- Oil prices rose on persistent concerns about supply disruptions in the Middle East.

- There is uncertainty around the start of the Fed’s rate cut.

- Economists forecast a job gain of 13,500 in Canada.

There has been a shift in the USD/CAD outlook, mainly fueled by incidents on the Libyan field and escalating tensions in the Israel-Gaza conflict. The Canadian dollar is stronger, riding a wave of rising oil prices fueled by concerns over supply disruptions in the Middle East.

If you are interested in automated Forex trading, check out our detailed guide-

Local protests on Wednesday led to a complete shutdown of production at Libya’s Sharara oil field, which produces up to 300,000 barrels a day.

Meanwhile, the currency strengthened to a near two-week high on Wednesday. This growth occurred as investor confidence in the Fed’s imminent move to cut interest rates waned. Notably, recent strong results in risk-sensitive assets such as equities have boosted the Canadian dollar.

Elsewhere, minutes from the Fed’s December 12-13 policy meeting provided little insight into the timing of a potential rate cut. Still, they pointed to a growing belief that inflation is under control. Moreover, there are concerns about the risks associated with an “overly restrictive” monetary policy for the economy.

This document marks the end of a year when the Fed was uncertain about the necessary measures to control inflation. However, by the end of the year, inflation was decreasing faster than expected.

The next big events for the pair include employment reports from the US and Canada on Friday. Economists forecast job gains of 13,500 in Canada and 168,000 in the US.

USD/CAD Key Events Today

- US ADP change in non-farm employment

- First jobless claims in the US

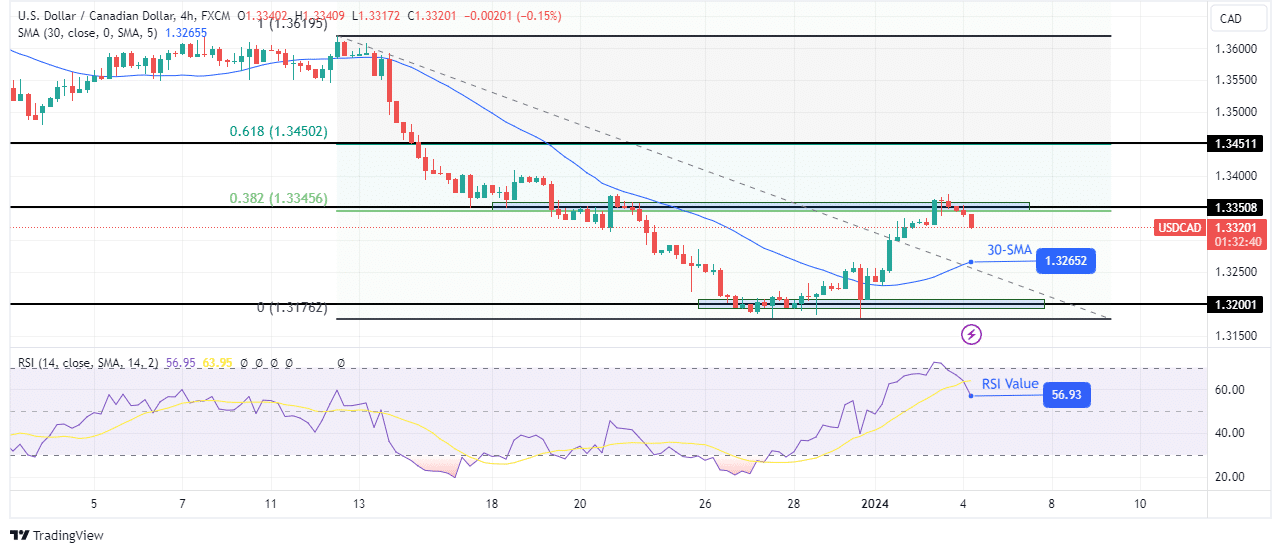

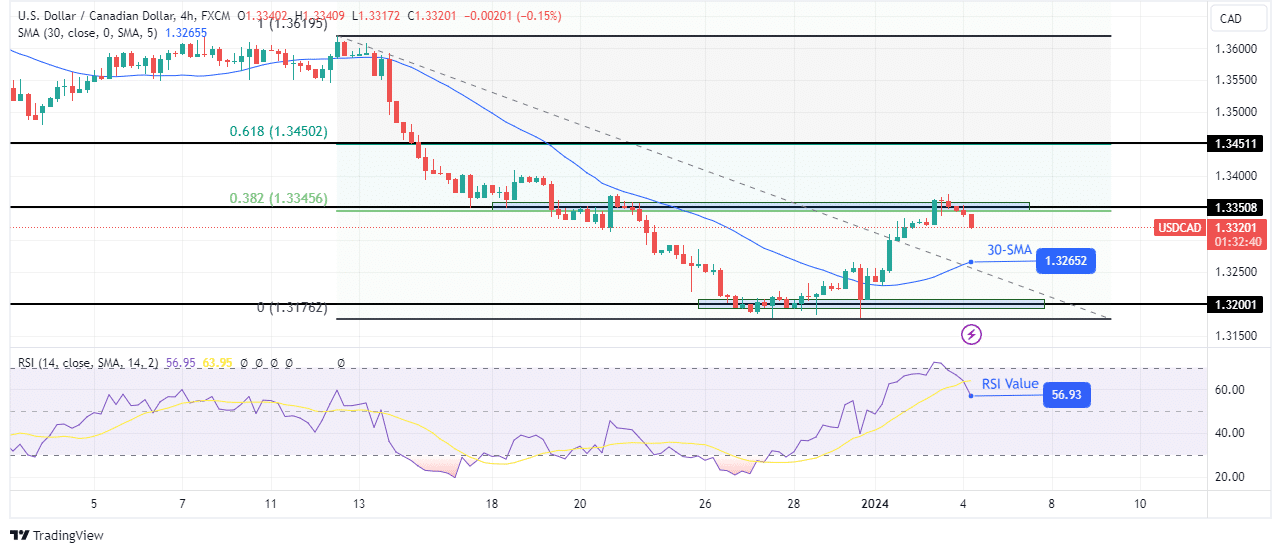

USD/CAD technical outlook: resistance at 1.3350 triggers pullback

The pair paused its recent rally after reaching the resistance level at 1.3350. At the same time, the bulls could not push beyond the fib retracement level of 0.382. As such, the price is pulling back and heading towards the 30-SMA support. However, the bullish bias is still strong as the price is above the SMA and the RSI is in bullish territory above 50.

Therefore, the decline is likely to stop at the 30-SMA, where the bulls are waiting to resume the new uptrend. If this happens, the price will climb to the resistance level of 1.3451. However, if the bears break below the 30-SMA, the price will fall to the 1.3200 support.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.