- Traders are preparing for the conclusion of the Federal Reserve’s policy meeting.

- Investors are waiting to see if Powell opposes the idea of cutting interest rates in the first half of 2024.

- The Bank of Canada could be one of the first central banks to ease in 2024.

On Wednesday, the USD/CAD forecast was leaning towards optimism, boosted by a slight rise in the dollar. Traders eagerly awaited the conclusion of the Federal Reserve’s policy meeting, where clues about the potential timing of interest rate cuts could be revealed.

–Are you interested in learning more about ECN brokers? Check out our detailed guide-

Market expectations indicate that rates will remain unchanged. Meanwhile, investors want to understand the central bank’s economic outlook. Moreover, the question is whether Fed Chairman Jerome Powell is opposed to the idea of cutting interest rates in the first half of 2024.

Recent indicators have pointed to a soft landing. However, overnight data revealed an unexpected increase in consumer prices for November. Still, traders are taking note of a quarter-point rate cut in May.

Meanwhile, the Canadian dollar has weakened against the US dollar since yesterday due to falling oil prices. Furthermore, there is speculation that the Bank of Canada could potentially be among the first major central banks to cut rates in the coming months. In particular, the Bank of Canada could be one of the first central banks to ease in 2024.

Money markets are predicting that the Bank of Canada will cut its benchmark rate, which is currently at a 22-year high of 5%, as early as April. However, analysts warn that the recent easing of financial conditions could hamper the central bank’s ability to control inflation. In addition, it could delay the transition to rate cuts if it causes increased activity in the housing market.

USD/CAD Key Events Today

- USA core PPI m/m

- US PPI m/m

- Fed policy meeting

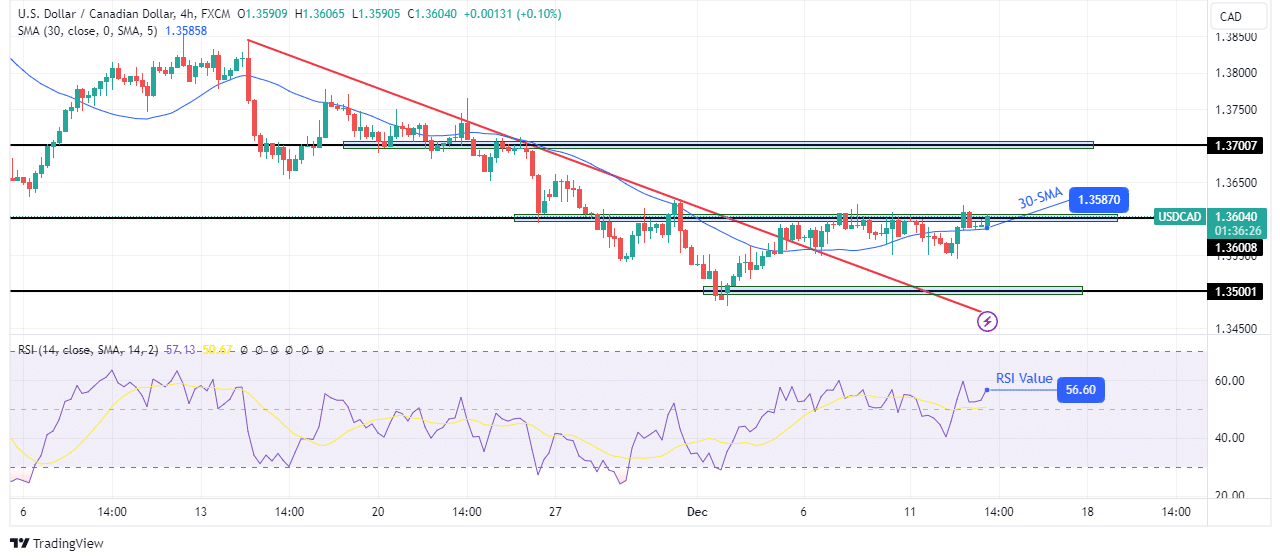

USD/CAD Technical Forecast: Bulls are preparing for another attempt to break 1.3600

USD/CAD bulls are trying to break above the key resistance level of 1.3600 on the charts. This comes after the price broke above its resistance trendline, signaling the weakness of the bearish trend.

–Are you interested in learning more about day trading brokers? Check out our detailed guide-

Moreover, the price is trading above the 30-SMA, which shows that the bulls have strengthened. At the same time, the RSI is above 50, in bullish territory. Therefore, the price is likely to break above 1.3600 to retest the key resistance level at 1.3700. However, there is also a chance that the price will retest the 1.3500 key level before the trend turns bullish.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.