- The pound rallied ahead of key US inflation data later in the day.

- The US economy beat forecasts in the fourth quarter, with growth of 3.3%.

- The pound remains steady against the dollar amid signs of recovery in the British economy.

On Friday, GBP/USD price analysis hinted at a modestly bullish tone as the pound began a recovery ahead of key US inflation data. The focus is on US personal consumption expenditure data, the Federal Reserve’s preferred gauge of inflation.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

Meanwhile, data from Thursday showed the US economy beat forecasts in the fourth quarter, growing 3.3%. Consequently, the dollar rose and the pound fell.

Strong economic performance in the fourth quarter, driven by robust consumer spending, eased recessionary concerns. The full-year growth was 2.5%. Moreover, the previous fourth quarter gross domestic product report revealed a further easing of inflationary pressures.

Despite the impressive results at the end of the year, doubts that the Federal Reserve will start cutting rates in March remain. However, March remains a possibility due to favorable inflation data in the GDP report.

The pound remains steady against the dollar, supported by strong UK business activity data earlier this week. Furthermore, Goldman Sachs analysts noted that growth momentum in the UK is improving, driven by a consistent expansion in the services sector, setting the UK apart from the rest of Europe.

In recent weeks, expectations for the ECB and the Fed to start cutting interest rates before the Bank of England strengthens the pound. The meeting of the Council of Europe is scheduled for next Thursday.

GBP/USD key events today

- US Core PCE Price Index Report

GBP/USD Technical Price Analysis: Bulls re-emerge at channel support

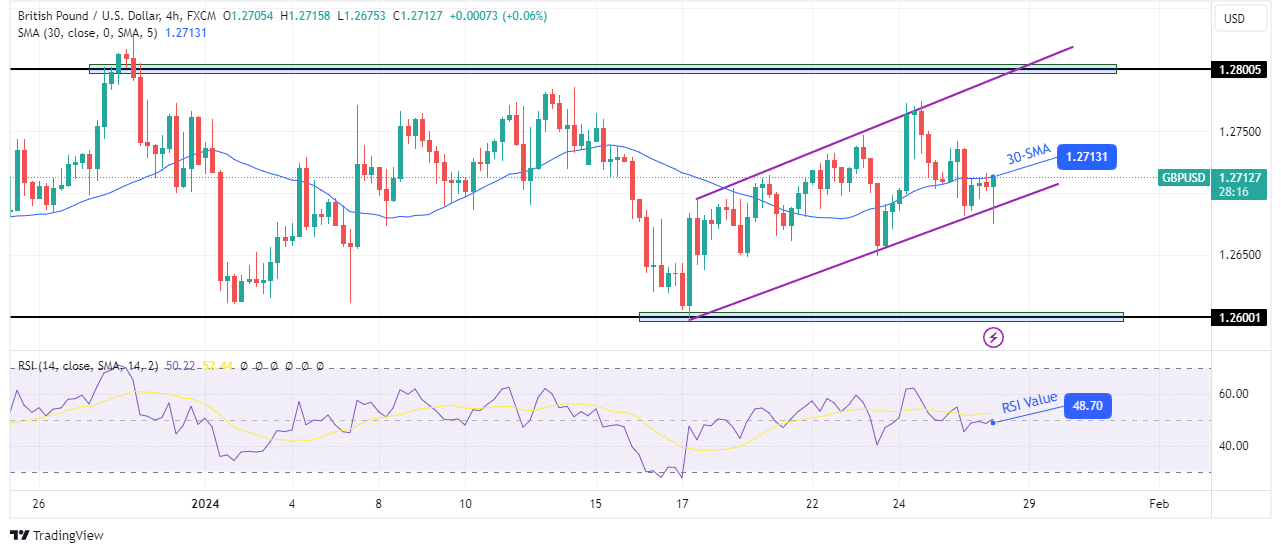

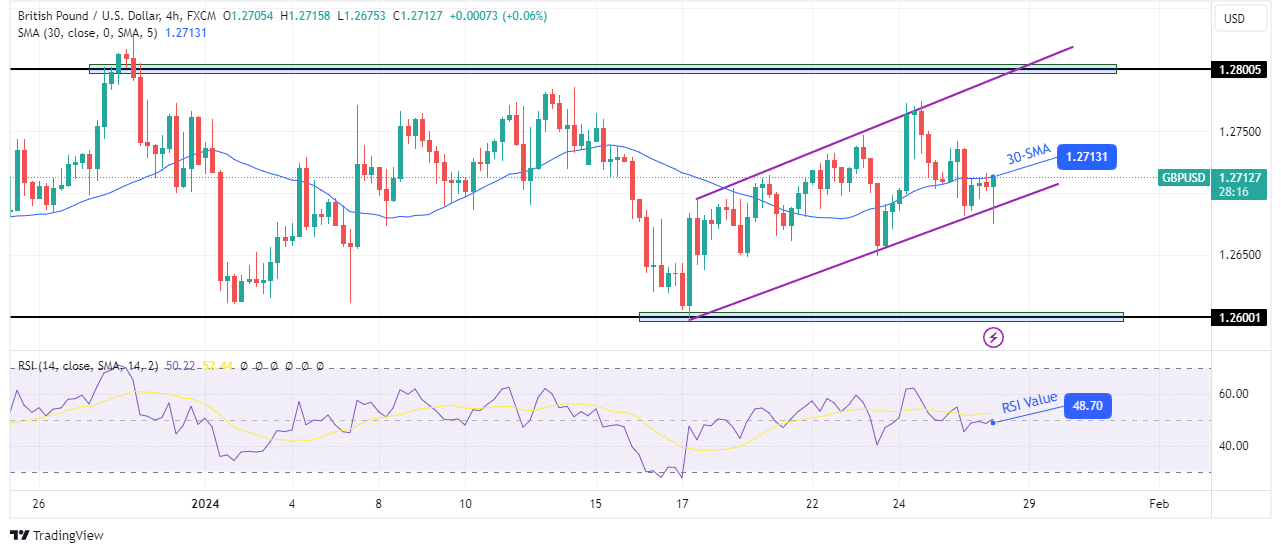

On the charts, the pound is trading in a bullish channel and is bouncing higher after respecting channel support. The bullish channel is shallow as the price is still trapped in the range between resistance at 1.2800 and support at 1.2600. For this reason, the price does not respect the 30-SMA as support or resistance. Similarly, the RSI continues to cross the key 50 mark, showing that the bears and bulls are fighting for control.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

However, within the channel, the price appears to be climbing and retesting the channel resistance. Such a move would also allow the bulls to retest resistance at 1.2800.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.