- The Federal Reserve could start cutting interest rates by the first half of next year.

- The euro strengthened by around 3.4%, which is its most significant monthly growth of the year.

- The data revealed a sharper-than-expected drop in US new home sales in October.

Tuesday saw bullish EUR/USD price analysis as the US dollar fell to a three-month low against major currencies, setting the stage for its biggest monthly decline of the year. Notably, this drop came amid expectations that the Fed could begin cutting interest rates by the first half of next year.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

Moreover, the increased likelihood of an earlier rate cut by the Fed in 2024, compared to the European Central Bank, is putting pressure on the dollar today.

Meanwhile, market prices point to a 23% chance that the Fed could start easing monetary policy as early as March. At the same time, investors are closely following various events and data this week. During the month, the euro strengthened by around 3.4%, its most significant monthly growth of the year.

The dollar suffered losses on Monday after data revealed a sharper-than-expected drop in US new home sales. Value fell 5.6% to a seasonally adjusted annual rate of 679,000 units. Meanwhile, September sales fell to 719,000 units from the previously reported 759,000 units.

Therefore, there is little potential for a reversal in the dollar. However, the third quarter GDP figures will be released later this week. If the US economy can demonstrate sustained growth, we could see a turnaround and some dollar strength to end the month.

EUR/USD key events today

- US CB consumer confidence for November

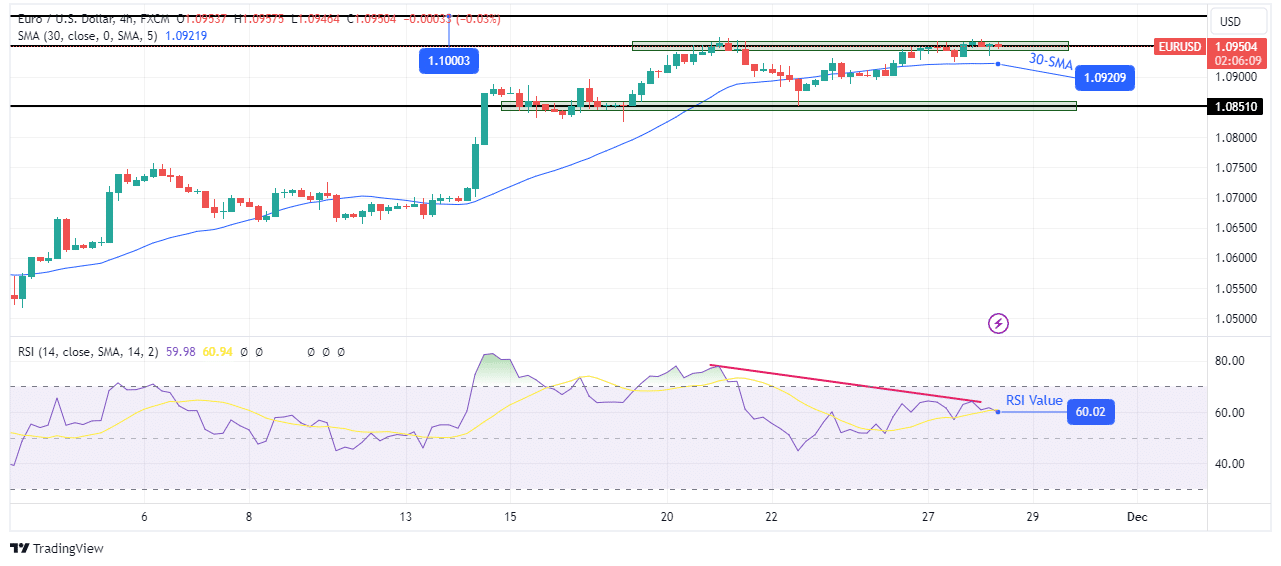

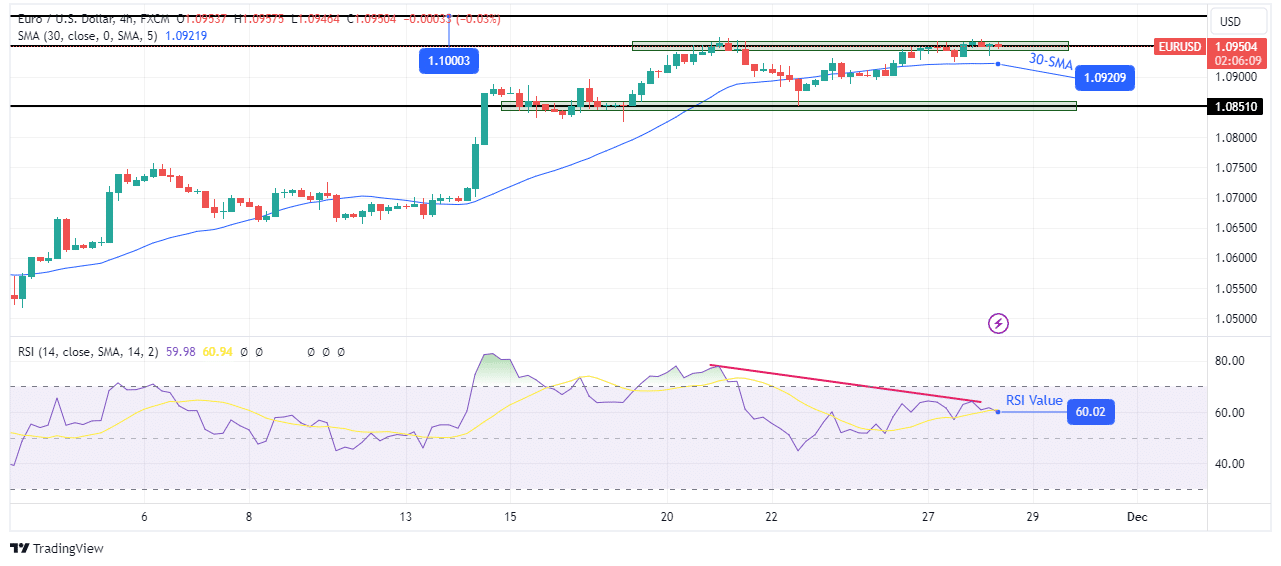

EUR/USD Price Technical Analysis: Euro bulls face tough test at 1.0950

Euro bulls are still struggling at the 1.0950 resistance level. Meanwhile, the RSI continues to show weakness in an uptrend that could lead to a reversal. If the bulls fail to make a higher high by breaking above 1.0950, the trend will likely pause to consolidate or reverse to the downside.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Bears may take control if price falls below the 30-SMA. However, to reverse the trend, they would need to start making lower lows by breaking below the 1.0851 support level. However, there is a chance for the bulls to regain momentum. Price is likely to clear the 1.1000 resistance in such a case.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.