- The Canadian dollar benefited from higher oil prices.

- USD/CAD posted a weekly gain due to the Bank of Canada’s recent policy change

- The Fed will announce its interest rate decision on Wednesday.

The USD/CAD outlook fell on Monday, led by a rise in oil prices triggered by a drone attack on US forces in Jordan. The event escalated concerns about potential supply disruptions in the Middle East. In particular, the Canadian dollar benefits from higher oil prices because Canada is a net exporter of oil.

–Are you interested in learning more about ETF brokers? Check out our detailed guide-

The pair fell slightly on Friday. However, it posted a weekly increase. Investors took note of the Bank of Canada’s recent change in guidance, anticipating increased volatility in the Canadian dollar. Notably, Bank of Canada officials said they are considering when to cut borrowing costs, rather than considering further interest rate hikes.

According to domestic data, a preliminary estimate revealed a 0.8% increase in Canada’s wholesale trade in December compared to November.

Meanwhile, the Federal Reserve will announce its interest rate decision on Wednesday. In December, there was a marginal increase in American prices. However, annual inflation growth is below 3% for the third month in a row. This has reinforced expectations that the Federal Reserve will initiate interest rate cuts this year. However, the timing of the expected rate cut remains uncertain.

In addition, Friday’s report pointed to a rise in consumer spending at the end of 2023, as Americans enjoyed goods and services during the holidays.

USD/CAD Key Events Today

Investors are not expecting any key events from Canada or the US on Monday. As a result, investors are likely to focus on developments in the Middle East.

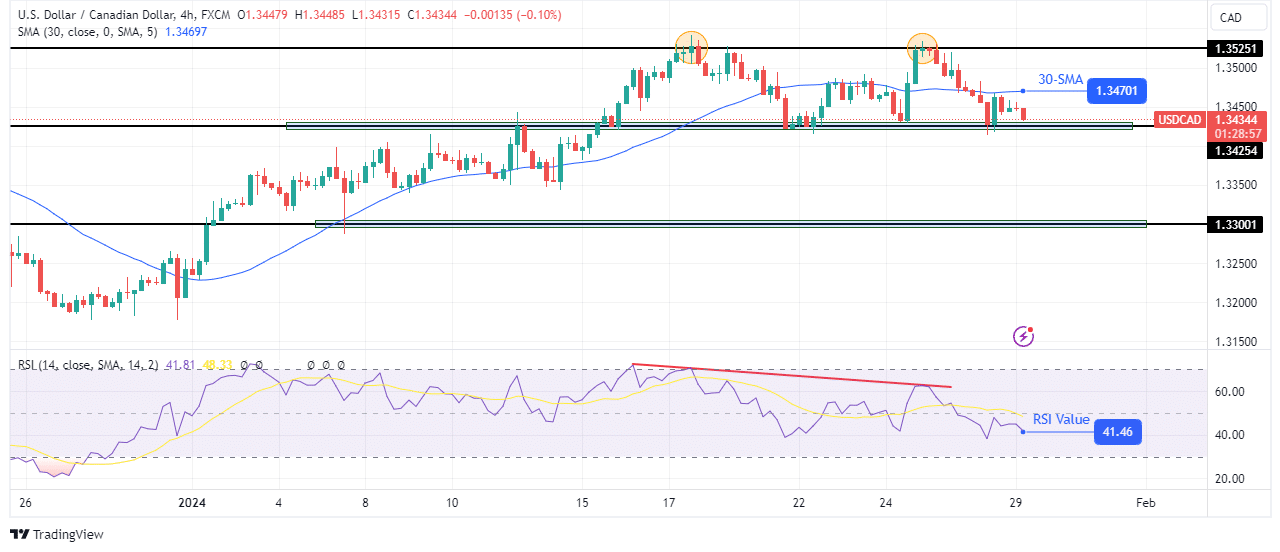

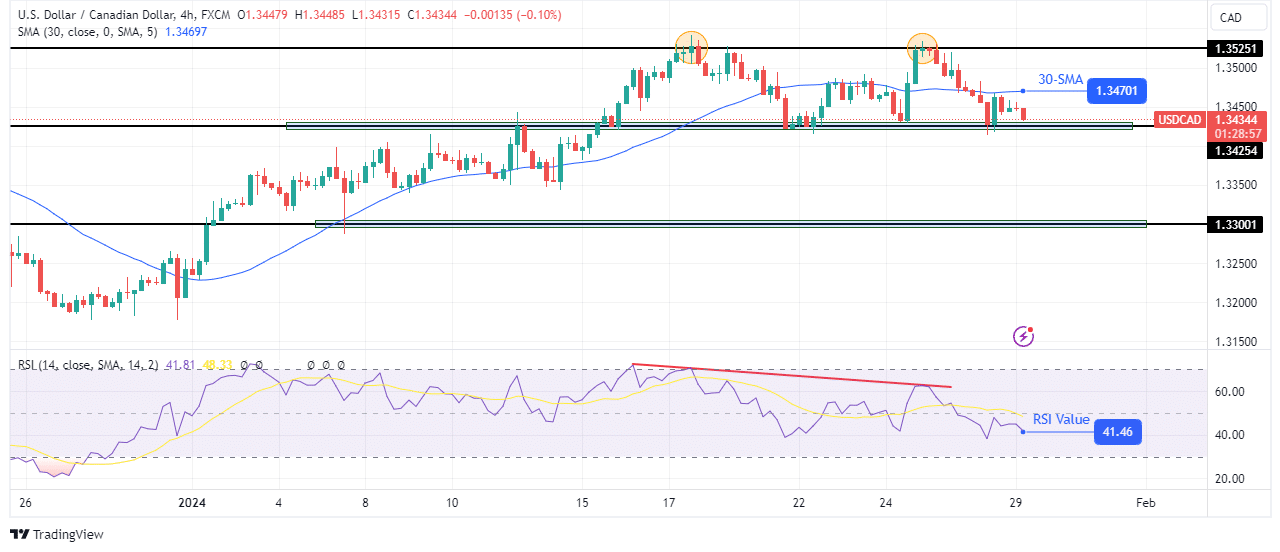

USD/CAD Technical Outlook: Bears are aiming to break the 1.3425 support barrier

On the charts, the bears are trying to break the support level of 1.3425. This bearish move comes after the price made a double top pattern and a bearish divergence. Meanwhile, the double top came when the bullish trend stalled at the key resistance level of 1.3525. At the same time, the RSI confirmed that the bulls were exhausted when it made a lower high. Consequently, the bears took control by breaking through the 30-SMA support line.

–Are you interested in learning more about Canadian forex brokers? Check out our detailed guide-

However, the price must now break below the support level at 1.3425 to make a lower low and confirm a bearish reversal. Otherwise, it will continue to consolidate between resistance at 1.3525 and support at 1.3425.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money