- The pound continued to fall after a brief respite on Thursday.

- The dollar was weak after the data boosted bets on a Fed rate cut.

- Recent data revealed a significant cooling in UK inflation in October.

Friday’s GBP/USD price analysis shows that the bearish tone continues as the pound continues to fall, following a brief respite on Thursday. This decline began after a poor UK inflation report. Similarly, the dollar was weak after recent data increased bets for a Fed rate cut.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Recent data revealed a significant cooling in UK inflation in October. It marked the fastest decline in the last 30 years. Moreover, it reinforced expectations of a BoE rate cut by the middle of next year. However, the BoE stressed that it is far from cutting rates from their 15-year high, even as the economy nears recession.

Deputy Governor Dave Ramsden indicated on Thursday that the Bank of England is likely to keep interest rates high for a longer period. However, financial markets predict that the BoE could start cutting interest rates in May or June next year. Moreover, by the end of 2024, reductions of three quarters of a point are predicted.

Meanwhile, in the US, new claims for jobless benefits rose to a three-month high. This indicates a gradual cooling of the labor market and supports the Federal Reserve’s fight against inflation.

As a result, the dollar weakened against a basket of currencies and US Treasury prices rose, nearing a two-month low. In addition, a series of inflation-friendly data led financial markets to expect interest rate cuts in May. As of March 2022, the Fed has increased the benchmark rate by 525 basis points.

GBP/USD key events today

- US Building Permits Report for October.

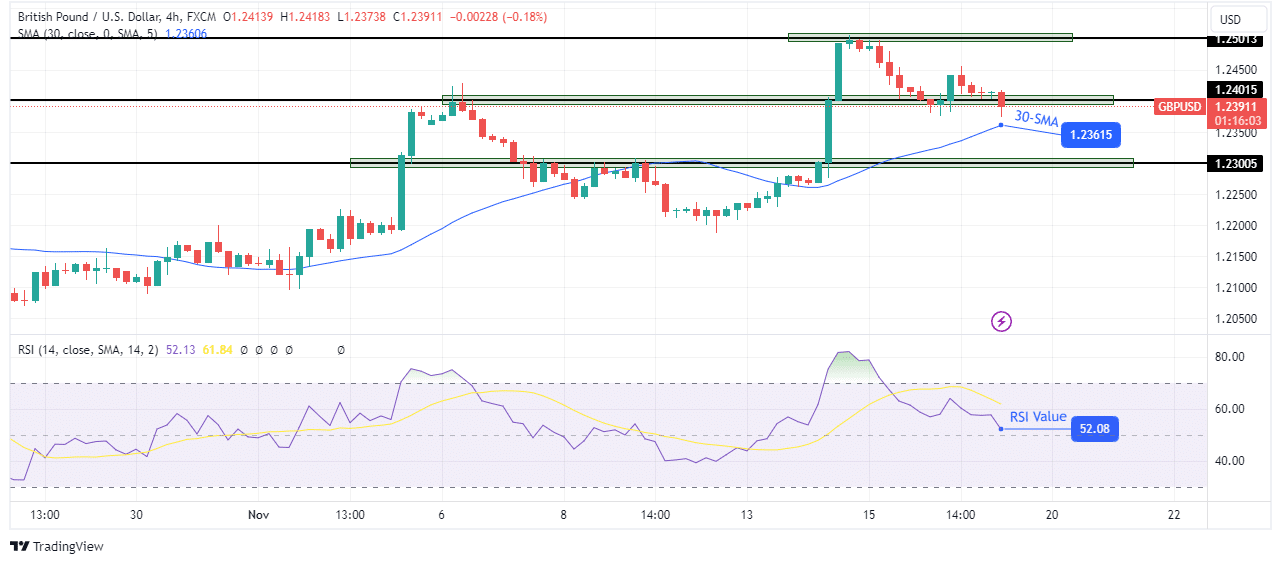

GBP/USD Technical Price Analysis: Price is moving to challenge the 1.2401 support level.

The pound declined from highs near the key 1.2501 level. The price is now trying to break the support level of 1.2401. However, the bulls are still stronger as the price is above the 30-SMA. Additionally, the RSI is just above 50, supporting bullish momentum.

–Are you interested in learning more about Thai forex brokers? Check out our detailed guide-

Bears must break below the 1.2401 support level and the 30-SMA for this bias to reverse. This would then signal a change in bearish sentiment. Furthermore, it would allow the price to retest the 1.2300 level. However, if the bullish bias persists, the price will rebound from the SMA to a new high above the resistance level at 1.2501.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.