- Investors have weighed in on the possibility of a dovish stance by the Bank of Canada.

- The Bank of Canada is likely to keep its key overnight rate at a 22-year high of 5% on Wednesday.

- Money markets expect a cut of 25 basis points by June.

The USD/CAD outlook showed a bullish stance on Tuesday, with the pair holding close to Monday’s highs. Investors weighed in on the possibility of a more dovish stance than expected from the Bank of Canada at Wednesday’s policy meeting.

-Are you interested in learning more about the Forex Signal Telegram Group? Click here for details –

The Bank of Canada is likely to keep its key overnight rate at a 22-year high of 5% on Wednesday. However, investors will focus on the release of updated forecasts on inflation and economic growth. If the central bank revises its growth projections lower, there is a chance that the market will anticipate an earlier cut in interest rates.

However, there is still a chance that the rate cut will be delayed. After three consecutive months in which prices either fell or stayed at the same level compared to the previous year, headline inflation rose to 3.4% in December from 3.1%. In addition, core inflation exceeded expectations.

This change prompted the money markets to postpone their expectations. Currently, money markets expect a 25 basis point cut by June. However, the likelihood of a similar cut in April has dropped from 100% ahead of the December inflation data to 70%.

Economists predict that inflation in Canada will remain more persistent than in the US. Therefore, the Bank of Canada is likely to lag behind the Fed in implementing the first rate cut this year.

USD/CAD Key Events Today

There won’t be any key releases from Canada or the US today. Therefore, investors will be looking forward to tomorrow’s BoC policy meeting.

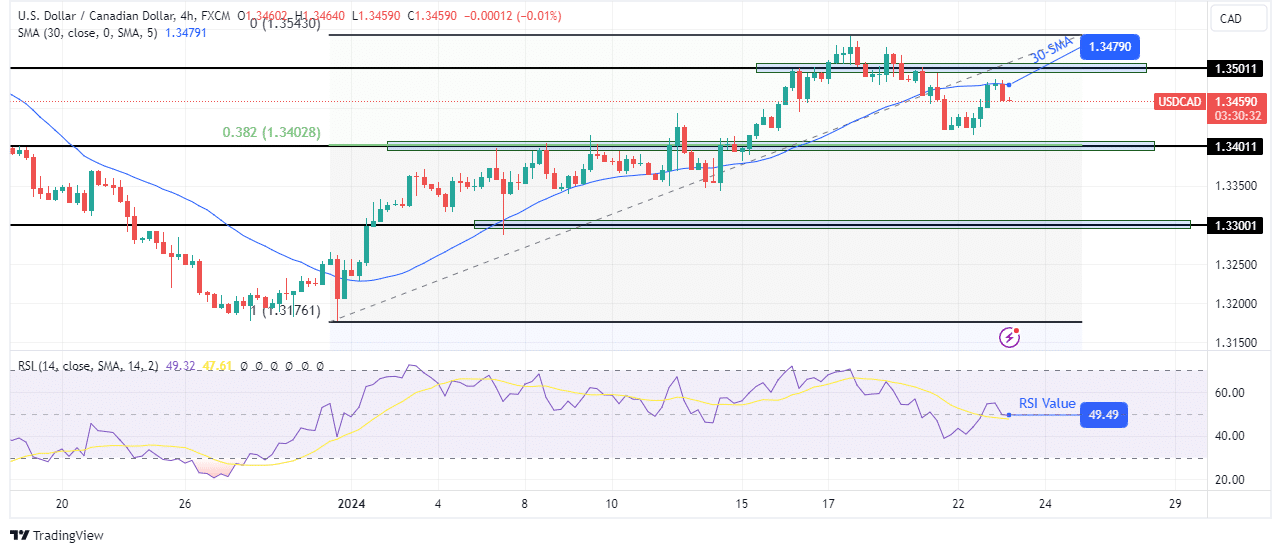

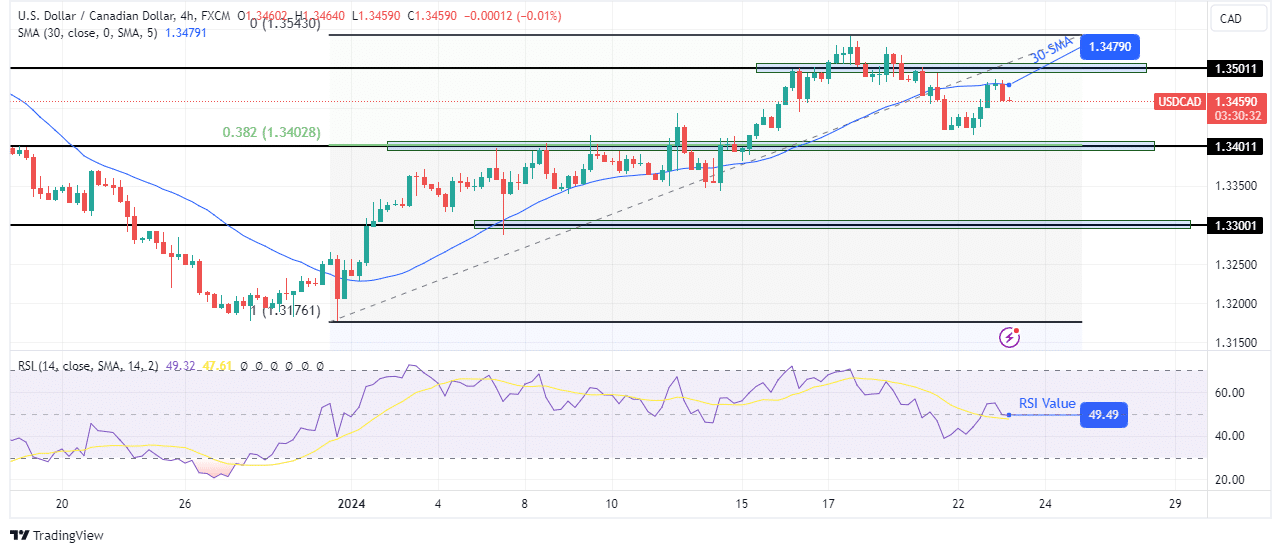

USD/CAD Technical Outlook: Price Retesting 30-SMA

On the technical side, USD/CAD pulled back to retest the 30-SMA resistance after the bears took control. Buyers gave up control after failing to hold the price above the key resistance level of 1.3501. The change in sentiment came when the price broke below the 30-SMA and the RSI went below 50. And now, the price is confirming this new direction by retesting the recently broken SMA. Further confirmation will come when the price is lower.

–Are you interested in learning more about forex earnings? Check out our detailed guide-

Currently, the price is poised to fall to the support level of 1.3401 which coincides with the fib retracement level of 0.382. The downtrend will continue if the price breaks this support zone to retest the key level of 1.3300.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.