- The dollar recovered from a three-month low.

- Data indicating faster than expected growth in the US economy.

- The BoC revealed skepticism about the benefits of a potential digital currency.

As Thursday unfolded, the USD/CAD outlook took on a bullish tone, led by the greenback’s recovery from a three-month low. However, the dollar was poised to mark its biggest monthly decline in a year. Investors increased bets that the Fed would refrain from further rate hikes. Furthermore, they awaited a key inflation report later in the day.

–Are you interested in learning more about scalping brokers? Check out our detailed guide-

Notably, the dollar fell 3.7% in November on growing expectations that the Fed will cut interest rates in the first half of 2024. However, the dollar recovered some losses on Wednesday following upbeat data on US economic growth.

The focus will be on Friday when Fed Chairman Jerome Powell speaks. This will follow comments by Fed Governor Christopher Waller that signaled a possible rate cut in the coming months. Before that, however, investors will focus on the critical Personal Consumption Expenditure (PCE) index. US futures markets are currently pricing in over a 100 basis point rate cut next year, starting in May.

Elsewhere, the Bank of Canada (BoC) revealed on Wednesday that most financial institutions expressed skepticism about the benefits of a potential digital currency. Like many other countries, Canada is exploring a digital version of its currency. The move prevents digital payments from being left solely to the private sector. Notably, the COVID-19 pandemic has reduced the use of cash.

As part of this initiative, the BoC consulted with civil society groups, focus groups, financial institutions and the general public to assess the support and viability of the digital Canadian dollar.

USD/CAD Key Events Today

- US Core PCE Price Index Report

- US awaits home sales report

- US unemployment claims

- Canadian GDP

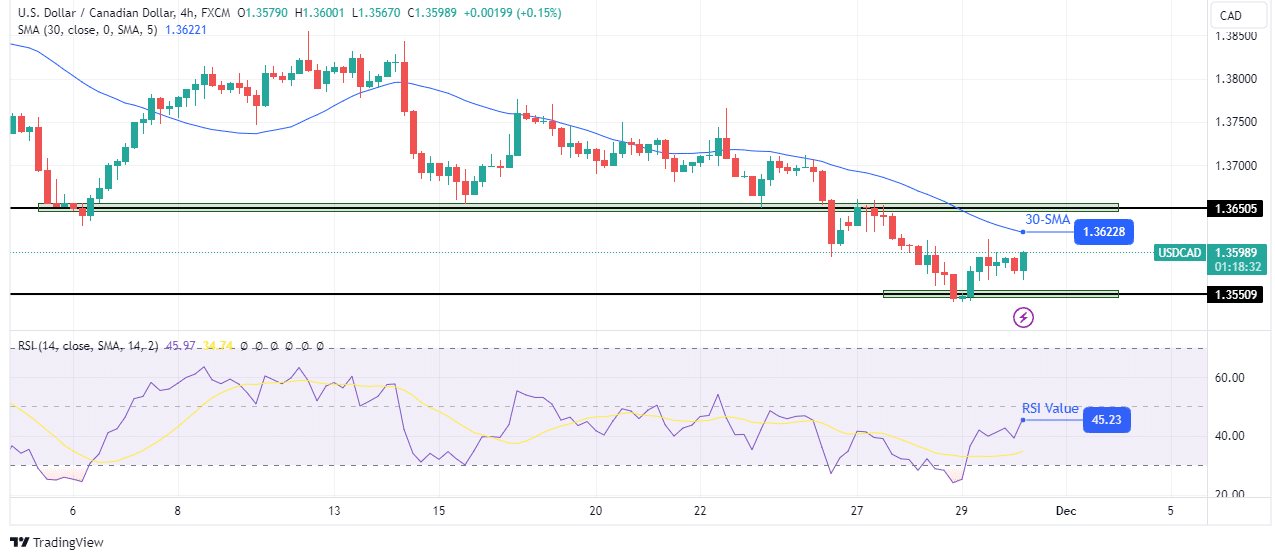

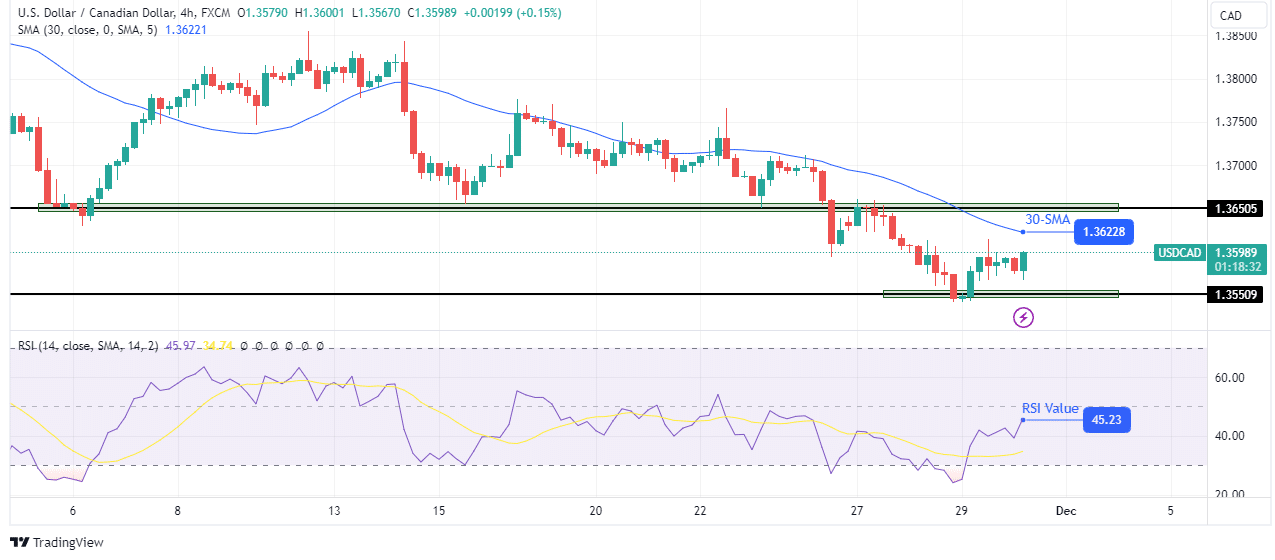

USD/CAD Technical Outlook: Bulls re-emerge after 1.3550 support level

The price recovered on the charts after finding support at the 1.3550 support level. However, the bias remains bearish as the bounce is below the 30-SMA. At the same time, the RSI is indicating strong bearish momentum as it trades below 50.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

The bulls are moving towards the 30-SMA resistance, which has repeatedly stopped them in the downtrend. Therefore, the price is likely to reverse to the SMA, allowing the bears to continue the downtrend. However, there is a chance that the bulls will break above the SMA and the 1.3650 level to reverse the trend.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.