- UK economic data revealed a contraction of 0.3% in October.

- Consumer prices in the US at the end of November recorded a growth of 3.1% on an annual basis.

- British earnings rose 7.3% year-on-year, excluding bonuses.

We saw stronger GBP/USD price analysis on Wednesday, as the British pound took a hit after revealing a 0.3% contraction in the UK economy in October. This drop raises the possibility that the Bank of England is considering an earlier cut in interest rates.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

Notably, the pound has gained approximately 3.8% against the dollar this year, its strongest annual performance since 2019. The rise came on expectations that the Bank of England could delay interest rate cuts compared to other central banks .

Meanwhile, the pound struggled for direction on Tuesday as US inflation slowed in November and UK wage growth cooled in October. At the end of November, consumer prices in the USA recorded a growth of 3.1% compared to the same period last year, slightly lower than October’s 3.2%.

Still, in the European morning session, the pound fell after data showed British wages rose 7.3% year-on-year, excluding bonuses, in the three months to October, up from 7.8% in September. Meanwhile, analysts had expected a decline to 7.4%.

The recent data introduces the possibility of a change in the attitude of the three hawks who voted for the increase in November. Chris Turner of ING noted the risk that they now favor retention. Economists and traders predict a likely hold on the interest rate of 5.25%. However, they will be listening closely for indications of a potential future rate cut. At the same time, the Federal Reserve is scheduled to announce interest rates on Wednesday.

GBP/USD key events today

- US producer inflation

- FOMC Policy Meeting

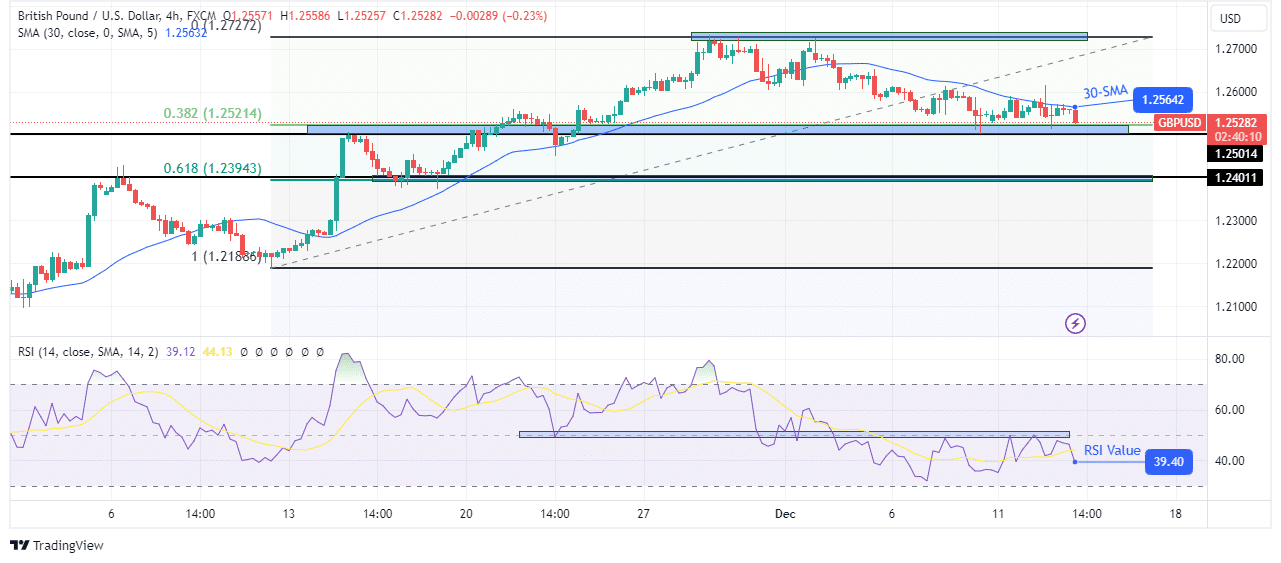

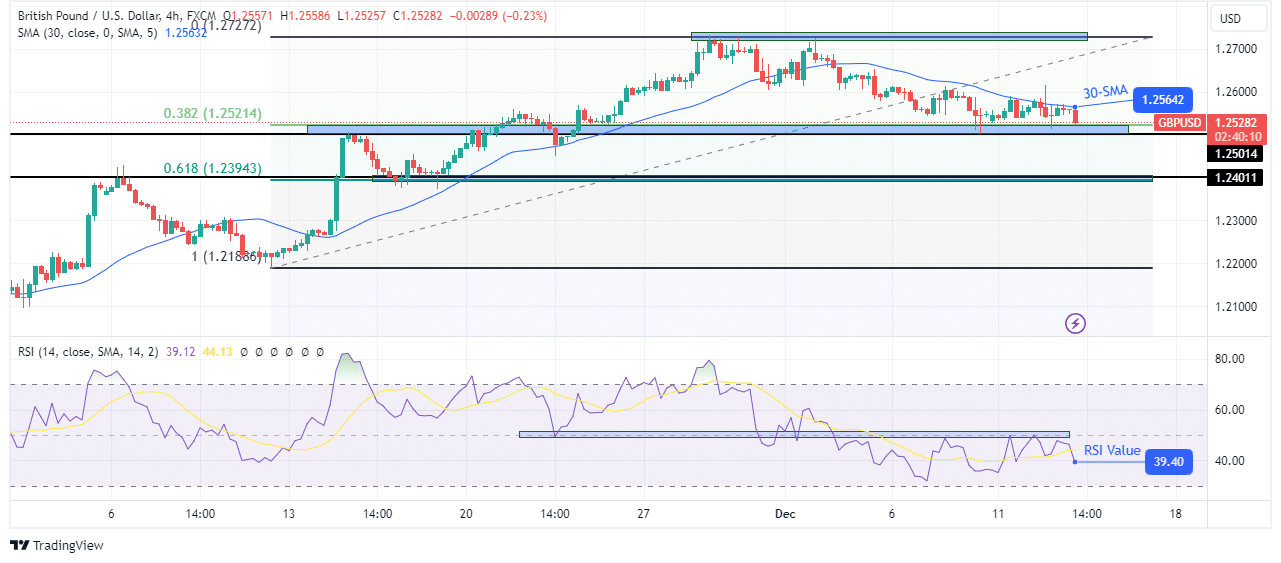

GBP/USD technical price analysis: Bears challenge 0.382 fib level

The pound is pushing lower after meeting the 30-SMA resistance. The downtrend was stopped after the price reached the fib level of 0.382. However, the bearish bias is strong as the bears have kept the price below the 30-SMA. Furthermore, the RSI remained below the 50 mark, supporting bearish momentum.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

At this point, the bears are retesting the support at the fib level. Soon, the price is likely to break below this and the 1.2501 support level to continue the downtrend. The next support zone is at 0.618 fib and 1.2401 key levels.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.