- Canadian retail sales fell 0.3% in January from December.

- Tuesday’s data showed a drop in inflation in Canada.

- The US economy remains resilient and inflation is high.

The outlook for USD/CAD is bullish, with the pair remaining close to last week’s highs. In particular, the Canadian dollar stumbled amid disappointing economic data, in contrast to the greenback’s resilience, boosted by upbeat reports.

-Are you interested in learning about the best AI trading forex brokers? Click here for details –

Data on Friday revealed a decline in retail sales in Canada, pointing to weaker consumer spending. In January, retail sales fell by 0.3% compared to December. A slowing economy is likely to put pressure on the Bank of Canada to cut rates. Tuesday’s data showed a drop in inflation in Canada, raising the odds of a June cut above 70%.

Major central banks are slowly turning more dovish as inflation eases and economies begin to buckle under the pressure of high borrowing costs. Last week, the Swiss National Bank became the first major central bank to cut interest rates. Moreover, markets expect the European Central Bank and the Bank of England to start cutting rates in June.

On the other hand, the US economy remains resilient and inflation remains a problem. Therefore, although markets expect the first reduction in June, there is doubt. Data last week showed continued strength in the US economy. Policy makers may worry about cutting interest rates too soon as this could lead to a resumption of inflation. Accordingly, the dollar ended the week with gains.

However, USD/CAD retreated slightly on Monday as the Canadian dollar strengthened on rising oil prices. Oil rose amid supply concerns fueled by geopolitical tensions.

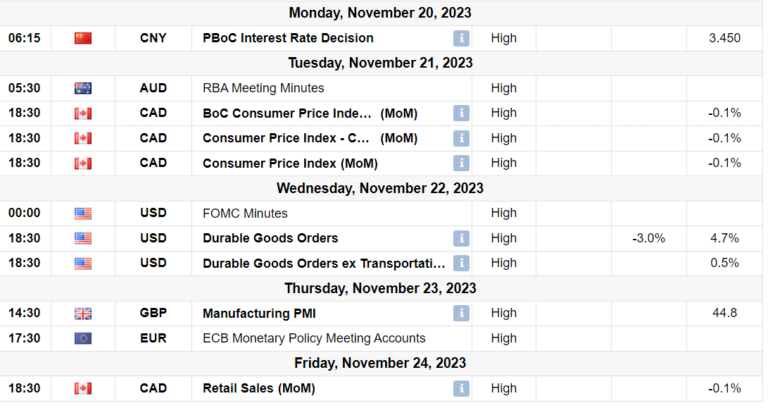

USD/CAD Key Events Today

There will be no major economic releases from Canada or the US today. As a result, volatility can be low.

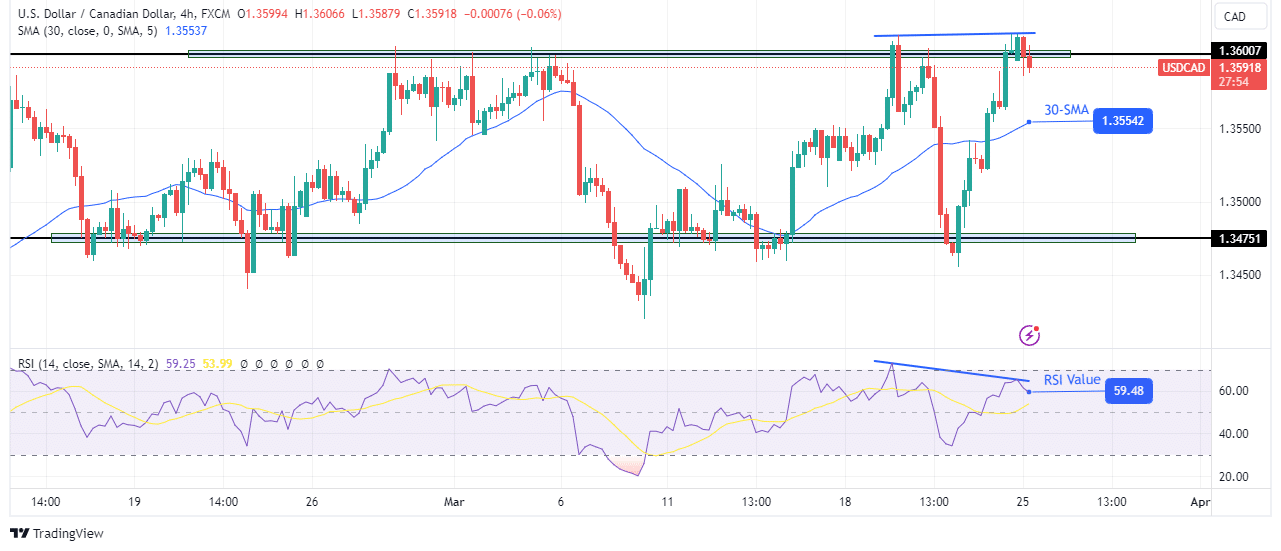

USD/CAD Technical Outlook: Bulls pause at 1.3600 resistance

On the technical side, the USD/CAD price is pulling back after retesting the key resistance level of 1.3600. However, there is no clear direction in the price as it bounces between the support level at 1.3475 and the resistance level at 1.3600. Moreover, the price made several unsuccessful attempts to break out of this area.

-Are you interested in learning more about forex indicators? Click here for details –

Right now the bulls are in the lead. However, the price stalled at range resistance, and the bears resurfaced. Therefore, there is a chance that the price will return to the support range. However, bulls could break above 1.3600 if the 30-SMA holds as support.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.