- Fourth-quarter US gross domestic product is likely to reveal a 2% year-over-year increase.

- The Bank of Canada kept its key overnight rate at 5% on Wednesday.

- Money markets are fully expecting a BoC rate cut of 25 basis points in June.

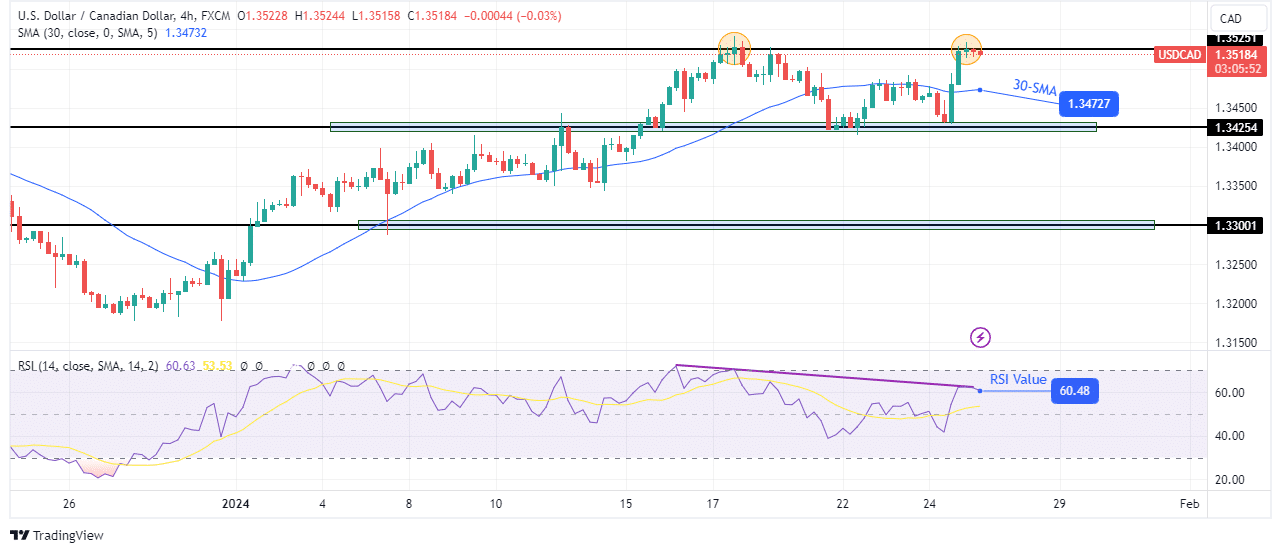

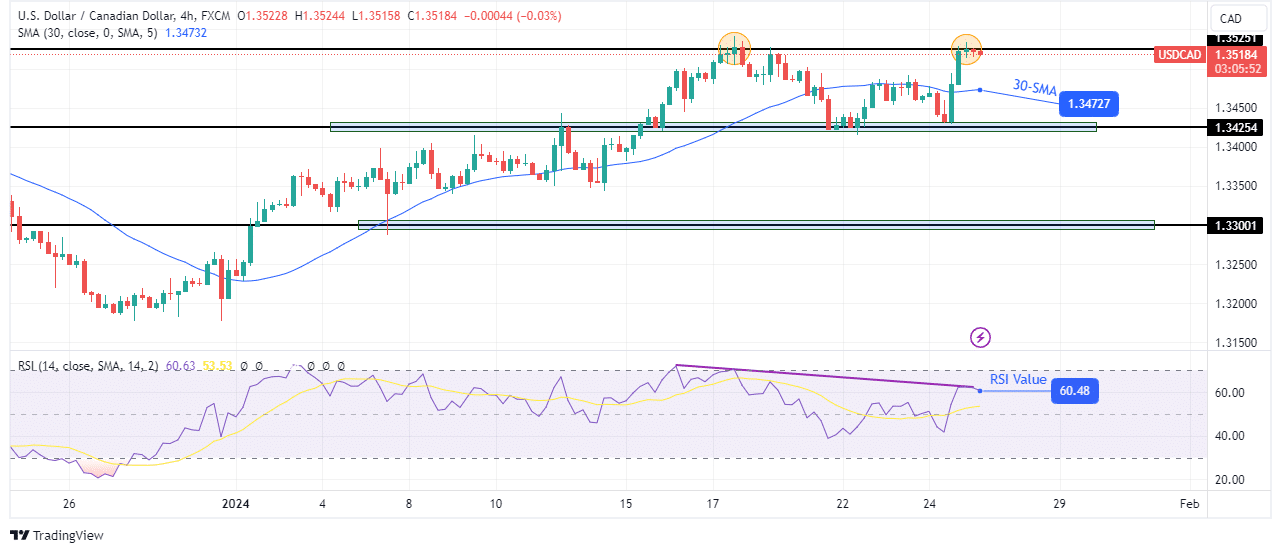

Thursday’s USD/CAD forecast hinted at a bullish outlook, with the dollar holding firm near a six-week high. Investors eagerly awaited GDP and other critical data, looking for valuable insights that could provide clues about the outlook for US interest rates.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

The initial report on US gross domestic product in the fourth quarter is likely to reveal a 2% year-over-year increase. Furthermore, the report could show that the US has avoided a recession in 2023. Furthermore, it is likely to indicate a slowdown in inflation during the final quarter. This could fuel expectations of a potential rate cut in the first half of 2024.

Meanwhile, the Canadian dollar weakened after the Bank of Canada kept its key overnight rate at 5% on Wednesday. In addition, it highlights a shift in focus from concerns about core inflation to considerations of when to cut rates.

Canadian money markets expect a 25 basis point cut in June. The BoC removed language from previous statements about a possible rate hike. However, Governor Macklem later mentioned that the possibility of an additional rate increase was not ruled out.

Moreover, the BoC adjusted its growth outlook, forecasting weak growth in the first quarter, followed by a gradual increase. Inflation is likely to remain around 3% in the first half of 2024, easing to 2.5% in the second half. Meanwhile, a return to the 2% target is likely to happen sometime in 2025.

USD/CAD Key Events Today

- Improve US GDP c/c

- US unemployment claims

USD/CAD Technical Forecast: The Bulls Are Back

On the technical side, USD/CAD retested the 1.3525 resistance level after the bearish takeover failed at the 1.3425 support level. At this point, the bulls are trying to continue the previous bullish trend. They have pushed the price above the 30-SMA and the RSI is above 50.

-If you are interested in learning more about forex broker scalping, read our guidelines to get started-

Initially, the bears tried to take control when the price broke below the 30-SMA. However, they were not strong enough to continue below the support level at 1.3425, allowing the bulls to regain control.

Now the bulls are facing strong resistance. At the same time, the RSI is showing weaker bullish momentum at this resistance. If it holds, the price will return to the 1.3425 support. Meanwhile, the bullish trend will continue if the bulls regain momentum.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.