- An unexpected drop in US producer prices sent Treasury yields down.

- There is a 78% chance that the US central bank will start cutting interest rates in March.

- The currency gained 0.2 percent last week, marking its second consecutive weekly gain.

Monday’s USD/CAD outlook showed a hint of optimism, but the pair remained largely flat amid muted US trading activity due to the bank holiday. At the same time, investors continued to assess Friday’s data, revealing unexpected easing in US producer prices.

–Are you interested in learning more about forex options trading? Check out our detailed guide-

The likelihood of Fed tapering this year, potentially starting in March, rose after Friday’s data. An unexpected drop in US producer prices sent Treasury yields down. The producer price index for final demand decreased by 0.1% last month.

Market prices now point to a 78% chance the U.S. central bank will begin a rate cut in March, up from 68% a week ago, according to the CME FedWatch tool.

Meanwhile, on Friday, the Canadian dollar showed little movement against the US dollar as oil gave back much of its earlier gains. Oil fell from its previous two-week high after US and British strikes on Houthi targets in Yemen. However, it closed up 0.9%.

Additionally, the currency gained 0.2% last week, marking its second consecutive weekly gain. It hit a four-week high on Thursday at 1.3442, weighed down by stronger-than-expected US inflation data that temporarily dampened expectations that the Fed will consider cutting interest rates in March.

Elsewhere, Canada’s December inflation report on Tuesday is likely to show an increase from 3.1% to 3.3%, according to economists.

USD/CAD Key Events Today

Neither the US nor Canada will release high-impact reports today, which could lead to a consolidation for the pair.

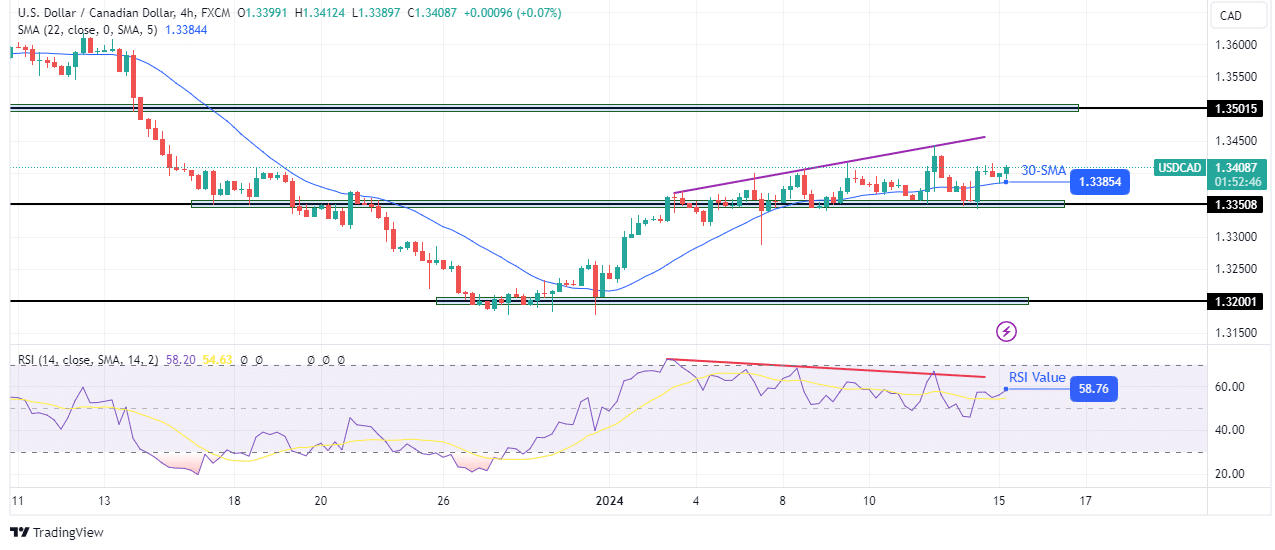

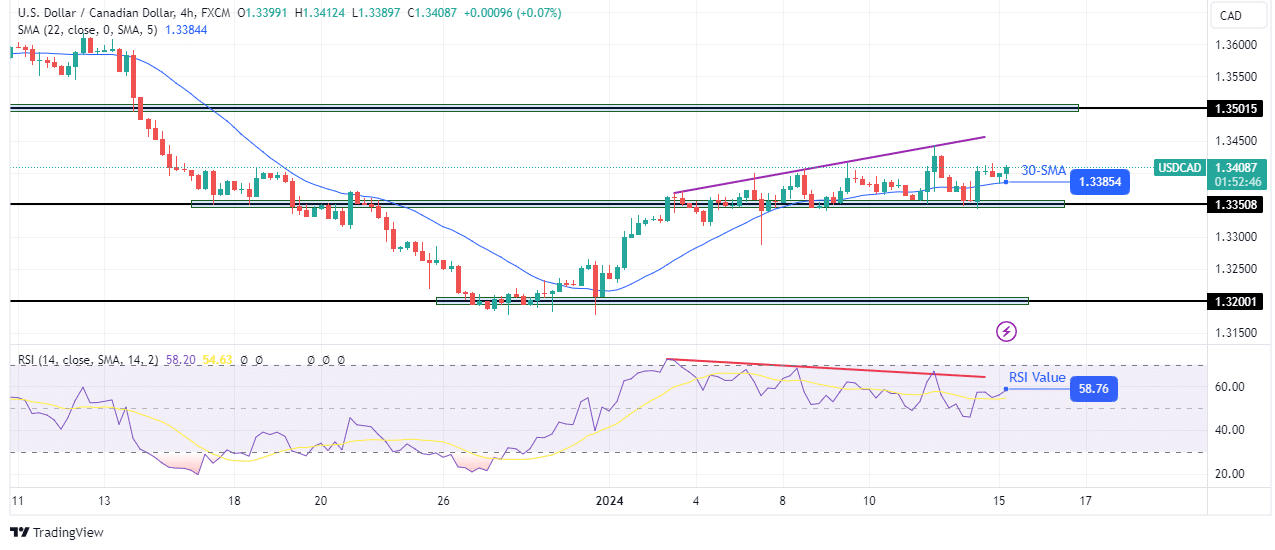

USD/CAD Technical Outlook: Price is making new highs while anchored at 1.3350

On the technical side, the USD/CAD price is making new highs but maintaining the same streak at 1.3350. This is a sign that although the bulls are in control, the bears are causing an uptrend. As a result, the price is now crossing through the 30-SMA.

–Are you interested in learning more about Forex robots? Check out our detailed guide-

Furthermore, the RSI made lower highs in the middle of an uptrend, indicating a weakening of the bullish momentum. Most recently, the bulls pushed back the 1.3350 support level with a candle engulfing them. If the bulls regain momentum, the price is likely to climb to the resistance level of 1.3501. Otherwise, the bears could finally break the support at 1.3350.

Do you want to trade Forex now? Invest in eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money.