- The dollar retreated on Tuesday as investors paused after a sharp rally.

- The hawkish Fed noted that it has changed its outlook for a rate cut in the US.

- Recent inflation data from Canada revealed a slowdown in price increases.

The USD/CAD outlook points to a temporary downtrend as investors take profits on their long dollar positions. Moreover, the Canadian dollar strengthened as oil prices recovered from a huge drop in the previous session. However, recent data from Canada indicate a further decline in insanity.

-Are you looking for the best AI trading brokers? Check out our detailed guide-

The dollar retreated as investors paused after a steep rally. The recent rise was due to comments from the Fed that changed the outlook for interest rate cuts in the US. Fed officials have changed their outlook for interest rates after recent upbeat data. As a result, they called for patience, with Powell saying the country would need tighter monetary policy conditions for longer. This has caused bets on a rate cut to fall, with the first cut likely to come in September.

Meanwhile, recent inflation data from Canada revealed a drop in price increases. Inflation rose a weaker-than-expected 2.8% in March, confirming a consistent downward trend towards the BoC’s target. That’s why there’s more pressure on the central bank to start cutting interest rates in June, well before the Fed. After the inflation report, markets were betting on a 55% chance of a BoC cut in June, up from 44% before the news.

The monetary policy gap between the US and Canada continues to widen with each new economic report. At this point, there is a good chance that the USD/CAD pair will continue its rise, especially since the recent decline in oil prices could continue. Oil traders have reversed recent gains as demand concerns outweigh supply worries.

USD/CAD Key Events Today

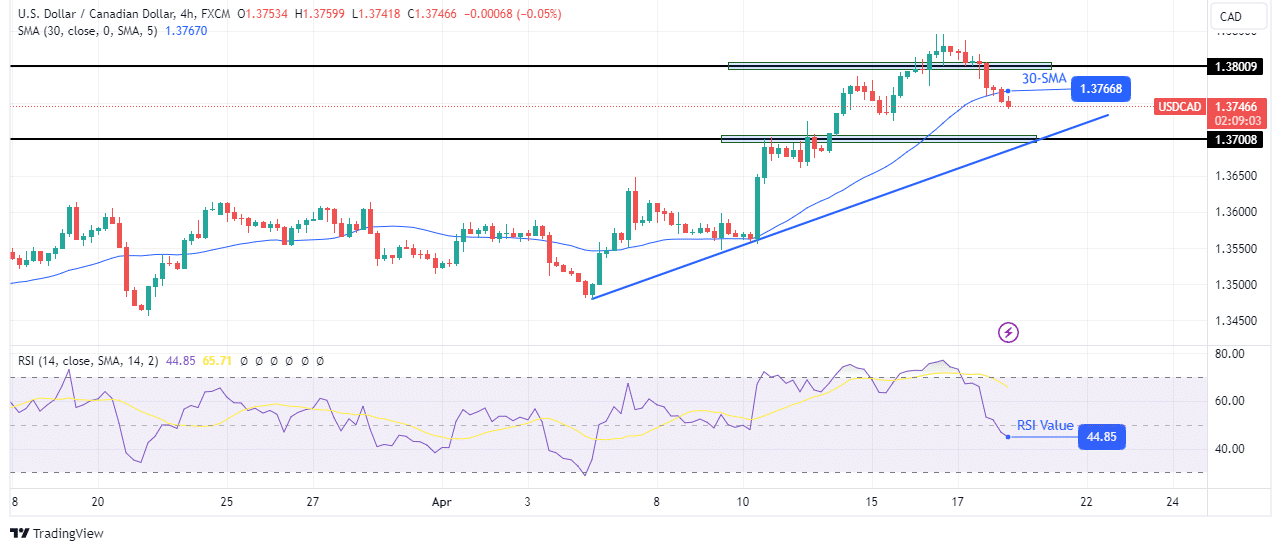

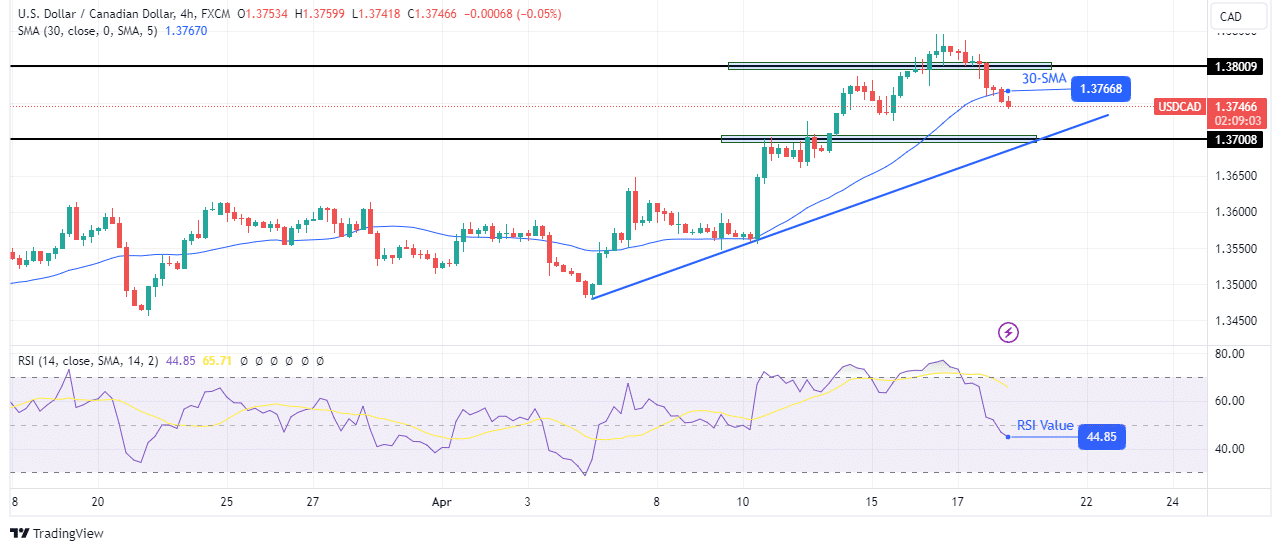

USD/CAD Technical Outlook: Bears trigger bullish momentum at 30-SMA.

On the technical side, the USD/CAD price fell after failing to sustain a move above the key resistance level of 1.3800. The decline broke below the 30-SMA support. At the same time, the RSI fell below the key mark of 50. Accordingly, there was a change in sentiment towards bears.

-Are you looking for the best MT5 brokers? Check out our detailed guide-

However, the bears will only reverse the trend if the price breaks below the key level of 1.3700. Furthermore, to confirm a new trend, the price must break below the bullish trend line and start making lower highs and lows.

Do you want to trade Forex now? Invest in eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.