- The wall / CAD Outlook indicates the collection of dollars because the markets are prepared for the Trump Reciprocal Tariffs.

- The United States has signed only trading offers in Great Britain, China and Vietnam.

- Participants in the market are expected crucial data on employment from Canada.

The wall / CAD Outlook shows the gathering dollar as markets violated for Trump reciprocal tariff deadlines. Meanwhile, the Canadian dollar is crazy because traders care for the probable influence of larger tariffs on Canadine economy.

–Are you interested in learning more about forex indicators? See our detailed guide-

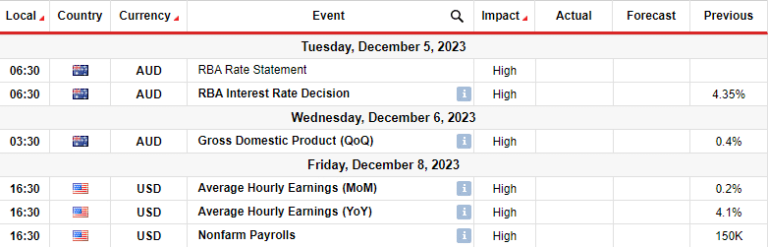

With several major economic editions this week, all focus is on the final way. In 90 days from the break, the United States signed only trading offers in the UK, China and Vietnam. Therefore, most of its trading partners can soon start paying higher tariffs.

Talks between Canada and the US are in progress since last week. However, the announced agreement, the traders remain uncertain in Outlook. High tariffs would reduce the demand for goods from Canada, significantly injuring the economy. This would, in turn, turned pressure on the Canada Bank to continue his aggressive cutting cycle, which would hurt the Canadian dollar.

The market participants are also expected by the Employment data from Canada. There is currently a small chance that the bottle will continue the decrease in the rate at its next meeting. Padua Employment Report could increase bets for such a move. On the other hand, if the labor market remains resilient, the central bank can continue to break.

Today is key events USD / CAD

The traders do not expect key economic editions from the US or Canada. The main catalyst is tariff uncertainty.

USD / CAD Technical Outlook: Bukova approaches of resistance from 1,3700

On the technical side, the USD / CAD price violated above the 30th and her bear in trend, indicating a change in feeling. The beets are now in leadership, with pricing trade above the 30th and RSI in the territory of Bucreens.

–Are you interested in learning more about Best Bitcoin exchangers? See our detailed guide-

However, the price must begin to make higher high and lower for confirmation of the new bikovna trend. Currently, the levels of resilience at 1,3700 is approaching. It could pause and pull back here to reset recently broken SMA.

If held as support, the price will look for higher height. This would allow the price to break over 1,3700 and probably reaches the resistance to 1,3800. If not, it could review the support of 1,3550.

Looking for forex trading now? Invest in Ethorro!

68% Retail order Loss of money lose money when trading CFDs with this provider. You should consider whether you can afford to take a high risk of losing money.