- There are signs that the Fed may delay any plans to cut interest rates.

- Japanese exports rose for the second consecutive month in October.

- Traders have reduced the likelihood of an initial Fed rate cut by March.

The USD/JPI outlook is tipping to the bullish side on Thursday as the greenback confirms signs that the Federal Reserve may delay any plans to cut interest rates. Meanwhile, the yen weakened after data revealed a slowdown in Japan’s economy.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Japanese exports rose for the second consecutive month in October. However, growth was significantly slower, mainly due to reduced shipments of chips and steel to China. Data from the Ministry of Finance show an increase in exports of 1.6% compared to the previous year. Although it exceeded the 1.2% forecast by economists, it lagged behind September’s 4.3% growth.

In particular, the trade-dependent economy faces the challenges of weak exports and sluggish domestic demand. Consequently, it complicates efforts to stimulate growth in the post-pandemic recovery.

Moreover, some economists warn that Japan, which lacks growth momentum, could enter a technical recession, defined as two consecutive quarters of contraction.

Meanwhile, the dollar found support after retail sales beat expectations and producer prices fell. The data contributed to the economic “soft landing” narrative. Moreover, this scenario would provide the Fed with additional time before implementing a rate cut.

Traders are still convinced that interest rates will not increase. However, they reduced the likelihood of an initial rate cut by March to less than 1 in 4.

USD/JPI Key Events Today

Investors are preparing to receive reports from the US that will show the state of the economy, including

- First report on unemployment claims

- Philadelphia Fed Manufacturing Index

USD/JPI technical outlook: potential upside above 30-SMA

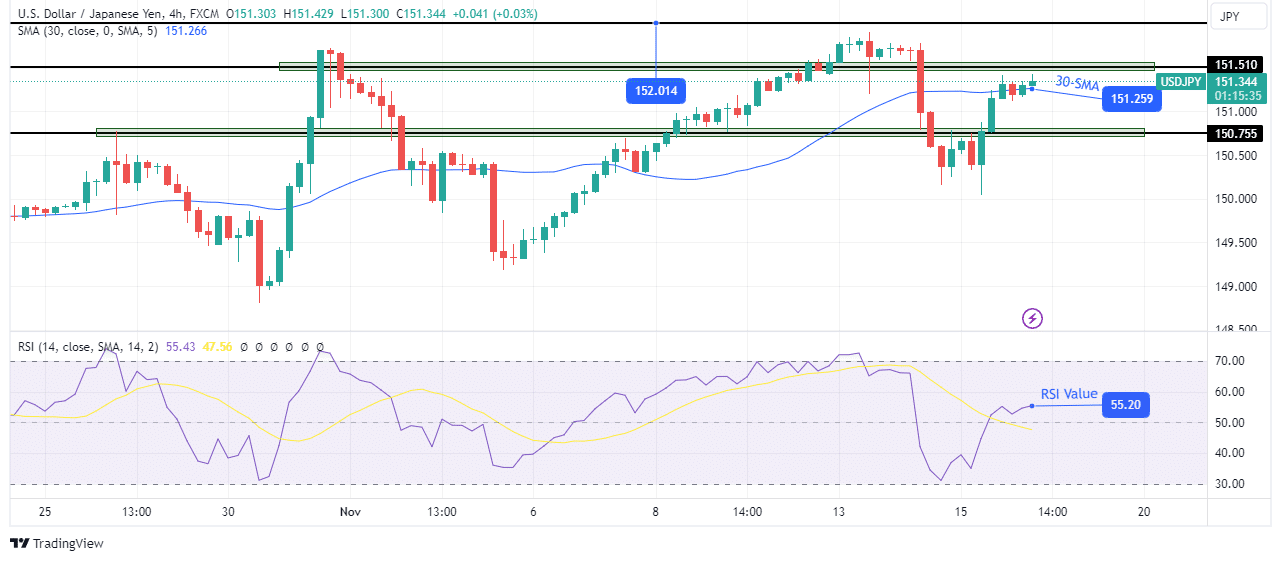

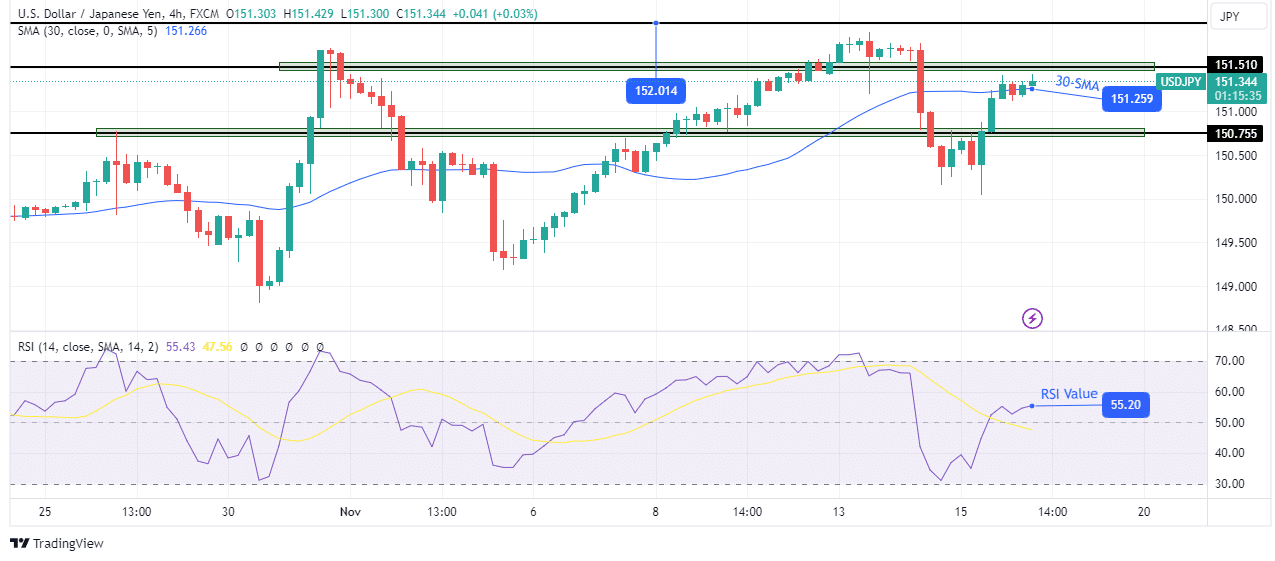

On the charts, the USD/JPI price is trying to push above the 30-SMA as the bulls fight for control. However, they face a tough task with resistance at the SMA and slightly above at the key 151.51 level. However, the RSI has crossed above 50, showing that the bulls are gaining momentum.

–Are you interested in learning more about Thai forex brokers? Check out our detailed guide-

The next step for the bulls will be to break away from the SMA and break above the resistance at 151.51. This would then allow the price to seek new highs. However, if the bulls fail to break the 151.51 level, the price is likely to collapse to retest the 150.75 support and below.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.