- A rise in oil prices on Tuesday led to a slight recovery in the Canadian dollar.

- Companies in Canada expect low demand over the next year.

- The data revealed a significant improvement in US manufacturing.

The USD/CAD outlook reveals a muted bearish tone on Tuesday, as the craze gains momentum on higher oil prices. In the previous session, the Canadian dollar weakened after research supported the view that the Bank of Canada will start cutting rates in June. Meanwhile, the dollar strengthened after upbeat manufacturing data.

–Are you interested in learning more about low spread forex brokers? Check out our detailed guide-

A rise in oil prices on Tuesday led to a slight recovery in the Canadian dollar. Oil prices rose as the outlook for demand improved after upbeat production data from the US and China.

The Canadian dollar weakened on Monday after a poor survey on the BoC’s business outlook. According to the survey, companies expect low demand during the coming year. This is a sign that the Canadian economy could weaken further. Furthermore, inflation has decreased, putting pressure on the Bank of Canada to cut interest rates.

At the same time, data revealed a slight improvement in Canadian manufacturing activity in March. However, the sector remained in contraction, slightly below 50.

On the other hand, the data revealed a significant improvement in US manufacturing that reduced expectations of a rate cut. It is significant that production expanded after a long period of contraction. The ISM manufacturing PMI rose from 47.8 in February to 50.3 in March, moving from contraction to expansion.

Manufacturing accounts for nearly 10% of the US economy. Therefore, the expansion in the sector shows a resilient economy that is functioning well, giving the Fed more room to keep interest rates higher. Accordingly, rate cut expectations fell after the report, boosting the dollar.

USD/CAD Key Events Today

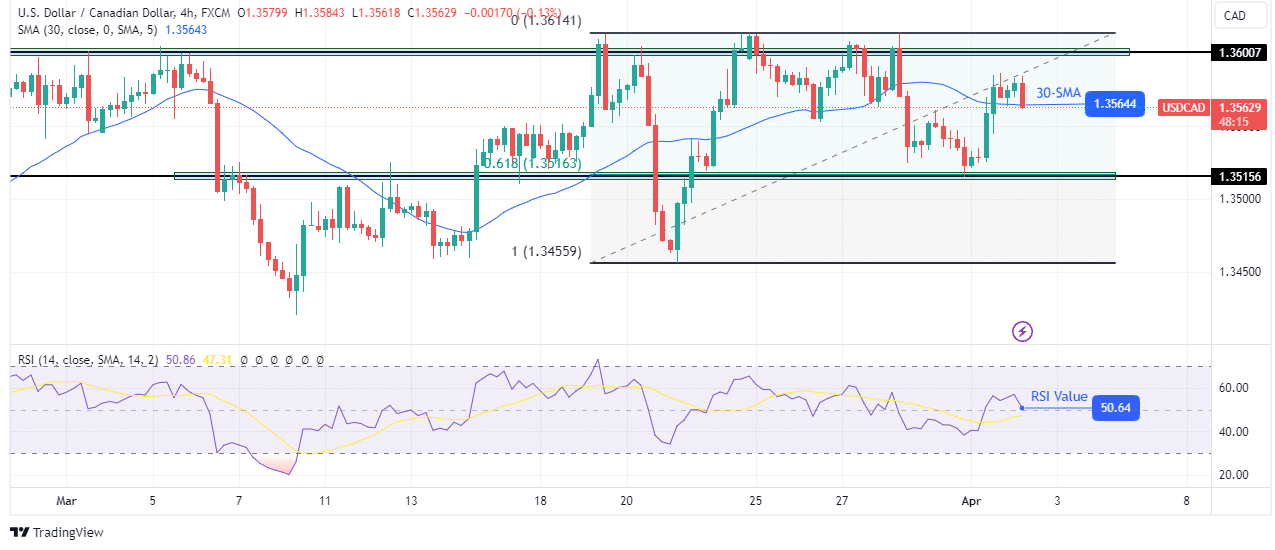

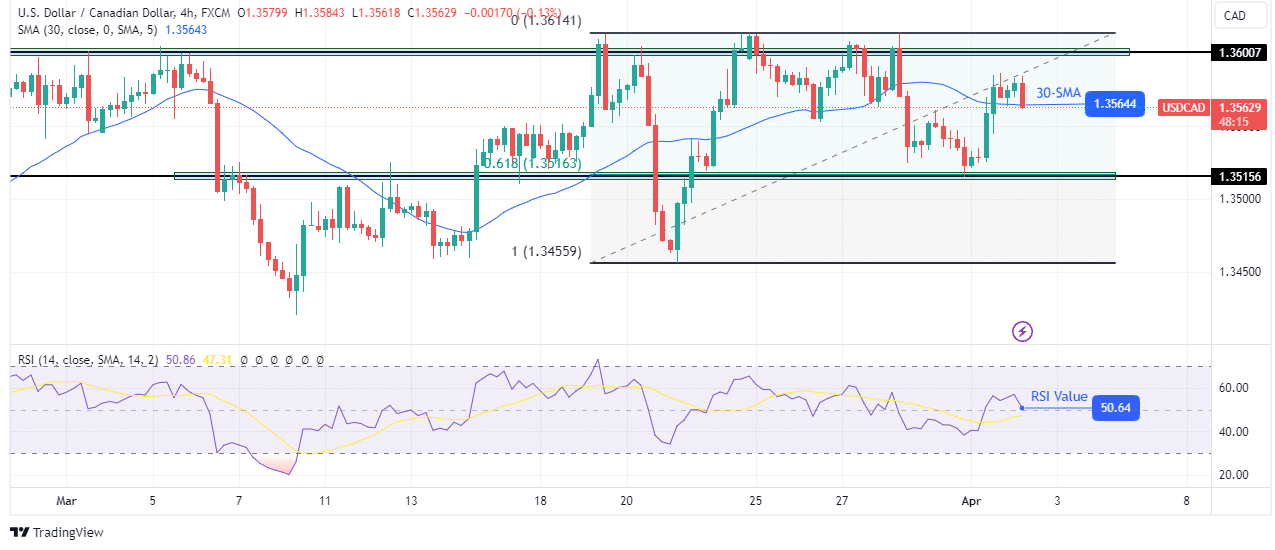

USD/CAD Technical Outlook: Declines around below 30-SMA

On the technical side, the USD/CAD price is on the verge of breaking below the 30-SMA as the bears reverse the recent bullish move. Initially, the bears pushed the price to the 0.618 Fib level. However, they failed to break below this level, allowing the bulls to take over.

–Are you interested in learning more about forex bonuses? Check out our detailed guide-

Although the bears are challenging the new move, the bullish bias remains intact. RSI is above 50. Therefore, if the SMA holds as support, the price will retest the resistance level at 1.3600. However, if the bears break the SMA, the price is likely to retest the 1.3515 support level. Moreover, the bias would change to bearish.

Do you want to trade Forex now? Invest in eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.