- British companies reported unexpected growth in November.

- The dollar is headed for a monthly loss of over 3%.

- Market prices indicate a 23% chance that the Fed will cut rates as early as March next year.

The GBP/USD forecast turned decidedly bullish on Monday, starting the week on a positive note as the pound surged to a two-month high, building on the previous week’s momentum. This upward trajectory was fueled by a surprise pick-up in growth reported by British companies in November, ending a three-month streak of contraction.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

As such, Carol Kong, currency strategist at the Commonwealth Bank of Australia, noted: “This points to the resilience of the UK economy despite very aggressive monetary policy tightening by the Bank of England. However, we still expect the UK economy to weaken and go through a short-term recession.

Furthermore, the pound was set to rise roughly 3.8% for the month, its biggest monthly gain of the year.

Meanwhile, the dollar index slipped 0.12% to 103.31. It was on track for a monthly loss of over 3%, marking its worst performance of the year.

CPI inflation rates across most of the G10 remain above central bank targets. Consequently, there is a strong incentive for policy makers to support the theme of ‘more for longer’. In addition, higher market rates will help fight inflation.

However, investors are looking beyond this policy and appear to be increasingly focused on speculation about the timing and pace of rate cuts next year. Market prices point to a 23% chance the Fed could begin easing monetary policy as early as March next year, according to the CME FedWatch tool.

GBP/USD key events today

- US Building Permits Report

- US New Home Sales Report

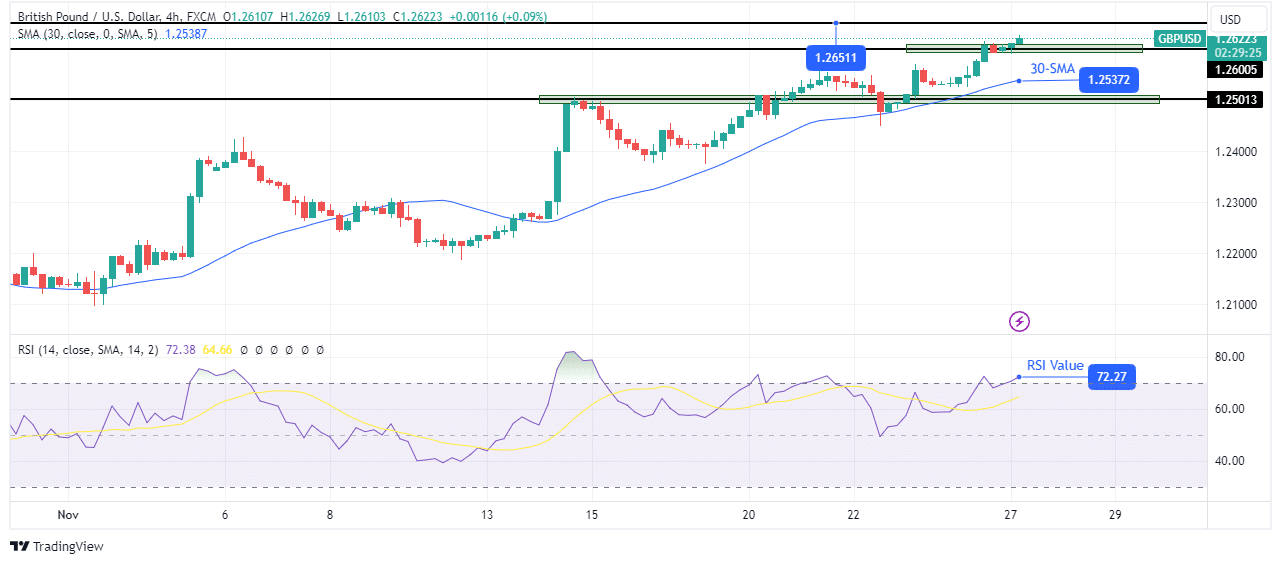

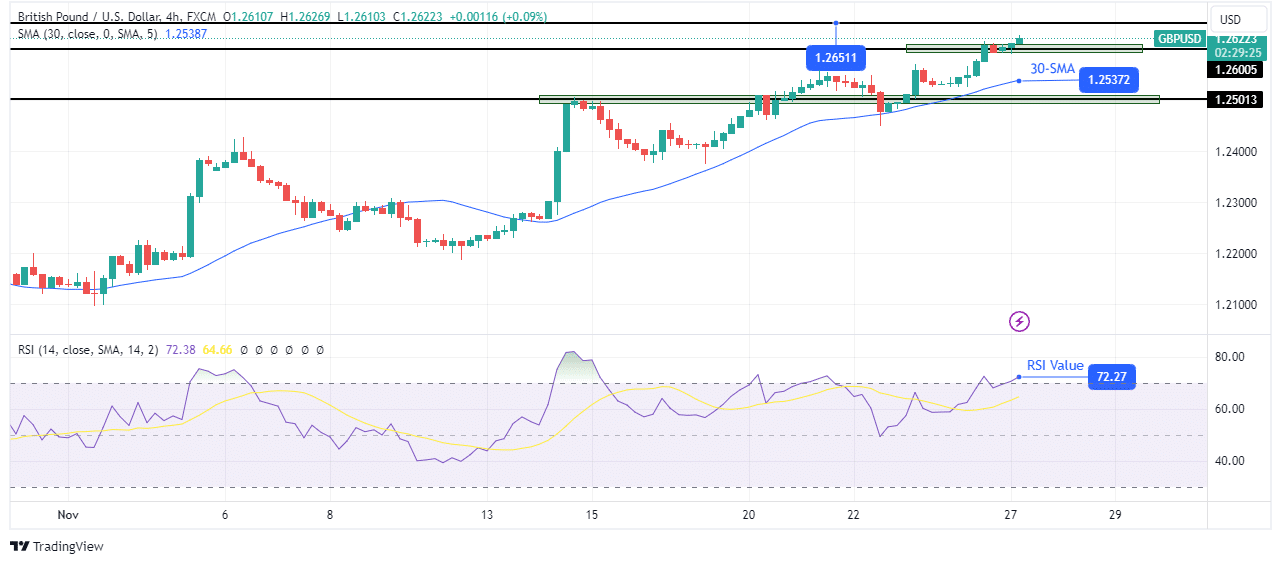

GBP/USD Technical Forecast: Bulls advance, RSI signals overbought levels

The pound is bullish, trading well above the 30-SMA and the RSI is overbought. Moreover, the price made bigger highs and lows, respecting the 30-SMA as support. It shows a well-developed trend that could continue to a higher level. The price is currently above the 1.2600 level and could reach 1.2651.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

However, with the RSI overbought, we could see the bulls pause for a breather. Consequently, the price could consolidate or pull back to retest the 30-SMA support. However, the bullish trend has upside potential. Therefore, the bulls are likely to push above the 1.2651 level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.