- The bias remains bullish despite the latest pullback.

- US data should be decisive tomorrow.

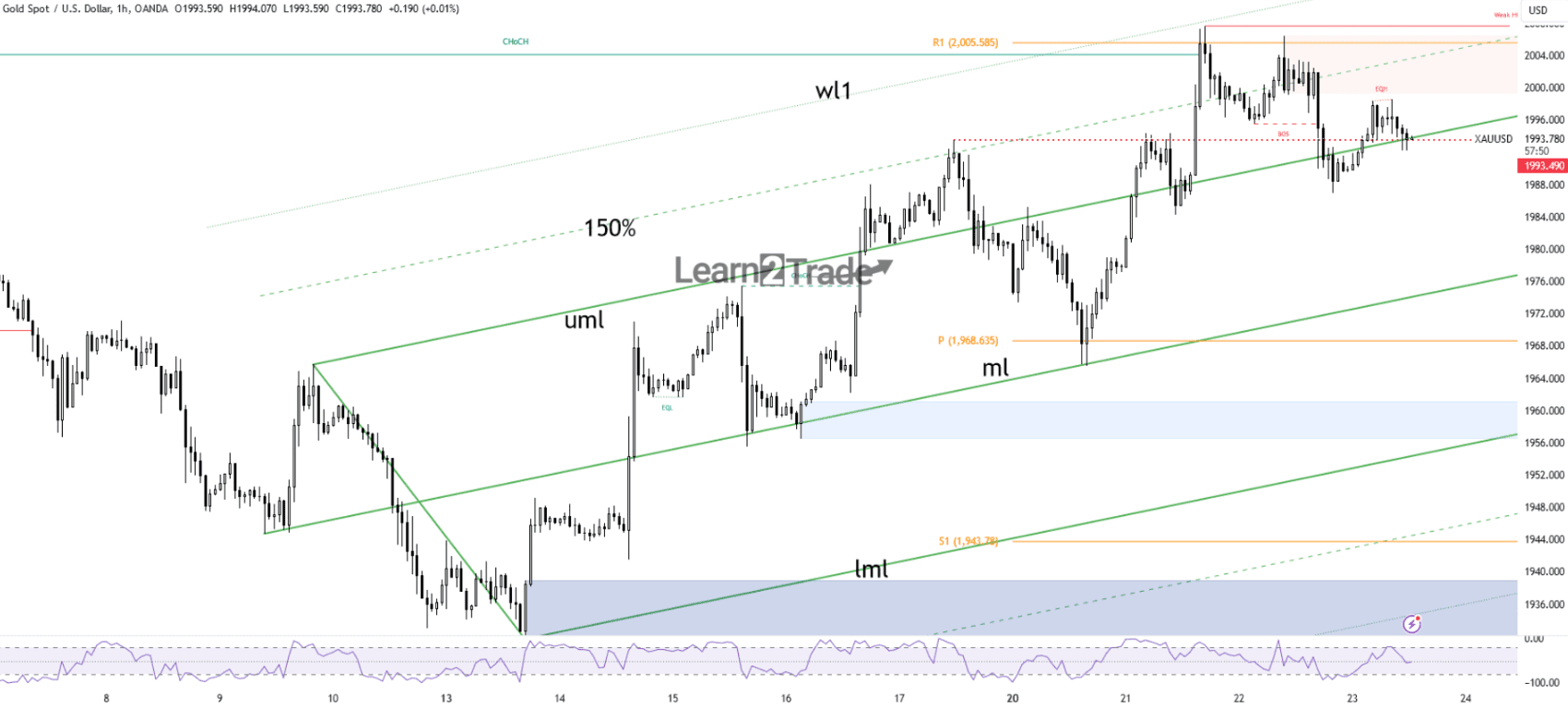

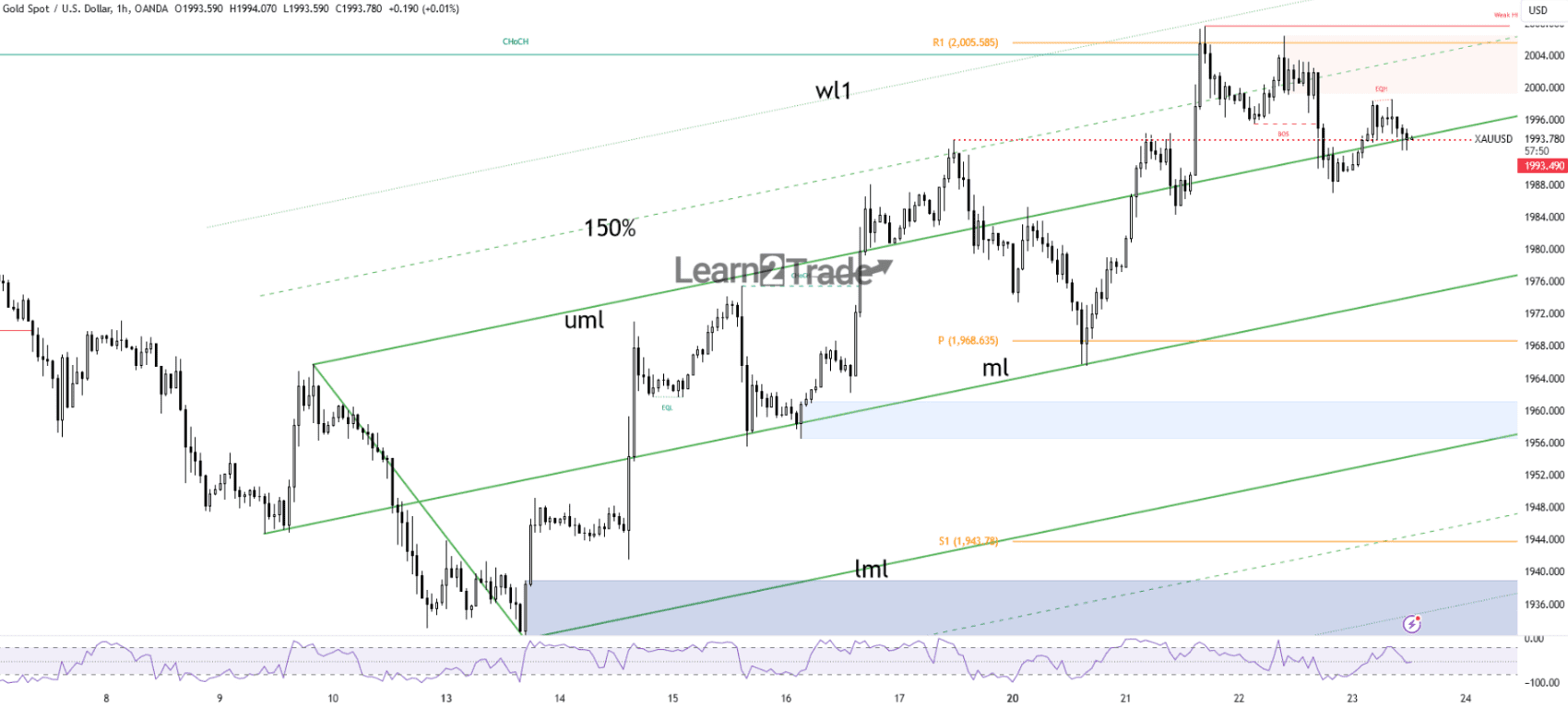

- Removing the upper middle line (uml) activates more declines.

The price of gold fell after hitting today’s high of $1,998. The metal is trading at $1,993 at press time. Bias remains bullish despite minor corrections.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

Gold lost ground as the US dollar recovered following the release of Canadian inflation data and minutes from the FOMC meeting.

Yesterday, the Greenback got a helping hand from Jobless Claims and Revised UoM Consumer Sentiment.

US banks are closed today for Thanksgiving, so volatility could be low during the US session.

Earlier, the UK Flash Manufacturing PMI came in at 46.7 points above expectations of 45.0 points, while the Flash Services PMI jumped to 50.5 points, again confirming expansion.

Furthermore, Germany’s and the eurozone’s manufacturing and service sectors remain in shrinking territory.

However, despite the high-impact data release, KSAU/USD is little changed in the short term. New Zealand will release retail sales and core retail sales this evening. The economic numbers should trigger something.

Tomorrow, the US Flash Manufacturing PMI and Flash Services PMI are high-impact events. In addition, Canadian retail sales data could revive KSAU/USD.

Gold Price Technical Analysis: Challenging Dynamic Support

As you can see on the hourly chart, the price found resistance at the weekly R1 (2,005). Now it has taken a turn for the worse. False breakouts confirmed exhausted buyers and an overbought situation.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

It now challenges the upper middle line (uml), representing dynamic support. If it stays above it, KSAU/USD could continue its rise at any time. On the contrary, a dip and stabilization below it can cause a larger downward movement.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.