- The BoC could wait for clearer Fed policy to avoid a major deviation.

- Canada posted a surprising trade deficit of C$2.28 billion in March.

- US stocks rallied a day after the Fed held rates and sounded less hawkish than expected.

The USD/CAD outlook has turned sharply into bearish territory, fueled by hawkish sentiments from Bank of Canada Governor Tiff Macklem. At the same time, the Canadian dollar, which usually tracks U.S. stocks, strengthened amid a recovery on Wall Street. Meanwhile, investors awaited the US non-farm payrolls report for more clues on Fed policy.

–Are you interested in learning more about crypto signals? Check out our detailed guide-

BoC Governor Macklem said on Thursday that there is a limit to how much US and Canadian interest rates can differ. Although he added that the limit was still a long way off, it confirmed the view that the BoC will wait to see what the Fed does on interest rates to avoid a big deviation. Investors remain confident that the Bank of Canada will cut rates before the Fed. Moreover, it could happen in June.

Canada’s economy is slowly declining, while inflation is easing faster than expected. This is why the conditions for the Bank of Canada to cut rates are being adjusted. In particular, data from Canada revealed a surprising trade deficit of C$2.28 billion as the country’s exports fell faster than imports in March.

At the same time, US stocks rallied a day after the Fed kept rates on hold and sounded less hawkish than expected. Investors are buoyed by the fact that Powell has maintained the prospect of a rate cut, allaying fears of possible hikes to control inflation. However, the timing for the first cut remains unclear. Investors will likely await further guidance from upcoming US employment data.

USD/CAD Key Events Today

- US Nonfarm Payroll Report

- US ISM Services PMI

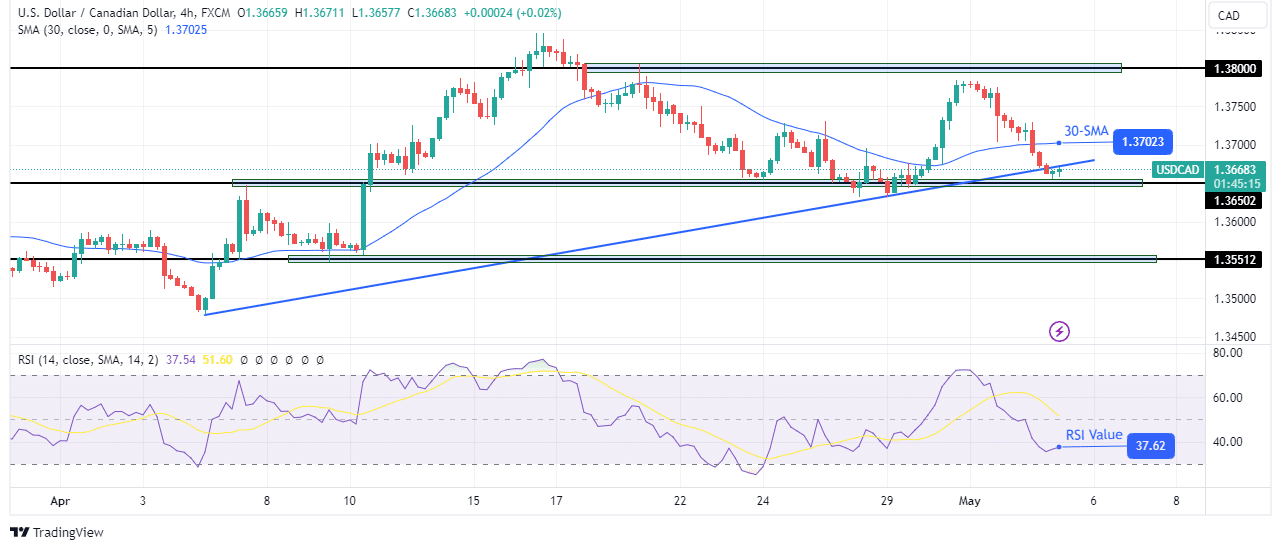

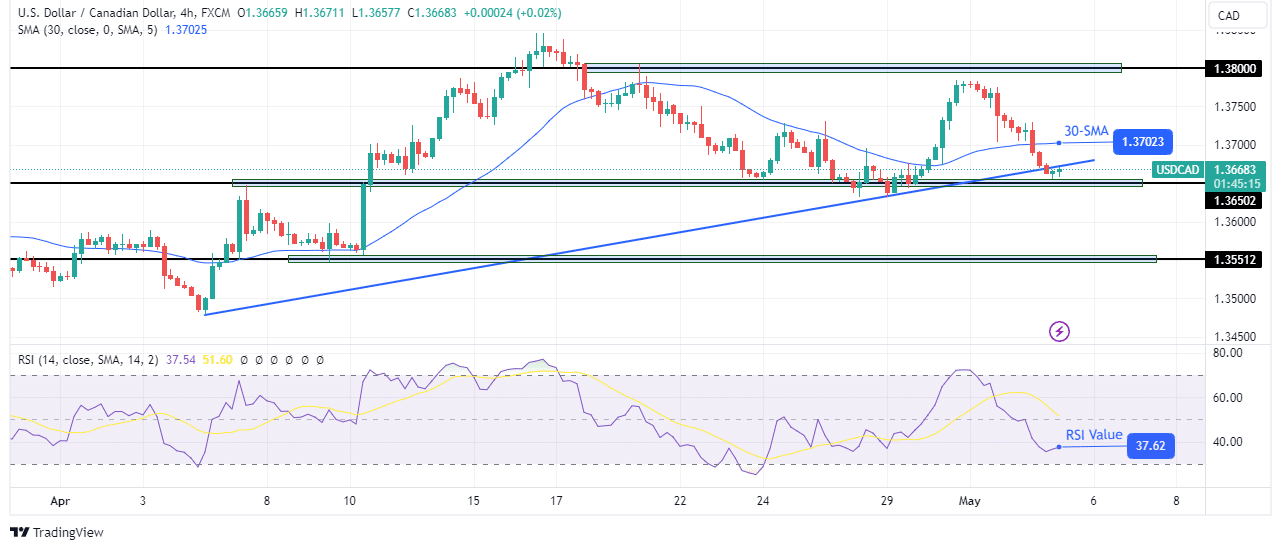

USD/CAD Technical Outlook: Bears will attack the 1.3650 support

On the technical side, the USD/CAD price has fallen below the 30-SMA and could soon break below the solid support trend line. However, the bears also face a key support level of 1.3650 that could stop further declines.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Notably, the price made a strong move, rising sharply before declining and reversing most of the previous movement. The bearish momentum is stronger now as the RSI is well below 50. Therefore, there is a good chance that the price will break below 1.3650. In this case, the bears would target the support level of 1.3551.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.