- Oil rose after the US and UK announced air and naval strikes on Houthi military targets in Yemen.

- US consumer prices rose in December, up 0.3% for the month.

- Traders estimate a 73.2% chance the Fed will initiate its first 25 basis point rate cut in March.

The USD/CAD outlook turned bearish on Friday due to a dynamic change. The Canadian dollar rose with oil prices following the announcement of US and UK air and sea strikes on Houthi military targets in Yemen. The strikes were in retaliation for the group’s attacks on ships in the Red Sea.

–Are you interested in learning more about MT5 brokers? Check out our detailed guide-

Meanwhile, investors continued to digest the US inflation report. That will shape market expectations of a Fed rate cut.

Consumer prices in the US rose in December, up 0.3% on the month and an annual increase of 3.4%. Still, traders estimate a 73.2% probability that the Fed will begin its first tapering of 25 basis points (bps) in March. Moreover, they expect additional cuts after that.

However, Fed officials are less optimistic. Austin Goolsby, president of the Chicago Fed, pointed to uncertainty about whether there has been enough progress for the Fed to begin cutting interest rates. Moreover, investors lost confidence in the early rate cut in the previous session.

The Canadian dollar fell to a four-week low against a stronger US dollar on Thursday on stronger-than-expected US inflation data. It initially cast doubt on the likelihood of an early Fed rate cut.

Tony Valente, senior currency dealer at AscendantFX commented: “With little domestic economic news, the CAD responded to the US inflation report.

USD/CAD Key Events Today

- US producer price index m/m

- Primary producer price index in the USA m/m

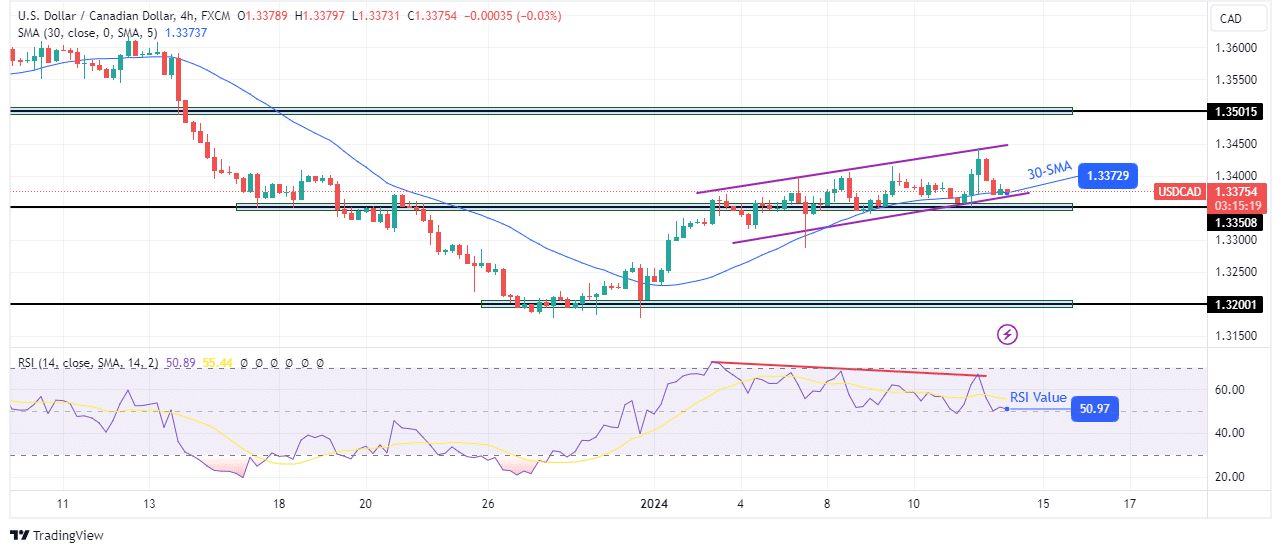

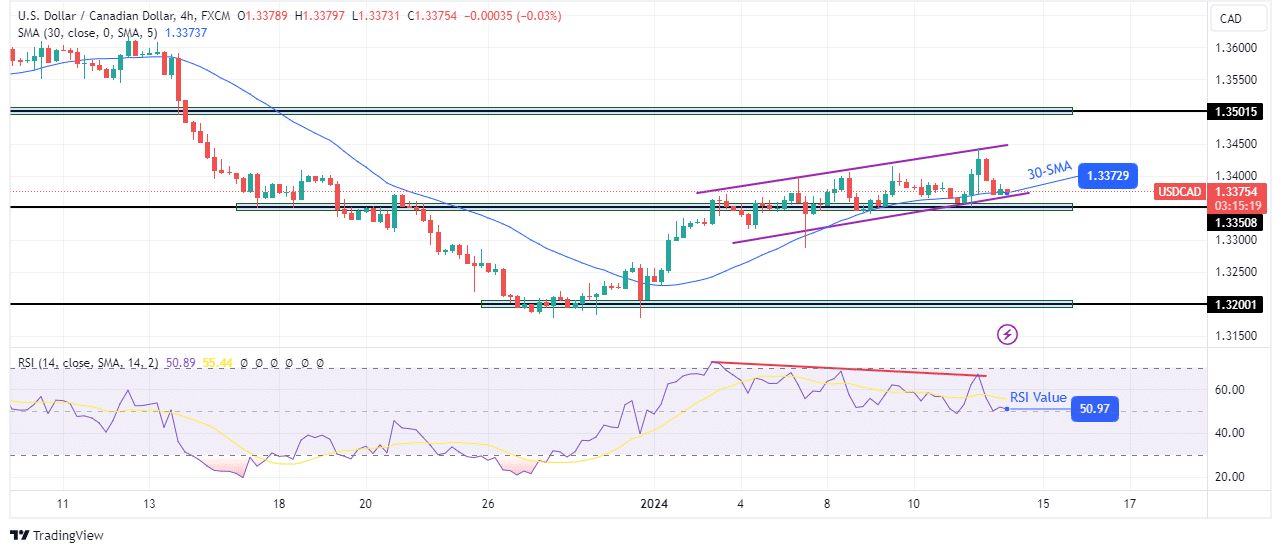

USD/CAD Technical Outlook: Bulls are channeling as the 30-SMA level lowers

On the technical side, USD/CAD remained in its bullish channel as the 30-SMA flattens out. The bullish bias remains as the price makes more highs and lows. Moreover, it remains mostly above the 30-SMA. However, the bullish momentum continues to weaken with each new high as the RSI descends.

–Are you interested in learning more about Telegram Groups for Forex Signals? Check out our detailed guide-

Therefore, the bears could soon become stronger than the bulls, leading to a break below the channel support and a reversal in the trend. However, if the bulls regain momentum at the channel support, the bullish move could continue higher to the resistance level at 1.3501.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money