dollar. This scenario may force the yellow metal to fall again.

KSAU/USD is trying to approach new highs after the Swiss CPI reported a rise of just 0.2% in January versus estimates of a 0.6% rise. Also, German and Eurozone ZEV Economic Sentiment were better than expected, but prices were little changed as traders awaited US data before taking action.

Technical analysis of the price of gold: A leg up

Technically, KSAU/USD turned upside after failing to close below the psychological level of $2,012. A zone of high demand stopped the sell-off. It has now crossed above the downtrend line, signaling a bigger leg higher. It will soon reach the weekly pivot point at $2,027.99, static resistance. Clearing this obstacle activates more progression.

–Are you interested in learning more about forex broker scalping? Check out our detailed guide-

The middle line (ml) could attract price if it stays within the body of the ascending forks. However, after such an impressive rally, the price may try to retest the broken downtrend line before reaching new highs.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.