- Governor Tiff Macklem has dampened expectations that the central bank will start cutting rates soon.

- The probability of a BoC rate cut in April fell to 23% from 43%.

- Oil prices have been on the rise recently due to supply concerns.

The USD/CAD forecast turned bearish after the Bank of Canada dashed hopes of an imminent rate cut. Moreover, the Canadian dollar strengthened, boosted by a rise in oil prices amid concerns about a supply shortage, which contributed to the currency’s slide.

–Are you interested in learning more about CFD brokers? Check out our detailed guide-

On Wednesday, the Bank of Canada kept rates at 5%, in line with market expectations. But Governor Tiff Macklem dampened expectations that the central bank would start cutting rates soon, saying inflation remained above the central bank’s 2 percent target. So policymakers want to see more progress. Consequently, investors lowered expectations for a rate cut in Canada, boosting the Canadian dollar. Notably, the probability of a cut in April fell to 23% from 43% before the meeting. What’s more, traders are now fully pricing in July’s first rate cut since June.

The pair also fell on rising oil prices. Oil prices have been on the rise recently due to supply concerns. Houthi militants continued to attack ships in the Red Sea, further disrupting supplies. Meanwhile, OPEC+ extended production cuts in the second quarter to support oil prices.

Elsewhere, the dollar weakened after Powell confirmed the Fed would cut rates in 2024. Market participants saw his testimony as slightly dovish, fueling hopes for a rate cut. The Fed chairman will continue his testimony today and may give more clues about the outlook for a rate cut in the US.

USD/CAD Key Events Today

- US unemployment claims

- Testimony of Fed Chairman Powell

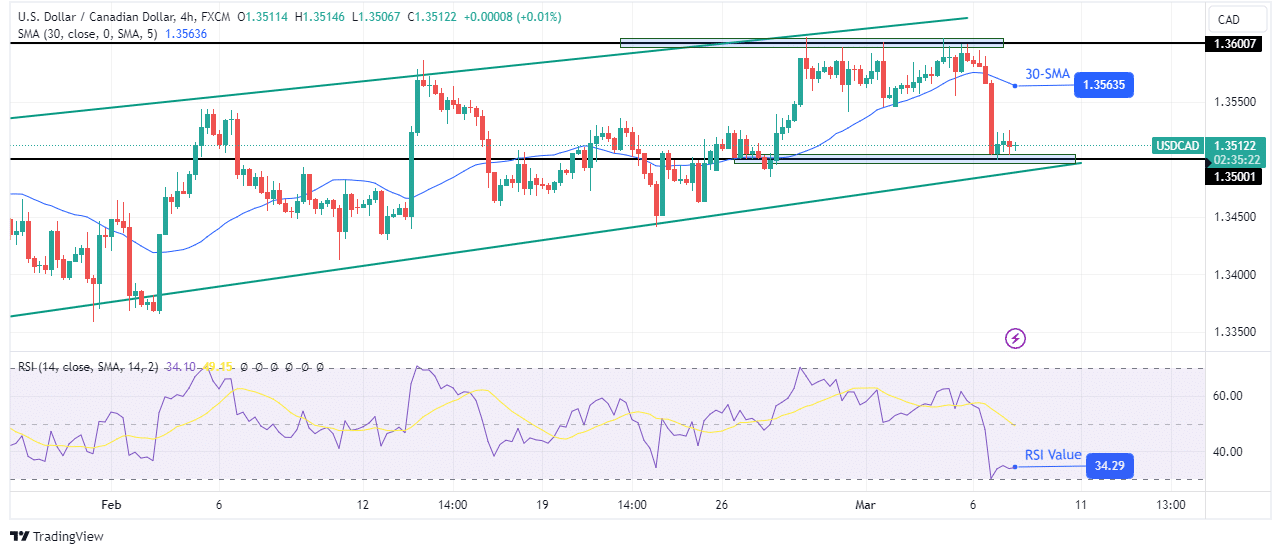

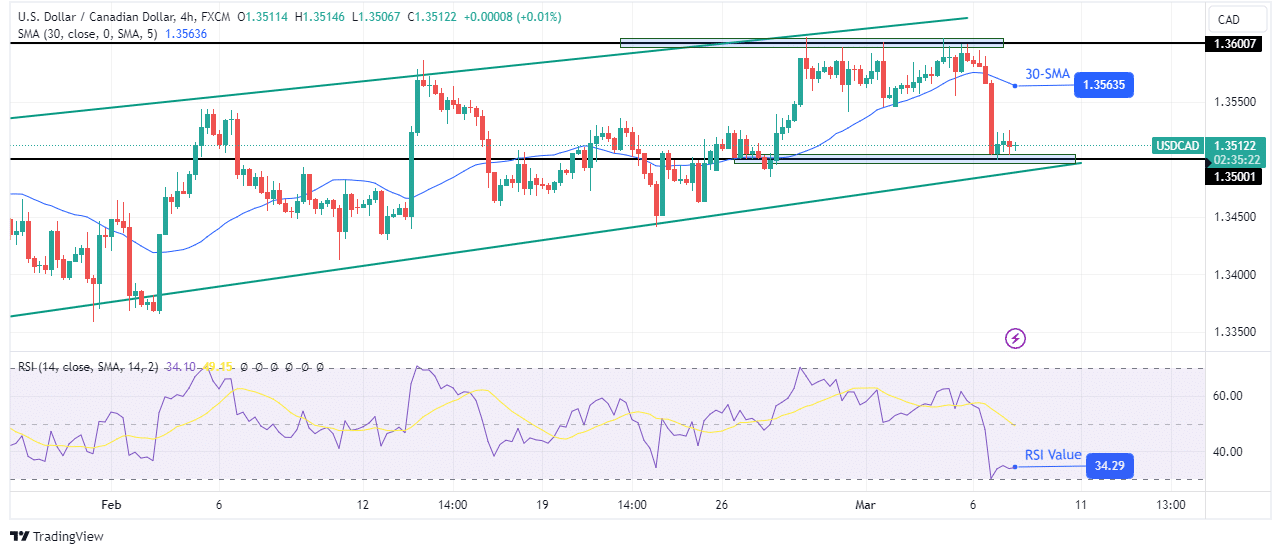

USD/CAD Technical Forecast: Price falls while resistance at 1.3600 remains firm

On the technical side, USD/CAD fell sharply after failing to break the resistance barrier at 1.3600. The sharp decline was stopped at the key support level of 1.3500. Notably, sentiment turned bearish as the price fell below the 30-SMA.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

However, the price is still trading in a bullish channel on a larger scale. That’s why it still makes more ups and downs. Although the bearish momentum is strong, with the RSI almost oversold, the price is trading close to channel support. Therefore, the bulls may be waiting to regain control and revisit the channel resistance.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.