- The BoC’s Carolyn Rogers urged companies to boost productivity by supporting investment.

- Data from Canada revealed a 0.8% increase in wholesale trade in February.

- The dollar was steady as investors braced for more inflation data this week.

The USD/CAD forecast turns bullish today as the Canadian dollar loses ground, boosted by the Bank of Canada’s observation of persistently low productivity in Canada. Moreover, the ludak has weakened in tandem with the drop in oil prices.

-Are you interested in learning about the best AI trading forex brokers? Click here for details –

The BoC’s Caroline Rogers said Canada’s economy is vulnerable to inflation due to low productivity. Therefore, she called on businesses to increase productivity by supporting investments. Moreover, the BoC expects little growth in the economy this year. It is very difficult for the central bank to control inflation when the economy is weak. The best weapon against inflation is high interest rates. However, if the economy is weak, higher borrowing costs could lead to a recession before inflation reaches the central bank’s target.

Meanwhile, data from Canada revealed a 0.8% increase in wholesale trade in February. Furthermore, USD/CAD rose as oil prices fell. This decline was due to a rise in US crude oil inventories, reflecting weaker demand. In addition, investors do not expect any policy changes when the OPEC group meets next week.

Elsewhere, the dollar was steady as investors braced for more inflation data this week. The core PCE price index is likely to cause a lot of volatility as it shapes the Fed’s rate cut outlook.

USD/CAD Key Events Today

No major events coming out of Canada or the US today. As a result, the pair is likely to consolidate.

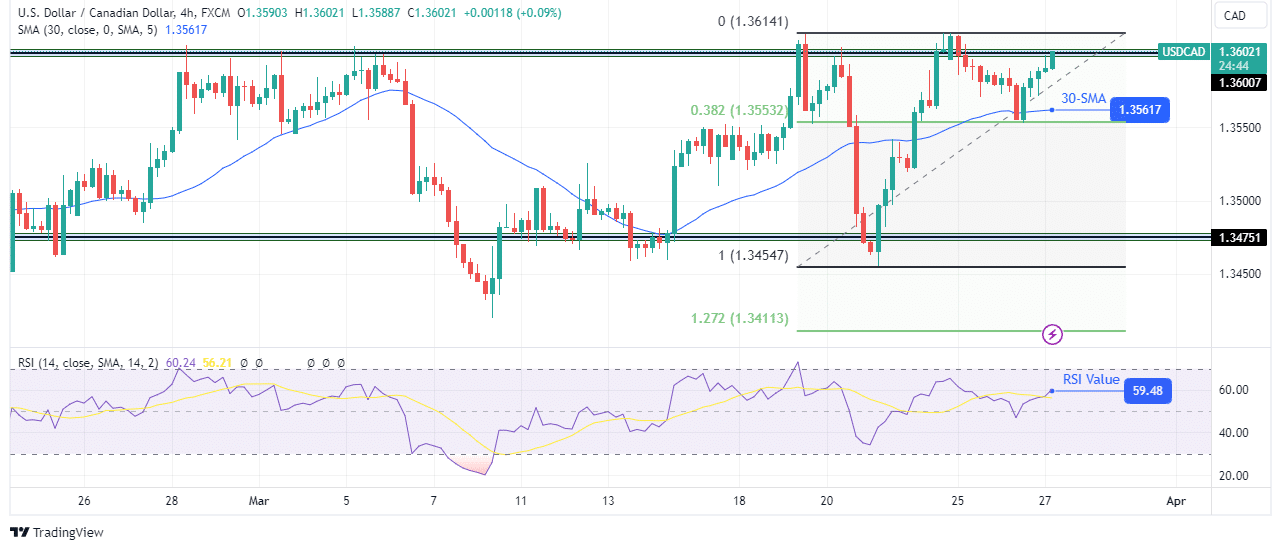

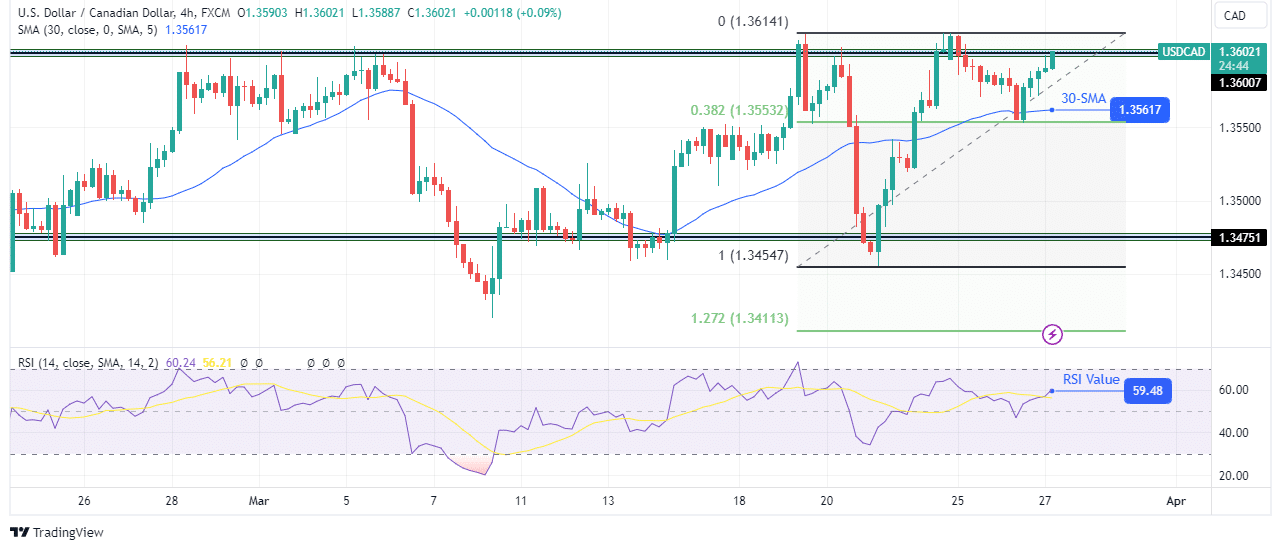

USD/CAD Technical Forecast: Price faces 1.3600 barrier after bounce from 30-SMA

On the charts, the USD/CAD price is once again facing the 1.3600 barrier after finding support at the 30-SMA. At the same time, the price bounced off the 0.382 Fib retracement level and could make a new high. The bulls’ return to the SMA line confirms a strong bullish bias. Meanwhile, the RSI, which is trading above 50, is supporting solid bullish momentum.

-Are you interested in learning more about forex indicators? Click here for details –

Therefore, the bulls are likely to try to break above the key resistance level of 1.3600. A break above would allow the price to start trending after a period of consolidation. On the other hand, if the resistance at 1.3600 remains as firm as it was earlier, the price is likely to return to the support at 1.3475.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.