- Employment in Australia rebounded in October.

- Australia’s unemployment rate rose slightly as more individuals actively sought work.

- Markets see little justification for a RBA hike in December.

A fall in the Aussie after a mixed jobs report prompted a hint of bearish sentiment in Thursday’s AUD/USD forecast. Australian employment rebounded in October after a sluggish period the previous month. However, the unemployment rate rose slightly as more individuals actively sought employment. At the same time, increased migration contributed to a greater labor supply.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Notably, net employment in Australia rose by 55,000 in October, beating market expectations of 20,000. Meanwhile, the unemployment rate rose to 3.7%, in line with forecasts. This increase was primarily driven by an increase in the participation rate, reaching an all-time high of 67%.

Record numbers of migrants and students entering the country have expanded the labor supply to meet demand. So, despite a solid employment figure of 55,000, the labor force grew even more significantly by 83,000. Consequently, increased supply suggests that the labor market is not the primary driver of inflation. As such, markets see little justification for the RBA to implement another rate hike in December.

The central bank recently raised rates to a 12-year high of 4.35% and kept open the possibility of further increases. However, futures point to only a 7% chance of growth in December. Moreover, labor data hinted at a potential easing in the market, with the ABS highlighting a drop in annual growth in hours worked from 5% earlier in the year to 1.7%.

AUD/USD key events today

Investors are eagerly awaiting major economic reports from the US, including

- Initial unemployment claims

- Philadelphia Fed Manufacturing Index

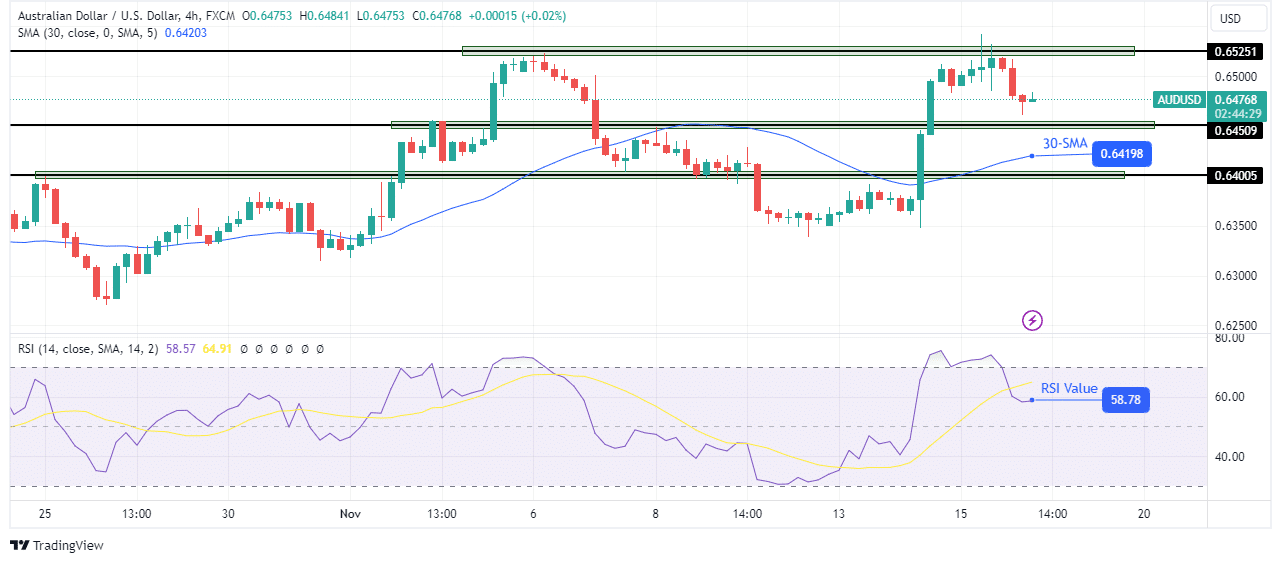

AUD/USD Technical Forecast: Resistance at 0.6525 encourages pullback.

Although the bias for AUD/USD is bullish, the price is currently pulling back after finding resistance at the 0.6525 level. The SMA, which is sitting below the price, and the RSI, which is trading in bullish territory, support the bullish bias.

–Are you interested in learning more about Thai forex brokers? Check out our detailed guide-

The pullback is approaching the 0.6450 support level, where the bulls may be waiting to continue their bullish move. Furthermore, the 30-SMA could act as price support if it breaks below 0.6450. The return of bullish momentum is likely to see the price make a new high above the 0.6525 resistance level. However, the bullish bias will change if the price falls below the 30-SMA.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.