- US headline inflation rose 0.4% month-on-month and 3.5% year-on-year.

- Investors now expect the Fed’s first tapering in September.

- Governor Tiff Macklem said the BoC is likely to cut rates in June.

The USD/CAD outlook shines brighter with a bullish outlook as the outlook for a rate cut between Canada and the US continues to diverge. On Wednesday, the US released a CPI report showing a jump in inflation. Meanwhile, the Bank of Canada has signaled the start of rate cuts in June.

–Are you interested in learning more about buying NFT tokens? Check out our detailed guide-

As more data comes in, it’s clear the Bank of Canada will be poised to cut rates sooner than the Fed. It is significant that annual and monthly inflation data in the US were higher than expected, indicating a break in the downward trend. Total inflation increased by 0.4% monthly and 3.5% annually. As a result, rate cut bets have fallen sharply, with investors now expecting the Fed’s first rate cut in September. Moreover, there is a chance that the Fed will cut rates only twice this year.

Fed policymakers have been waiting to assess the data to be sure inflation will reach its 2% target. However, after three months of hot numbers, policymakers and investors have lost confidence. Moreover, the labor market remained resilient, with the latest jobs report beating forecasts.

Meanwhile, the situation in Canada is completely opposite. Labor market data revealed a worsening economy putting pressure on the Bank of Canada to start cutting interest rates. At Wednesday’s policy meeting, the BoC kept rates at 5% as expected. But Governor Tiff Macklem said the central bank was likely to cut rates in June if inflation continued to ease.

USD/CAD Key Events Today

- USA core PPI m/m

- US PPI m/m

- US unemployment claims

- US 30-year bond auction

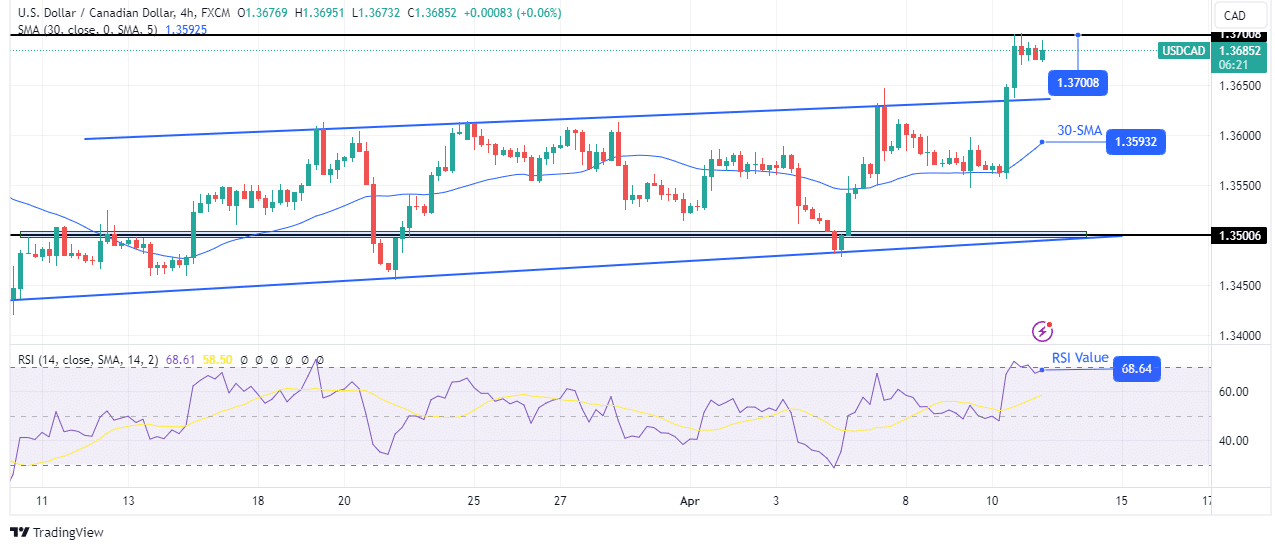

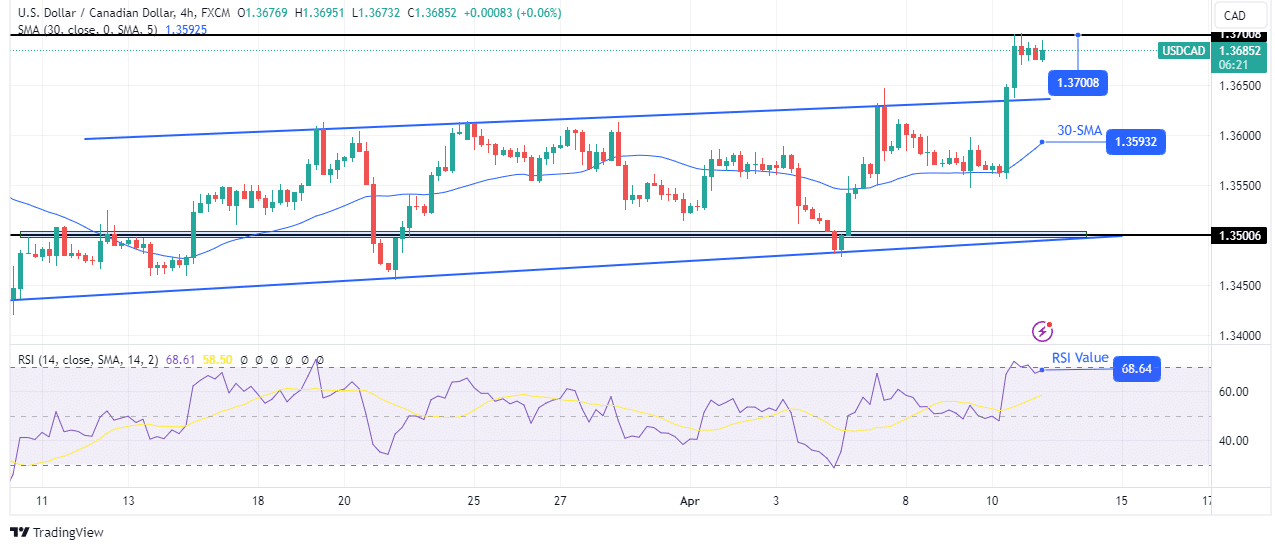

USD/CAD Technical Outlook: Breakout of the channel signals an increase in momentum

On the charts, the USD/CAD price has broken above its bullish channel, showing an increase in momentum. Consequently, this could be the start of a stronger bullish trend. The momentum build came when the price paused at the 30-SMA support. From here he made a bullish candle that broke above the channel resistance. At the same time, the RSI rose into the overbought region.

–Are you interested in learning more about the UK Trading Platform overview? Check out our detailed guide-

Currently, the price is paused at the key resistance level of 1.3700. It may consolidate below this level as the SMA catches up before breaking above.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.