- The golden weekly forecast turns Bullish as a chair on the schedule against the reduction rate in September.

- Measuring tensions in Ukraine could convert gains in gold.

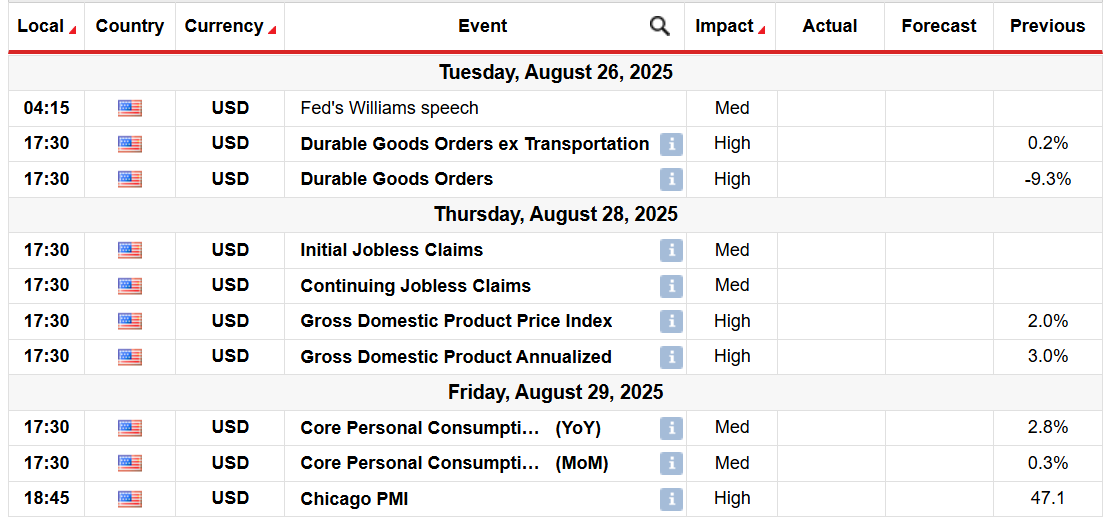

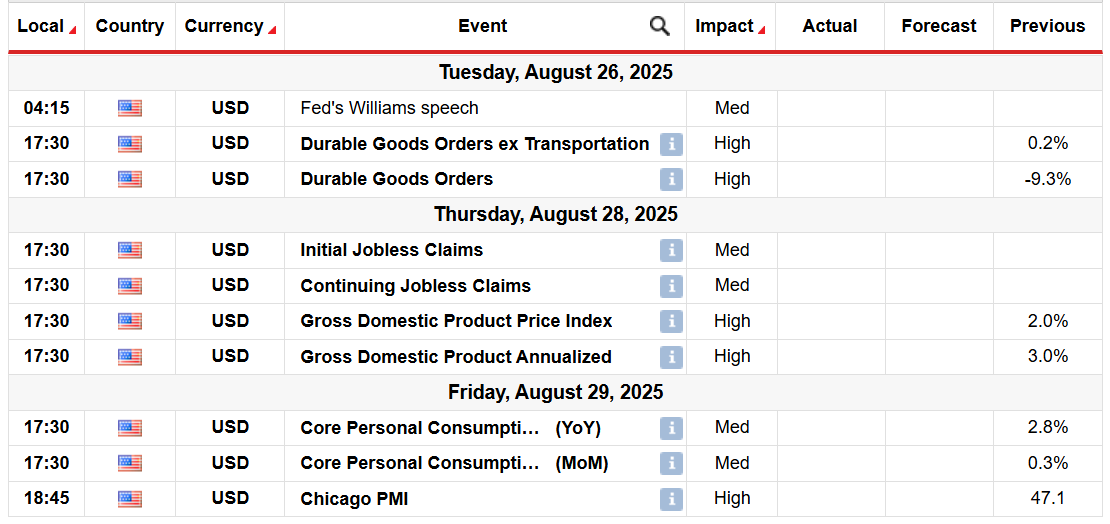

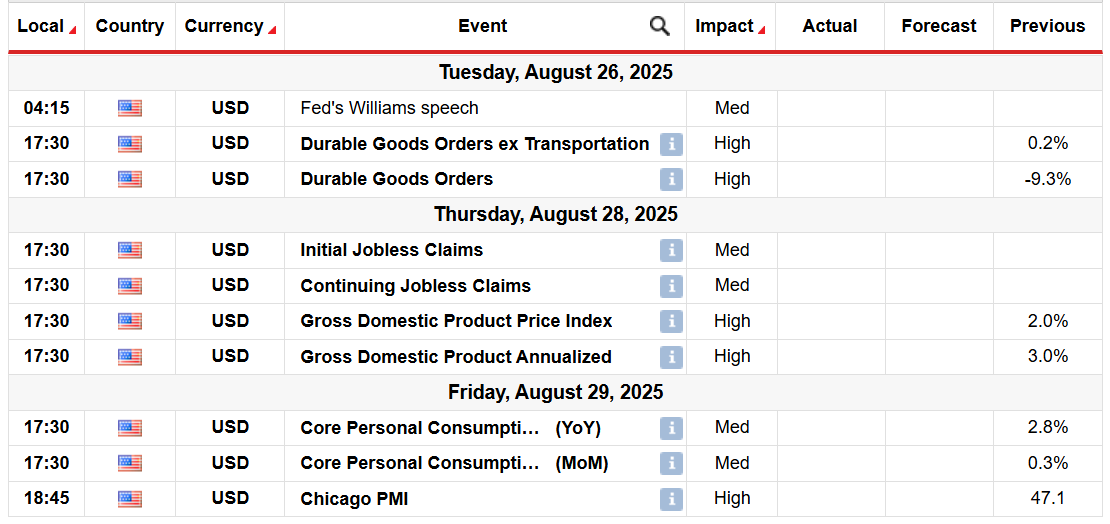

- The traders of the American Core of the PCE and American data of GDP K / K to be next week for more.

The gold ended the previous week at the optimistic note, increases above $ 3,370, after the statements of the Fed Stolid Pismo in the Jackson hole that launched the dollar down and returning the dollar. Powell, of course, showed a change in adaptive inflation because higher interest rates are valid in labor markets. This weekend recovery will focus on the second week intense data that can determine whether gold continues to recover or is once again under pressure.

–Are you interested in learning more about crypto robots? See our detailed guide-

The motivation for investing in gold will mainly be American macroeconomic editions that will test Outlook FED policy. Tuesday requires data on goods orders that will indicate business activities. After a sharp 9.3% drawn in June, markets predict another 4.0% reduction. This could also be a mixed bag like the lower imprint would drag on gold in the dollar and used, while the overwhelming organization pushed the treasury and stop gold bulls.

The most important thing on the freedom of the week is July edition of personal consumption (PCE) price index on Friday. Inflation remains sticky, and any surprise suddenly surprise would request a review of future rates reductions. Stronger than the expected PCE would lead to minibus to be applied up and gold. On the other hand, the weaker number would support bets on good feeding and could see another momentum in XAU / USD.

The markets will see another GDP growth in K2 on Thursday. The first increase in reading was healthy with 3% annual growth. The setting down would confirm the idea that the American economy is slowing down. This would increase gold because traders seek refuge during the period of economic fall.

Geopolitical tensions calmed down after the tension mitigation in Ukraine, which closed gold demand last week. According to the CME Feventh Tool, the probability of BPS reduction in September is now 90%. The traders predict consistent mitigation near the year. However, such weighted dellings also limits the ability of dollars to weaken further if future data is obviously during that move.

Gold weekly technical forecast: Bulls to cause $ 3,400

The daily ticket shows close above the estuary of 20- and 50-day to nearby $ 3,350. However, the price is still playing in the range, it is significantly below the upper limit of $ 3,440. MA 100-day MA continues to support bulls. The following key gold resistance lies at $ 3,400.

–Are you interested in learning more about Dogeco’s purchase? See our detailed guide-

At the party, a $ 3,300 support in 100-daymas could open the way for losses according to the level of support for $ 3,260 before the next support to $ 3,200.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.