- The Canadian dollar strengthened after the Fed signaled a looming rate cut.

- Economists expect Canadian inflation to slow to an annual rate of 2.9%.

- Oil rose due to an attack on ships in the Red Sea by Yemen’s Iran-aligned Houthi militant group.

The USD/CAD outlook was bearish on Tuesday, as the resilient Canadian dollar took center stage, outperforming the declining greenback. The dollar weakened due to expectations of a potential interest rate cut by the US Federal Reserve in the coming year. Meanwhile, the Canadian dollar received support from rising oil prices.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

On Monday, the Canadian dollar fell slightly against the US dollar. However, it held close to its four-month high, supported by rising oil prices and anticipation of domestic inflation data.

The loonie hit its highest level since August 4 at 1.3347 on Friday. The rise was a result of the Federal Reserve’s signaling of a potential interest rate cut in the coming year, which weighed on the US dollar.

Meanwhile, economists expect Canadian inflation to slow to an annual rate of 2.9% in November from October’s 3.1%. Significantly, higher inflation could lead the Bank of Canada to hold current interest rates for a longer period, further strengthening the Canadian dollar. Despite growing optimism about reaching the 2 percent inflation target, Canada’s central bank kept the door open to further tightening.

Elsewhere, oil, a key Canadian export, rose 1.5 percent to $72.47 a barrel. The increase has been attributed to attacks by Yemen’s Iran-aligned Houthi militant group on shipping in the Red Sea, disrupting maritime trade and driving up supply costs.

USD/CAD Key Events Today

- Canadian CPI m/m

- Canadian Average CPI y/y

- Canadian abbreviated CPI y/y

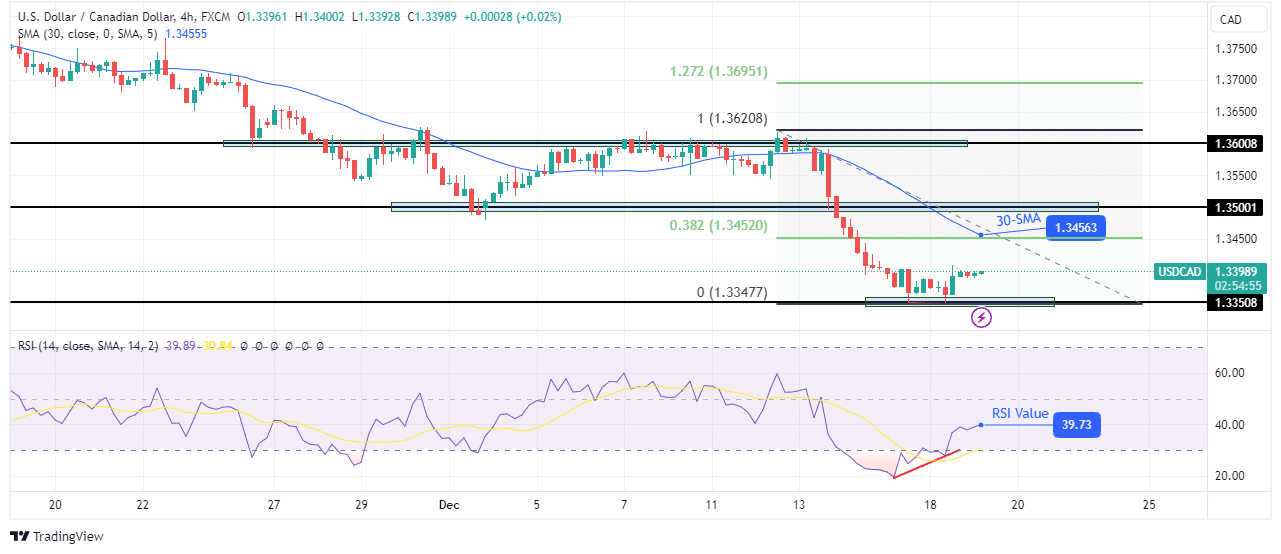

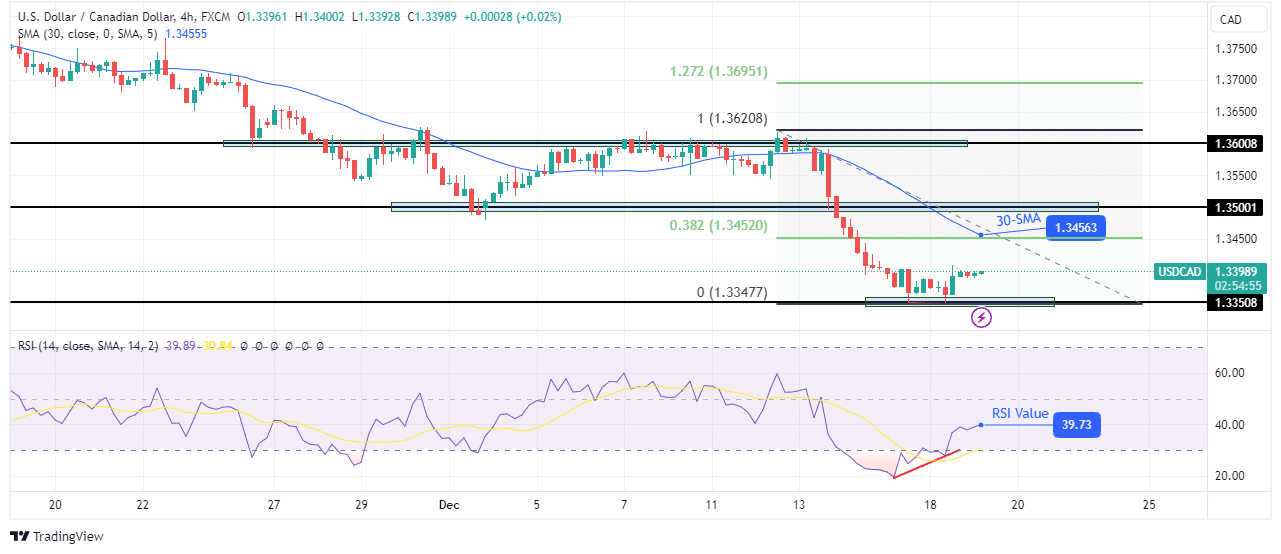

USD/CAD Technical Outlook: Bearish momentum weakens in oversold region

On the charts, USD/CAD is recovering after pausing a sharp decline at the key support level of 1.3350. However, the bearish bias is still strong as the 30-SMA is above the price and is pointing down. At the same time, the RSI is below 50, supporting the bearish trend.

–Are you interested in learning more about forex tools? Check out our detailed guide-

However, there is a chance that the bullish move will continue higher. The RSI made a small bullish divergence in the oversold region. Therefore, the bears are exhausted, allowing the bulls to retrace the recent move. However, the bounce is likely to stop at the resistance zone consisting of the 30-SMA and the 0.382 fib retracement level.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.