- Data revealed that the Canadian economy unexpectedly shed 2,200 jobs in March.

- The US added an impressive 303,000 jobs in March.

- Fundamentals support further upside for the USD/CAD pair.

The USD/CAD forecast points north as the Canadian dollar weakens while the greenback continues to rise after Friday’s employment data. Traders are reducing expectations for a Fed tapering in June, while increasing bets for a BoC tapering in June.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

Data showed Friday that the Canadian economy unexpectedly shed 2,200 jobs in March. Meanwhile, the unemployment rate rose to a higher-than-expected 6.1% in the same period. This report revealed weakness in the labor market and the economy. Consequently, there is more pressure on the Bank of Canada to cut interest rates. Before the report, there was a 68% probability that the BoC would cut rates in June. However, after the report, this figure rose to 75%.

On the other hand, the US dollar strengthened on Friday after another employment report. Unlike Canada, the US added an impressive 303,000 jobs in March. In addition, the unemployment rate fell to 3.8, indicating strong labor market conditions. As a result, investors cut back on bets that the Fed will cut interest rates in June.

The outlook for a rate cut between the Fed and the Bank of Canada differed with this latest employment data. The US economy remains robust, allowing the Fed to keep rates high for longer. Meanwhile, Canada’s economy is weak, which could prompt the BoC to start cutting rates in June. These fundamentals support further upside for the USD/CAD pair.

USD/CAD Key Events Today

There are no major events today that could cause major volatility. Therefore, the USD/CAD pair could consolidate.

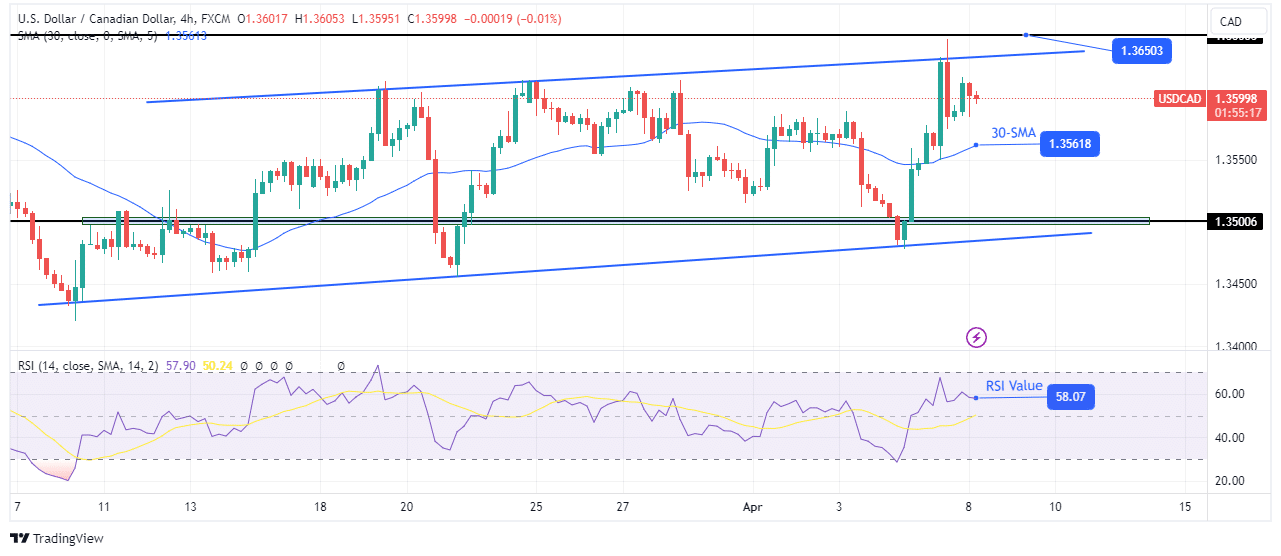

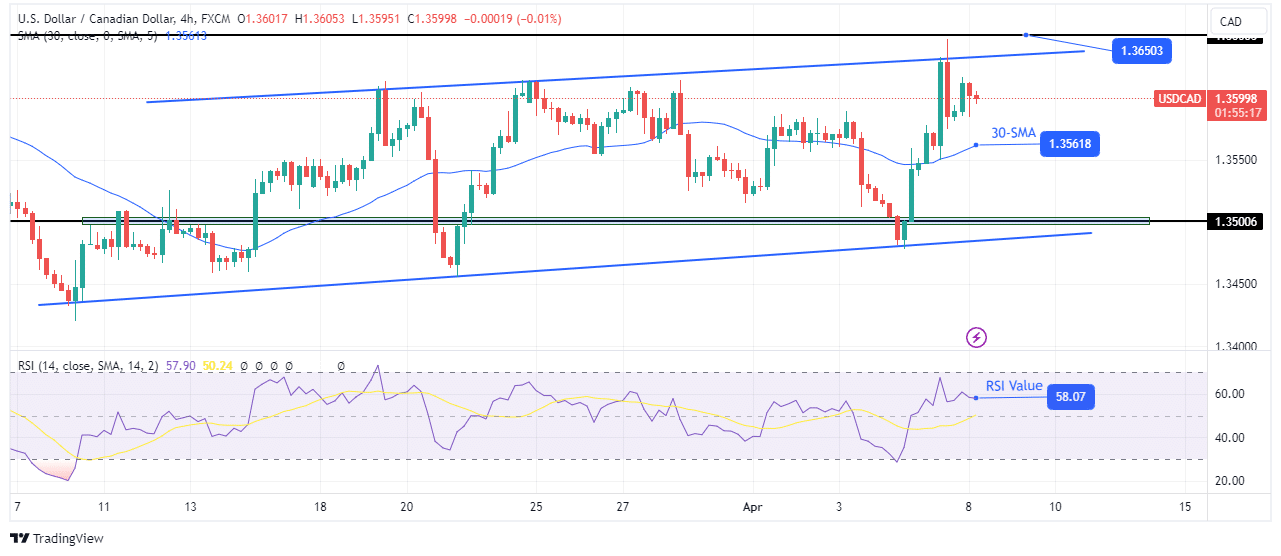

USD/CAD Technical Forecast: Bullish momentum stops at channel resistance

On the technical side, the USD/CAD price is trading in a bullish channel and recently retested the channel resistance. Furthermore, the price is above the 30-SMA with RSI above 50, indicating a strong bullish bias.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

However, since the price recently rose to channel resistance, it could now pull back to retest the SMA or channel support. However, the bulls will remain in control as long as the price remains within the channel. Furthermore, with the bulls in the lead, the USD/CAD pair could soon break the 1.3650 resistance level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.